Gold Weekly: Bulls Will Come Back With A Vengeance

.

- Money managers are now very bearish toward gold.

- ETF investors sold the precious metal for a second straight week, albeit at a slower pace.

- Current sentiment is weak, but I view the medium-term risks to gold prices titled to the upside.

- I remain on the sidelines. I am now looking for a buying signal to take a constructive stance in gold.

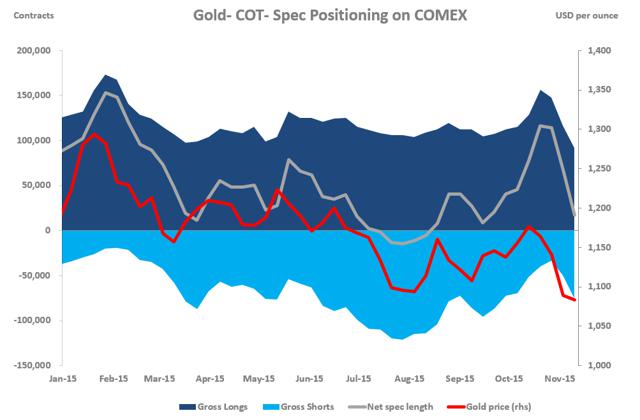

Speculative positioning

(click to enlarge)

Source: CFTC.

Gold.

According to the latest Commitment of Traders provided by the CFTC, money managers, viewed as a relevant proxy for speculators, lowered massively their net long position for the third week in a row as of November 10, while spot gold prices fell by almost 3 percent over the period covered by the data.

The net spec length dropped 50,338 contracts (or 75 percent) to 16,869 from 67,207 between November 3 and November 10, driven by a combination of a build-up of shorts (+25,516 contracts, the second consecutive weekly increase and the biggest one since November 2013) and long liquidation (-24,822 contracts, the third straight weekly decrease).

The net spec length is now down 81 percent year-to-date after being up 33 percent year-to-date as of October 20. This therefore reflects a sharp negative swing in sentiment against gold. The net spec length is below its 2015 average of 51,625 contracts and its long-term average (2006-2015) of 109,742 contracts. That said, it remains above the 2015 low when money managers were net short of 14,633 contracts.

We believe that the outstanding US employment report for October, released November 6, was the trigger of the drastic deterioration in the spec positioning. As a reminder, non-farm payrolls rose 271,000, versus 184,000 expected, and up from 137,000 in September. While the October 27-28 FOMC meeting was the starting point of the negative change in sentiment towards gold as the Fed showed its increasing confidence about a liftoff in December, the release of the jobs report was a further sign that the Fed might be inclined to proceed to a rate hike next month. This was incidentally reflected in changes in the 30-day fed-funds futures, which are presently pricing in a 70-percent probability for a Fed increase at the December FOMC meeting, versus 30 percent before the October FOMC meeting.

Looking ahead, we expect the net spec length to rise from current extremely weak level. Last week, I mentioned in my weekly report that despite my bearish bias, I would prefer to wait further market action before taking another (short) tactical position. I changed my mind. I now believe that given the massive fall in net long positions, money managers have not sufficiently "dry power" to exacerbate the sell-off. That said, I am not willing to implement a long position now as my indicators continue to point to a fragile sentiment.

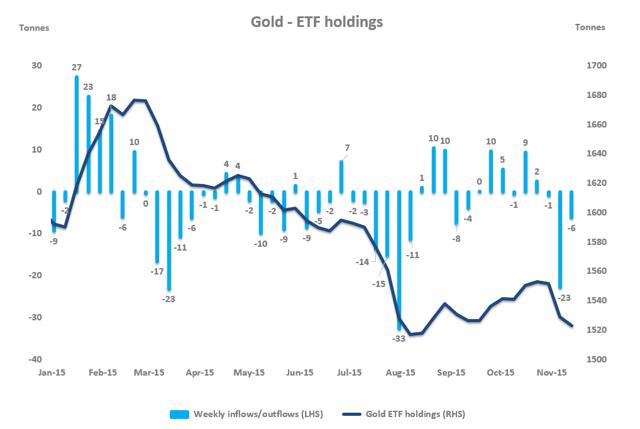

Investment positioning

(click to enlarge)

Source: FastMarkets.

