Summary

- Gold fell last week when the Fed cut QE and the Bank of Japan increased QE.

- The fundamentals right now are not relevant to gold as it is trading based on very negative sentiment.

- Investors need to think long-term and control their emotions as that is the only way to weather "sentiment bottoms".

- Investors should not be idle, but instead be developing their strategies and culling their portfolios to the best gold stocks.

This is a question that probably every long investor in gold is asking themselves considering that the precious metal has plummeted from its 2014 highs of close to $1400 ounce way down below its previous bottoms to settle at $1173 per ounce.

We could go into any one of the following fundamentals of gold:

- How Chinese gold demand last week (as represented by SGE withdrawals) was a strong 59.7 tonnes (at gold prices much higher than today's) and YTD they are on pace for close to 2,000 tonnes of gold - or around 80% of all worldwide newly mined available gold.

- How the Russian central bank makes the biggest monthly gold purchase in over 15 years at 1.2 million ounces in August - large enough to impact worldwide gold demand if done consistently.

- How Swiss citizens are pushing for an initiative that will force the Swiss central bank to repatriate reserves immediately and force it to buy 1700 tonnes of physical gold over the next five years. Oh yeah and this referendum has actually more "yes" votes than "no" votes.

- How the current gold price is above the all-in costs it actually takes to mine new gold and many operations are well into the negative at current prices.

- How new gold discoveries have plummeted and industry insiders and gold production forecasts call for a dramatic drop in production in a few years.

- How many countries are continuing to diversify away from the dollar and how Russia is calling for a de-dollarized world.

- How Alan Greenspan, the former Fed chairman, has broken all kinds of political correctness to predict that we will see a much higher future gold Price.

- How COMEX gold inventories, GLD gold holdings, and sources of "investable" gold have continued to plummet (most of it probably to Asia) and we're certainly not awash with gold.

The list goes on and on but I think you get my point. But here's the thing - NONE of the so called fundamentals matters. As a friend and fellow Seeking Alpha contributor Avi Gilburt has stated before:

I keep saying . . logic and economy have nothing to do with it! :) All sentiment my friend!! :)I had to leave the happy faces because Avi is simply that nice of a guy! But at this point he is absolutely right and it became extremely clear this past week.

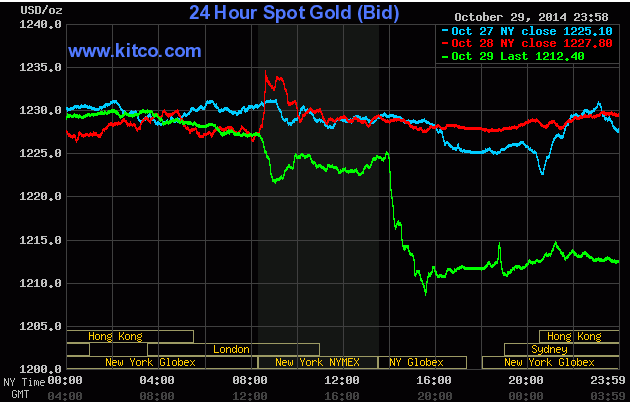

On Wednesday the Fed made it's much anticipated decision to end QE and gold did this:

It plummeted from its pre-FOMC levels all the way down to close to $1200 per ounce before bouncing back. The Fed removes the final $10 billion per month in QE and gold tumbled - oh yeah and by the way this decision was pretty much expected by the markets as no conference was scheduled afterwards and stocks ended relatively unchanged on the day.

Fast forward to Friday morning and the Bank of Japan decides to increase its QE program from 70 to 80 trillion Yen - a little under $100 billion dollars per year (or pretty close to what the Fed cut). This surprised the markets and they jumped - except gold which once again plummeted.

So when the Fed cut its QE program (as expected) gold tumbles, but when the Bank of Japan increases its QE program by a similar amount gold …tumbles?

That means that it isn't the central bank balance sheets, QE, debt levels, geopolitical unease, or anything else moving gold - it is only sentiment. The market is looking for any reason to sell gold and it is doing just that so that bad news is bad news and good news is bad news. This is the complete opposite of the euphoria we had in 2011 when gold was making new highs as all news was good news for gold, now its gold making new lows and every day it seems that the gold sector is bleeding red.

Just scanning the Kitco website's "Contributed Commentaries" section just rests my case as here are a handful of headlines from a site that is filled with gold bulls:

- The Herd Is On The Move: Don't Try To Catch A Falling Knife

- Pressure Escalates As Support Breaks

- Gold's Obituary

- More Downside Ahead for Precious Metals

- Tough Times Ahead... Gold to Bottom Around $1,000!

What Should Gold Investors Do Now?

So let us get to the most important part - what do you do now if you're a gold investor? There are many different things for gold investors to do but they all hinge on one key concept.

Think Long-term and Check Your Emotions

First and foremost, we're writing for long-term investors here and if you're trying to trade gold or expect what we say today to be what happens next week - then read something else. We have no idea what gold will do this week, next week, or next month - but when it comes to a longer term horizon then there is some value in what we focus on - fundamental analysis of the gold industry and the macroeconomic climate.

