.

CHINA THROWS BULLS A CURVE

.

China’s PMI declined to 48.1 vs 49.6 indicating a much sharper contraction that “soft landing” proponents believed. This created a ripple effect throughout global markets. Retail Sales in the U.K. were also poor (-.8% vs -.5% expected) which also included energy. Even Canada’s Retail Sales (.5% but ex-auto declined .5%) which missed expectations. Back in the eurozone old fears (debt and economic contraction) bubbled again to the surface driving markets there lower.

.

In the U.S. Jobless Claims (348K vs 350 expected & another revision higher for prior 352K) allowed for a minor beat and some overhyped headlines. FHFA House Price Index came in absolutely flat which shouldn’t surprise given the inventory overhang. Leading Indicators (LEI) were higher (.7% vs .6% expected & prior revised lower to .2%). Together, not so bad, but U.S. markets can’t take a solo walk higher given high levels of global integration and correlation.

An ETN blow-up occurred Thursday with TVIX (Velocity Shares 2 X VIX Long ETN) as Credit Suisse suspended new share creation. The ETN should have been rising with as the VIX rose today. Investors should have been making great returns either through speculation or hedging have been disadvantaged in a major way. Here is our write-up and that of Yahoo and ZeroHedge.

.

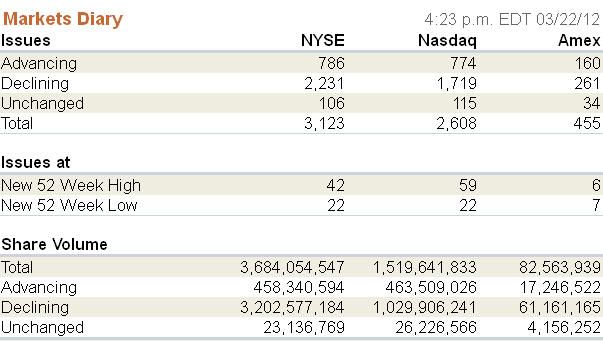

Volume on selling was only slightly more impressive than on recent melt-up days. But more selling is due to open trailing stops getting executed generally. Breadth per the WSJ was negative.

.

.

China is the world’s second largest economy and a slowdown there cannot be ignored. Further, developed markets and economies like the U.S. logically can’t be separated by conditions there.

Currently markets are getting oversold at least on a short-term basis. Friday brings us more campaign speeches from Bernanke and New Home Sales. Fed governors have been like dueling bands Thursday with Evans arguing for more QE while Fisher says “over my dead body”. Nevertheless there will be more of these jawboning speeches Friday from Lockhart and Bullard.

.

Let’s see what happens.

.

Let’s see what happens.

0 comments:

Publicar un comentario