Selling By Western Investors Can't Hold Down Gold Prices For Long As Asian Demand Surges

Aug 12 2013, 18:25

by: Hard Assets Investor

By Sumit Roy

Western investors have a finite amount of gold to sell.

Much has been made about the large amounts of selling by gold exchange-traded funds this year. The story is now familiar. As the Federal Reserve and other central banks draw closer to ending their stimulus programs, Western investors have been furiously liquidating their positions, a large part of which is in gold-related ETFs. In turn, prices for the yellow metal are set to register an annual decline for the first time in 13 years.

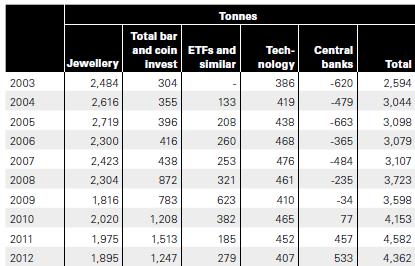

But just how significant are ETFs in the grand scheme of things? And how significant are Western investors in general? That depends on your perspective. In the short term and on the margin, they can be quite influential. Thus far this year, exchange-traded funds—which are primarily held by Western investors—have seen their aggregate holdings decline by 670 metric tons.

.

That’s a big swing from the 279 metric ton increase seen during 2012, and it puts ETF holdings well on their way for the first-ever annual decline.

.

To answer one of the questions posed earlier, in an annual market of roughly 4,400 metric tons, the 950-ton swing in ETF demand is quite significant.

.

Some might argue that even though holdings have dropped from a record 2,618 metric tons at the end of 2012 to 1,948 tons today, there’s certainly more room for declines.

.

While that’s true, ETF selling can’t go on indefinitely. There’s a finite amount of gold in ETFs. We’re not going to see selling to the tune of 670-plus metric tons every year. Eventually, ETF holdings will stabilize and cease to be a drag on prices.

.

That brings us back to the point about perspective. While we’ve established that ETFs have been one of the most significant factors in the gold market this year, for the past decade as a whole, their influence hasn’t been nearly as large.

Spurred by the launch of the largest gold exchange-traded fund, the SPDR Gold Trust (GLD) in November 2004, institutions and retail investors that may not have had the access or inclination to purchase gold began buying the yellow metal heavily that year.

.

These new investors in gold bought consistently between 100 to 300 metric tons per year, with an anomalous spike to 623 metric tons during 2009 amid the financial crisis of that year.

In 2011, when gold peaked above $1,921, gold ETF buying totaled only 185 metric tons. Thus, while ETF buying certainly helped fuel gold’s record ascent, it wasn’t these financial investors that were the primary driver of gold prices. Rather, it was physical investors.

Physical investment in gold is dominated by two countries—China and India. The Asian duo accounts for roughly half of global gold demand. Fueled by the emerging markets boom, growth in physical gold demand, which includes purchases of bars and coins, soared from 304 metric tons in 2003 to a high of 1,513 metric tons in 2011. Demand in this segment fell modestly to 1,247 metric tons in 2012 as the Indian government actively attempted to restrain imports.

Indications are that physical investment demand will easily set a new record in 2013. Demand may continue hitting records in the coming years as the Chinese and Indian economies grow. Unlike in the West, gold plays an important cultural role in the East, and it’s seen as the pre-eminent store of value.

In essence, Eastern investors have been happy to buy the massive amounts of gold that Western investors have been selling over the past year.

Eventually, Western investors will be scrambling to buy gold again. But in the meantime, prices will be well supported by insatiable demand from investors in the East.

0 comments:

Publicar un comentario