Gold.

ETF investors sold gold for a second straight week ending November 13, albeit at a slower pace than last week. While I was confused last week by the strong pace of gold ETF selling, I conjectured that some investors preferred to reverse some tactical positions ahead of the US employment report due to its strong source of volatility. I am also willing to admit that renew selling in gold ETF holdings over the past two weeks is due to a weak sentiment in the gold market, reflected in lower prices, which therefore lead some investors to retrench.

However, I view the slowing pace of decline as a confirmation that gold ETF holdings are held by stronger hands. As I outlined in my previous report, in spite a downward trend in ETF holdings since late 2012, the pace of outflows has gradually declined, which leads me to consider that 1,500 tonnes represents a solid floor for total gold ETF holdings.

Amounting to 1,523 tonnes as of November 13, total gold ETF holdings (tracked by FastMarkets) were down 6 tonnes from last week and 23 tonnes from the start of November. They are therefore on track to record the first monthly outflow in 4 months as investors were net buyers of 12 tonnes of gold in October, 2 tonnes in September and 10 tonnes in August. ETF investors are currently net sellers of 77 tonnes of gold on the year, due to strong outflows between March and July.

Additional note: On Monday 16 November, gold prices gapped higher and rose sharply in the first part of the day. As I documented in my daily report, I conjectured that safe-haven flows toward gold were behind this upward move amid rising geopolitical tensions following the horrific attacks in Paris this weekend and the subsequent France's decision to launch "massive" airstrike on the ISIS stronghold of Raqqa in Syria. However, this seems not be the case. ETF investors sold about 3.6 tonnes of gold on Monday whereas the rest of the precious metals complex (silver, platinum, and palladium) experienced strong inflows. While one could have expected strong inflows in gold, those outflows suggest rather that sentiment in the investment community is weak.

Looking ahead, although I do not discount the possibility that gold ETF holdings retest their current 2015 low of 1,517 tonnes seen early in August, I do not believe that ETF holdings will be a source of strong selling in the gold market. In other words, although physical ETF holdings could continue to move sideways to lower, the fact that they are hold by "strong hands" investors with a long-term philosophy should prevent those holdings to fall drastically, as it is the case in PGMs.

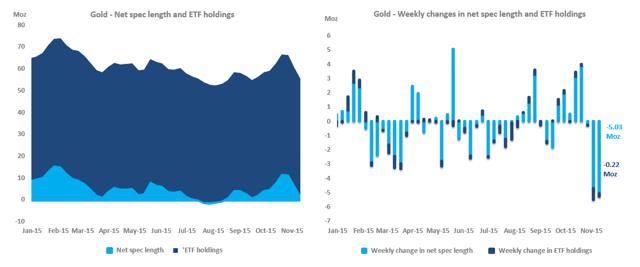

Spec positioning vs. investment positioning

(click to enlarge)

Source: MikzEconomics.

My GLD positioning - Bulls will come back with a vengeance - weekly chart

(click to enlarge)

Source: TradingView.

As noted early in November in one of my previous reports, Bears will come back with a Vengeance, extreme bullish spec sentiment led me to implement a double short position (one with a short-term view, another with a longer-term view).

My bearish bet characterised by a risk/reward profile highly skewed in my favour moved for me and was closed last week, as indicated in my report.

Since then, I have been on the sidelines. While last week, I was more inclined to play the short side, I am now more willing to play the long side.

From a technical picture, the market is deeply oversold in the near term, as evidenced by the RSI (21) gyrating around the 14 level.

From a fundamental perspective, I believe that money managers have sold gold too aggressively and too quickly so they are likely to lack some "dry powder" to drive spot prices much lower.

That said, current sentiment appears to me weak in the sense that despite the resurgence of potential bullish factors such as geopolitical tensions, the gold market has not benefited from safe-haven bids.

As a result, I prefer to await a bit further before taking a constructive stance on gold. As seen in the chart above, I would not be surprised to see GLD fall toward the $100 level, but it would suggest at the same time that money managers have become even more bearish, which would raise the likelihood of a strong short-covering rally. To sum up, I have changed my bias from bearish to bullish, holding the view that bulls will come back with a vengeance.

0 comments:

Publicar un comentario