MARKETS RETHINK SPAIN AND ITALY

June 11, 2012

Most financial broadcasters were excited about prospects for a substantial rally last night as the Spanish bailout was announced. But, then there are those pesky details and fallout to be dealt with. Will current Spanish sovereign debt be subordinate to freshly issued eurozone loans? It seems that’s likely. For most of the trading day Monday, Italian stocks (Fiat, Intesa & others) were halted in trading as contagion worries persisted. Italy will want a similar, if not larger deal. The Italian MIB Index was down 2.80%. The leftists in Greece have pounced on the bailout as a sign they can renegotiate their deal. Indeed, Syriza the hard left party vying for control in Sunday’s election has taken the lead in polls which is a poor sign for the durability of previous agreements. The Germans must be none too happy how events are unfolding. They’re doing everything they can to keep eurozone together without having to finance the bulk of it, and, they’re not willing to be ignored over austerity.

.

Anyway, markets rallied early as expected but then sellers hit the sell button as these bailout rumors and plans are becoming tiresome. Investors want to see eurozone officials confront reality and cut deals that address the systemic problems—or, no more tip-toeing around period.

Investors were caught leaning the wrong way from last week’s rally to the opening bell Monday. Stocks were down sharply and selling was universal, so there isn’t any reason to single out leaders. Gold (GLD) was modestly higher in “risk-off” mode while Gold stocks (GDX) fell because…well, because they’re just stocks in the sell program basket. Most commodities (DBC), (USO) & (JJC) were lower. The dollar (UUP) reversed some selling and rallied as the euro (FXE) weakened.

.

Not so cheery news came from the Fed which indicated U.S. family net worth had fallen to levels (40% lower) than those in the early 1990s. This is the kind of news that will bite hard on consumer sentiment and they’re living it.

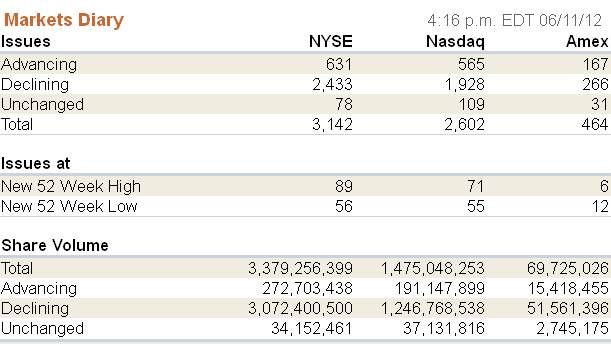

.Volume on Monday was about average for the period while breadth per the WSJ was quite negative. The roller coaster ride in breadth is quite remarkable but distribution is still dominant. ETF Digest members receive added signals when markets become extended such as DeMark triggers to exit overbought/oversold conditions.

.

0 comments:

Publicar un comentario