Will U.S. Banks Cut Their Dividends Due To Basel III?

May 18, 2012

by Dividendinvestr

In a just-released report, Fitch Ratings estimates that the world's largest banks will have to come up

with additional $566 billion in order to meet new capital adequacy requirements

according to Basel III capital provisions. The report says 29 global

systemically important financial institutions (G-SIFI), including major U.S.

banks, will have to allocate 23% more in capital provisioned for potential loan

losses. For a median bank, this amount would equal to no less than three years

of retained earnings. The ratings house suggests that the pressure to meet the

new requirements may constrain the banks' share repurchase programs and dividend

payouts.

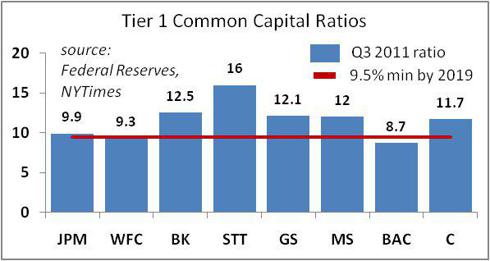

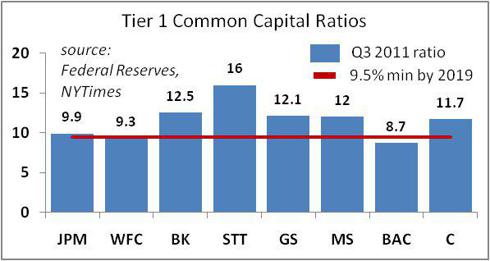

Most U.S. banks have already taken steps to bolster their capital adequacy. The popular Federal Reserve's bank stress tests have shown that the 19 bank holding companies participating in the tests "have increased their tier 1 common capital levels" by nearly 81% between the first quarter of 2009 and the fourth quarter of 2011. "The tier 1 common ratio for these firms, which compares high-quality capital to risk-weighted assets, has increased to a weighted average of 10.4% from 5.4," over the same period, says the Fed press statement about the last round of bank stress tests. In the process, U.S. banks have reduced their dividend payouts from 38% of net income in 2006 to 15% of net income in 2011.

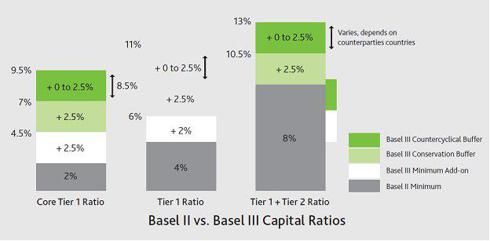

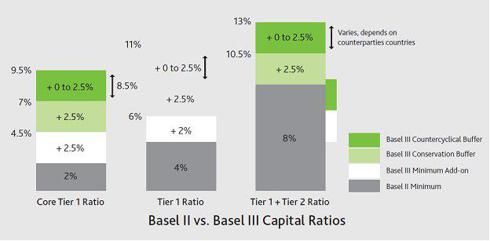

Will the new Basel III rules force the U.S.-based dividend-paying G-SIFIs to slash their dividends in the future? For most institutions, the answer is likely no. According to new Basel regulations, banks will have to boost their tier 1 common capital ratios to a minimum of 9.5% by 2019 (see the image below). The U.S.-based G-SIFIs have already raised their ratios to levels above or close to the upcoming capital adequacy requirements (see the chart below). Moreover, the U.S.-based banks noted below are expected to see a relatively robust growth in earnings over the next five years. This will facilitate the banks' efforts to meet or sustain the new minimum ratios. Still, some banks, such as Bank of America (BAC) -- which is expected to grow its bottom line modestly -- may cut dividends if they appear to be unsustainable and the measure becomes necessary in order to meet new capital requirements.

Click to enlarge all images.

Source: Moody's Analytics.