Being able to think long-term is critical to being able to weather these sentiment bottoms - without that you will not be able to check your emotions. Investors should remind themselves that unless they believe the gold industry will soon cease to exist, the price of gold will have to go higher as the majority of operations are not profitable at current levels, new discoveries have plummeted, and supply is expected to fall as peak gold is reached and passed. All of these things are fundamentals that cannot be ignored - if you think for the long term.

We haven't even mentioned the macroeconomic reasons that have been propelling gold since the turn of the century. Government debt levels that are simply not sustainable without overt or covert defaults, the vast amounts of money central banks are pumping into the system, the continuing de-dollarization of the world as more dollars will be pursuing less dollar-holders, and the list goes on.

There are plenty of fundamentals for gold, and the only strong argument against gold is the price is going down.

Before we move on, we want to remind investors that sentiment and emotions are so important when it comes to investing. We don't have time to go into it into a lot of detail, but here's a quote from an excellent Financial Post article about one of the most famous traders from the 1930's, Richard Wyckoff, and his "secret" trading strategies:

Instead, here's how he sets it up: first, he'll "shake out" the little guys by forcing the stock lower in order to get a better price. "He prefers to do this while the market is weak, dull, inactive and depressed. To the extent that they are able, he, and the other interests with whom he works, bring about the very conditions which are most favorable for accumulation of stocks at low prices…

"When he wishes to accumulate a line, he raids the market for that stock, makes it look very weak, and gives it the appearance of heavy liquidation by sending in selling orders through a great number of brokers."

"Then, he will try to time the top of his planned price rise with some "good news" about the stock he may already know about. You have often noticed that a stock will sell at the highest price for many months on the very day when a stock dividend, or some very bullish news, appears in print. This is not mere accident.

The whole move is manufactured. Its purpose is to make money for inside interests - those who are operating in the stock in a large way. And this can only be done by fooling the public, or by inducing the public to fool themselves."

There's no doubt in my mind that that still happens today, and the key lies in the ability to control your emotions and play to the emotions of others on both the tops and the bottoms. For investors that can think long-term and control their emotions, we feel that these bleak days can be turned into a much brighter future for gold investors.

Gold investors shouldn't be twiddling their thumbs and sitting on their portfolio, instead they should be actively biding their time by remembering and doing the following four things:

1. Develop An Investment Strategy

2. Cull The Portfolio

3. Remember That Volatility is NOT the Same Thing As Risk

4. Increase Knowledge of the Industry

In our next piece in this series we will be detailing all four of these things for gold investors but we wanted to give a little preview to those of you who made it down to this section. Of course if you don't want to miss the next piece or if you want to keep up with the trends in the gold market (including our favorite picks), consider following me (clicking the "Follow" button next to my name) or join our free email list where we send out a weekly email summarizing all the important events in the gold and silver industry, which includes our latest articles and research pieces and all of our all-in pieces as they are published.

Conclusion for Investors

This past week we've seen events that seem to solidify the opinion that the gold market is being driven by utterly negative sentiment as gold fell when the Fed (as expected) ended QE, and when the Bank of Japan (surprisingly) added to its QE. As we said before, currently in the gold market bad news is bad news and good news is bad news - the opposite emotions of the euphoria we saw in 2011.

Being able to recognize these sentiment bottoms is the first step, but the only way most investors can persevere through it is to be able to think long-term. That will help investors control their emotions and keep their gaze on the big picture - the fact that the same fundamentals that propelled gold to $1900 per ounce are still in place. If investors can control their emotions and think long-term, we think that they will do just fine in the gold market.

Thus forward-looking investors would be wise to be building gold positions now and we believe they should be increasing exposure to physical gold and the gold ETF's (SPDR Gold Shares (NYSEARCA:GLD), PHYS, CEF). The miners have been absolutely hammered and we think will provide a lot of leverage to the gold price, albeit at a much higher level of risk, so investors may want to consider evaluating gold miners such as Goldcorp (NYSE:GG), Agnico-Eagle (NYSE:AEM), Newmont (NYSE:NEM), or even some of the explorers and silver miners such as First Majestic (NYSE:AG) or Pan American Silver (NASDAQ:PAAS). We're not suggesting these companies specifically - only suggesting them for further investor research.

But we think the real opportunities right now are in the explorers, as their valuations are much lower than the miners and the fact of the matter is that these gold miners will be looking to expand reserves and buying out the quality explorers. Thus we just began a series of our top potential takeover candidates in the gold and silver explorers, and those who are interested can click the "Follow" button next to my name or join our email list that we linked to above.

These are certainly tough times for gold investors, and I wish we could have seen the drop in gold coming from 2011 so we could have advised everyone to get out of gold until further notice, but investing doesn't work like that. Nobody said investing would be easy, but with patience and the ability to weather this vicious storm in gold, we think that Alan Greenspan is absolutely correct that gold is heading "measurably higher" - but most former gold bulls will probably miss that move.

0 comments:

Publicar un comentario