The Rational Reason To Be Bullish On Gold

Oct 4 2013, 11:13

What I would like for my birthday, today, October 4, is to discuss the "gold is underowned" argument.

This argument comes from legendary Hedge Fund manager Ray Dalio of Bridgewater Associates: "Gold is a very underowned asset, even though gold has become much more popular. If you ask any central bank, any sovereign wealth fund, any individual what percentage of their portfolio is in gold in relationship to financial assets, you'll find it to be a very small percentage. It's an imprudently small percentage, particularly at a time when we're losing a currency regime."

What should we think about Dalio's argument?

First, it is true that gold and precious metals have become much more popular as a result of 12 consecutive years of boom. Gold (GLD) rose 500 per cent from $265 an ounce in January 2000 to $1,660 an ounce in December 2012 while silver (SLV) surged as well 500 per cent from $5 an ounce in January 2000 to $30 in December 2012.

Consequently, some investors such as legendary investor Warren Buffet call gold price a bubble today: "What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis. As "bandwagon" investors join any party, they create their own truth - for a while. But bubbles blown large enough inevitably pop."

As a value investor, Warren Buffet believes that a gold purchaser is only inspired by his/her belief that someone else will pay more for gold in the future given that gold is an unproductive asset.

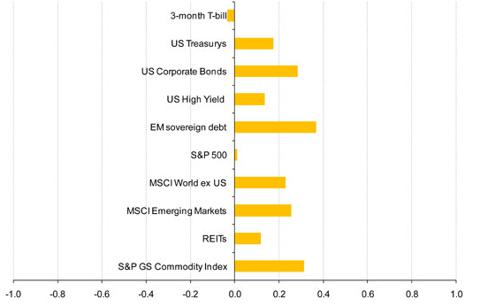

By saying that, he seems to ignore the importance of gold in institutional strategic allocation. Indeed, gold is a valuable tactical asset as it provides long-term diversification. According to World Gold Council, holding gold in a portfolio results in increased diversification due to gold's lower correlation to other assets. As seen in Exhibit 1, on average, gold's correlation to U.S. equities and Treasury Bills has been 0.1 over the past ten years.

Exhibit1: Average correlation of gold to US equities and Treasury bills (2000-2010)

Second, to examine whether or not gold is underowned, let's compare the appropriate allocation to gold with gold's current share of financial assets.

1/Gold's current share of financial assets

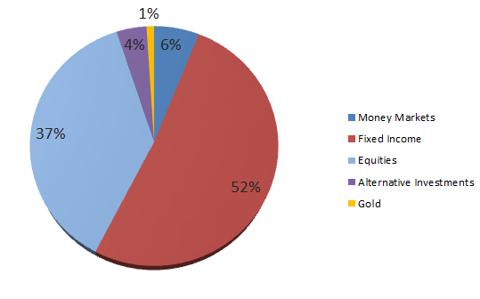

World Gold Council estimates suggest that in 2012:

-The global financial assets held by investors were about $149tn

-The global equity and fixed income markets (central bank holdings were excluded) were about $131tn

- The private investment stock of gold was about $1.9tn with the average gold price of $1,651.34 an ounce during the first half of 2012, representing just 1 per cent of financial assets.

Exhibit2: Distribution of investor global holdings by asset class as percentage of total

Source: WGC

2/The optimal allocation to Gold

How much gold should investors hold? Theoretically, investors should hold the "market portfolio" according to the Capital Asset Pricing Model.

Now comes the tricky question: how to define and measure the size of the gold market in the "market portfolio"?

It is fair to say that the size of the gold market in the "market portfolio" should be the size of the investable gold market, which represents the private investment and official sector holdings. The investable gold market can also be considered as the financial market for gold.

As gold held by central banks is worth about $1.5tn and gold held by private investors is worth $1.9tn, the investable gold market is worth $3.4tn (with the average gold price of $1,651.34 an ounce during the first half of 2012).

Consequently, the optimal allocation to gold should be 2 per cent ($3.4tn/$150.5tn) according to the Capital Asset Pricing Model.

Conclusion

The objective was to examine the "gold is underowned" versus the "gold is overowned" arguments. The evidence indicates that even though the gold market has experienced 12 years of boom from 2000 to 2012, on average, investors are under-allocated to gold relative to the results from the Capital Asset Pricing Model. Consequently, if investors decide to re-allocate to an optimal 2 per cent gold allocation, demand for gold ETFs such as the SPDR Gold Trust or Sprott Asset Management's Physical Gold Trust (PHYS) will surge gold will rise significantly.

As Ray Dalio said, "Buffett is making a big mistake".

0 comments:

Publicar un comentario