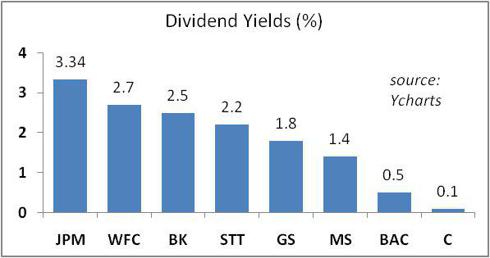

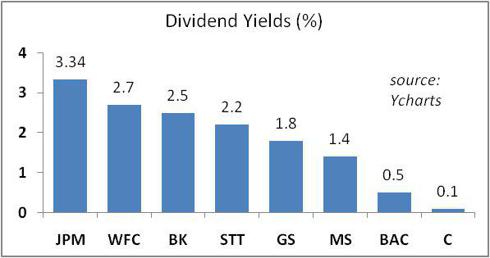

JPMorgan (JPM) is a $132 billion multinational G-SIFI and the largest U.S. bank by assets. The bank holds $2.27 trillion in assets, including $59.6 billion in cash. It pays a dividend with a yield of 3.34% and a dividend payout ratio of 22%. The bank has attractive valuation; its forward P/E is at a low 7.7, compared with the banking industry ratio of 10.1. This G-SIFI is expected to grow its earnings per share (EPS) by an average of 7.3% annually over the next five years. The bank is currently a focus of investor interests due to a $2 billion and rising trading loss in the bank's synthetic credit portfolio. In regard to this loss, the Department of Justice has opened a criminal investigation. The shares of the company are trading at $34.70, more than 15% below the price level before the loss announcement. Among guru investors, Ken Fisher and George Soros are bullish on JPMorgan.

Wells Fargo (WFC) is a $168 billion multinational diversified financial institution. With assets of $1.3 trillion, it is the fourth largest bank in the U.S. by asset size. The bank holds some $19.4 billion in cash. Wells Fargo pays a dividend yield of 2.7% and has a dividend payout ratio of 20%. The bank has favorable valuation. It is currently trading at 9.5 times its forward earnings, compared with the industry's ratio of 10.1. The bank is expected to grow its EPS robustly over the next five years, with an average growth rate of 10.5% per year. The company is popular with famous investors Warren Buffett and Daniel Loeb.

Bank of New York Mellon (BK) is a $25 billion G-SIFI and the 11th largest U.S. bank by assets. According to Global Finance magazine, it is also ranked the world's 25th safest bank, the only U.S. bank in the top 25 list. The bank pays a dividend with a yield of 2.5% and a dividend payout ratio of 25%. The company has attractive valuation, featuring a forward P/E of 9.2, below the industry average of 10.1. Analysts expect the bank's EPS to grow energetically by an average of 12.4% per annum over the next five years. The stock price is currently down some 14% from the beginning of the month. Famous investors Warren Buffett, Ken Fisher, and Mario Gabelli are all bullish about this global bank.

State Street (STT) is a $20.5 billion financial services company and one of the G-SIFIs. With assets of some $217 billion (including $61.1 billion in cash), it is the 13th largest financial company in the U.S. State Street, both a bank and an asset manager, pays a dividend with a 2.2% yield. It has a dividend payout ratio of 21%. This financial services company is trading at 10.4 times its forward earnings, compared to 10.1 for the banking industry and 12.8 for the asset management industry. In April, the bank stated that it would repurchase some $1.8 billion in shares through the first quarter 2013. The bank's latest dividend payout is back to its split-adjusted high. The company's shares are down 10.5% since the beginning of May. State Street's EPS is expected to increase, on average, by 10.7% a year over the next five years. The company is popular with fund manager Donald Yacktman.

Goldman Sachs (GS) is a $49 billion multinational investment banking and securities trading firm. It has some $923 billion in assets, including $120 billion in cash. This G-SIFI is the fifth largest U.S. financial institution by asset size. The investment bank pays a dividend yield of 1.8%, with a payout ratio of 20%. Its forward P/E is 8.2, below the banking industry ratio of 10.1 and the investment services ratio of 10.8. The bank is currently trading at $98.40 a share, nearly 15% below the price levels on May 1. The company is expected to grow its EPS by 11.7% annually over the next five years. Among fund managers, this investment services company is popular with Ken Heebner and Andreas Halvorsen, both of whom initiated positions in the company in the first quarter 2012.

Morgan Stanley (MS) is a $27 billion global financial services firm and one of the G-SIFIs. The company has $750 billion in assets, including $76.8 billion in cash. It is also seventh largest U.S. financial institution by asset size. Morgan Stanley pays a dividend with a yield of 1.4%. Its dividend payout ratio is 41%. With regard its valuation, the company is trading at $13.60, some 6.4 times its forward earnings. This compares with the ratio of 10.8 for the investment services industry. The stock has fallen about 22% from the beginning of May and nearly 36% since late March. Morgan Stanley is forecast to grow its EPS by an average of 14.6% a year over the next five years. Investment gurus Ken Fisher and Ken Heebner are bullish about this company.

Bank of America is a $76 billion bank with $2.1 trillion in assets (including some $120 billion in cash). By asset size, the bank is the second largest financial institution in the United States. Bank of America pays a small dividend yield of 0.50%. In 2011, it had a dividend payout ratio of 400% of its annual EPS. The dividend does not look sustainable, taking into consideration the new Basel capital requirements. The bank is expected to expand its EPS by an average of 7.2% a year over the next five years. Investment genius David Tepper of Appaloosa Management is bullish about the stock, while Ray Dalio sold out his stake in the company in the first quarter 2012.

Citigroup (C) is a $79 billion multinational, diversified financial services company and one of the G-SIFIs. With assets of $1.87 trillion it is the third largest financial institution in the United States. The bank pays a dividend with a negligible 0.1% yield and a minute payout ratio of 1%. The bank recently failed to meet capital requirements under the Federal Reserve stress tests, reported back in March 2012. Its stock has dropped almost 20% since the beginning of May and, cumulatively, about 30.5% since mid March. Analysts forecast that Citibank will grow its EPS by an average rate of 9% per year over the next five years. The bank is popular with George Soros, David Tepper, and Andreas Halvorsen, while it is out of fashion with Ray Dalio and Julian Robertson of Tiger Management, both of whom closed out their stake in the company in the first quarter.

Most U.S. banks have already taken steps to bolster their capital adequacy. The popular Federal Reserve's bank stress tests have shown that the 19 bank holding companies participating in the tests "have increased their tier 1 common capital levels" by nearly 81% between the first quarter of 2009 and the fourth quarter of 2011. "The tier 1 common ratio for these firms, which compares high-quality capital to risk-weighted assets, has increased to a weighted average of 10.4% from 5.4," over the same period, says the Fed press statement about the last round of bank stress tests. In the process, U.S. banks have reduced their dividend payouts from 38% of net income in 2006 to 15% of net income in 2011.

Will the new Basel III rules force the U.S.-based dividend-paying G-SIFIs to slash their dividends in the future? For most institutions, the answer is likely no. According to new Basel regulations, banks will have to boost their tier 1 common capital ratios to a minimum of 9.5% by 2019 (see the image below). The U.S.-based G-SIFIs have already raised their ratios to levels above or close to the upcoming capital adequacy requirements (see the chart below). Moreover, the U.S.-based banks noted below are expected to see a relatively robust growth in earnings over the next five years. This will facilitate the banks' efforts to meet or sustain the new minimum ratios. Still, some banks, such as Bank of America (BAC) -- which is expected to grow its bottom line modestly -- may cut dividends if they appear to be unsustainable and the measure becomes necessary in order to meet new capital requirements.

Click to enlarge all images.

Source: Moody's Analytics.

JPMorgan (JPM) is a $132 billion multinational G-SIFI and the largest U.S. bank by assets. The bank holds $2.27 trillion in assets, including $59.6 billion in cash. It pays a dividend with a yield of 3.34% and a dividend payout ratio of 22%. The bank has attractive valuation; its forward P/E is at a low 7.7, compared with the banking industry ratio of 10.1. This G-SIFI is expected to grow its earnings per share (EPS) by an average of 7.3% annually over the next five years. The bank is currently a focus of investor interests due to a $2 billion and rising trading loss in the bank's synthetic credit portfolio. In regard to this loss, the Department of Justice has opened a criminal investigation. The shares of the company are trading at $34.70, more than 15% below the price level before the loss announcement. Among guru investors, Ken Fisher and George Soros are bullish on JPMorgan.

Wells Fargo (WFC) is a $168 billion multinational diversified financial institution. With assets of $1.3 trillion, it is the fourth largest bank in the U.S. by asset size. The bank holds some $19.4 billion in cash. Wells Fargo pays a dividend yield of 2.7% and has a dividend payout ratio of 20%. The bank has favorable valuation. It is currently trading at 9.5 times its forward earnings, compared with the industry's ratio of 10.1. The bank is expected to grow its EPS robustly over the next five years, with an average growth rate of 10.5% per year. The company is popular with famous investors Warren Buffett and Daniel Loeb.

Bank of New York Mellon (BK) is a $25 billion G-SIFI and the 11th largest U.S. bank by assets. According to Global Finance magazine, it is also ranked the world's 25th safest bank, the only U.S. bank in the top 25 list. The bank pays a dividend with a yield of 2.5% and a dividend payout ratio of 25%. The company has attractive valuation, featuring a forward P/E of 9.2, below the industry average of 10.1. Analysts expect the bank's EPS to grow energetically by an average of 12.4% per annum over the next five years. The stock price is currently down some 14% from the beginning of the month. Famous investors Warren Buffett, Ken Fisher, and Mario Gabelli are all bullish about this global bank.

State Street (STT) is a $20.5 billion financial services company and one of the G-SIFIs. With assets of some $217 billion (including $61.1 billion in cash), it is the 13th largest financial company in the U.S. State Street, both a bank and an asset manager, pays a dividend with a 2.2% yield. It has a dividend payout ratio of 21%. This financial services company is trading at 10.4 times its forward earnings, compared to 10.1 for the banking industry and 12.8 for the asset management industry. In April, the bank stated that it would repurchase some $1.8 billion in shares through the first quarter 2013. The bank's latest dividend payout is back to its split-adjusted high. The company's shares are down 10.5% since the beginning of May. State Street's EPS is expected to increase, on average, by 10.7% a year over the next five years. The company is popular with fund manager Donald Yacktman.

Goldman Sachs (GS) is a $49 billion multinational investment banking and securities trading firm. It has some $923 billion in assets, including $120 billion in cash. This G-SIFI is the fifth largest U.S. financial institution by asset size. The investment bank pays a dividend yield of 1.8%, with a payout ratio of 20%. Its forward P/E is 8.2, below the banking industry ratio of 10.1 and the investment services ratio of 10.8. The bank is currently trading at $98.40 a share, nearly 15% below the price levels on May 1. The company is expected to grow its EPS by 11.7% annually over the next five years. Among fund managers, this investment services company is popular with Ken Heebner and Andreas Halvorsen, both of whom initiated positions in the company in the first quarter 2012.

Morgan Stanley (MS) is a $27 billion global financial services firm and one of the G-SIFIs. The company has $750 billion in assets, including $76.8 billion in cash. It is also seventh largest U.S. financial institution by asset size. Morgan Stanley pays a dividend with a yield of 1.4%. Its dividend payout ratio is 41%. With regard its valuation, the company is trading at $13.60, some 6.4 times its forward earnings. This compares with the ratio of 10.8 for the investment services industry. The stock has fallen about 22% from the beginning of May and nearly 36% since late March. Morgan Stanley is forecast to grow its EPS by an average of 14.6% a year over the next five years. Investment gurus Ken Fisher and Ken Heebner are bullish about this company.

Bank of America is a $76 billion bank with $2.1 trillion in assets (including some $120 billion in cash). By asset size, the bank is the second largest financial institution in the United States. Bank of America pays a small dividend yield of 0.50%. In 2011, it had a dividend payout ratio of 400% of its annual EPS. The dividend does not look sustainable, taking into consideration the new Basel capital requirements. The bank is expected to expand its EPS by an average of 7.2% a year over the next five years. Investment genius David Tepper of Appaloosa Management is bullish about the stock, while Ray Dalio sold out his stake in the company in the first quarter 2012.

Citigroup (C) is a $79 billion multinational, diversified financial services company and one of the G-SIFIs. With assets of $1.87 trillion it is the third largest financial institution in the United States. The bank pays a dividend with a negligible 0.1% yield and a minute payout ratio of 1%. The bank recently failed to meet capital requirements under the Federal Reserve stress tests, reported back in March 2012. Its stock has dropped almost 20% since the beginning of May and, cumulatively, about 30.5% since mid March. Analysts forecast that Citibank will grow its EPS by an average rate of 9% per year over the next five years. The bank is popular with George Soros, David Tepper, and Andreas Halvorsen, while it is out of fashion with Ray Dalio and Julian Robertson of Tiger Management, both of whom closed out their stake in the company in the first quarter.

0 comments:

Publicar un comentario