MR. MARKET MEETS THE FOCKERS

November 01, 2011

.

A couple of really dumb moves highlight the massive sell-off seen in equity markets Tuesday. The first came from Greece where Prime Minister Papandreou after committing to a deal with the EU had a change of heart and wants a public referendum. That’s nice but clearly blindsided markets and his EU brethren given this wasn’t part of the deal.

The concern is banks have agreed to a voluntary haircut in sovereign debt. Should the public reject it (and they’re 58% against it per recent polls) then a default would become involuntary triggering massive CDS (Credit Default Swaps) events where counterparty risk is questionable. There may be over $500 billion of this debt with most held and/or issued by the top five U.S. banks. This creates more uncertainty than the markets can handle.

Next in the Focker household is Jon Corzine, CEO of now bankrupt MF Global (MF). He was a Goldman Sachs CEO, U.S. Senator and NJ Governor who destroyed NJ financially. As CEO of MF, earning $14 million in 2010, he evidently approved large speculative positions in euro zone debt which then blew-up that company. Given his background in securities management one would be shocked to know the company is alleged to have invaded and/or stole $300 million of segregated client assets. If true, this would be criminal fraud and we’ll see those involved with some jail time.

Naturally stocks globally tanked on this news as November begins heading south like so many snow birds. A two day drop of nearly 500 Dow points is more than just mere profit-taking. The volatility remains intense with two-way action remaining much with us. Last week’s previous sector leaders like materials (XLB) and financials (XLF) reversed course sharply. Taken together, it’s no wonder Main Street investors are fleeing a corrupt and volatile investment world.

Gold fell moderately as the dollar rallied along with bonds. Commodities overall took the hit pretty hard on both the Greek situation but softer data from China overnight.

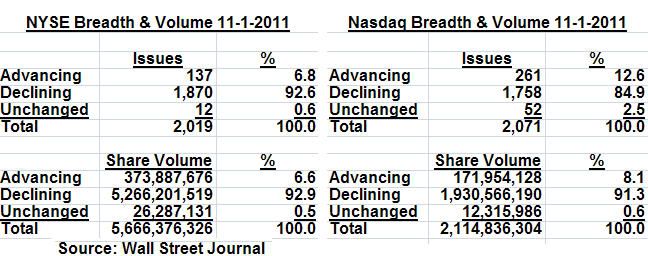

Volume was much heavier Tuesday as investors most likely took off positions from the previous week. Breadth per the WSJ was negative and looks close to a 10/90 day.

ETF Digest subscriber and friend, David Hurwitz, confirms a 10/90 day bearish day.

What’s going on in the global financial system seems unprecedented. This is the type of action we experienced in the Great Depression but not since. Then there was a 10 year bear market relieved by WWII and pent-up demand. It’s hard to say what will happen next but curing centrally planned economies and socialist regimes hasn’t worked in the past and probably won’t work now.

Let’s see what happens.

0 comments:

Publicar un comentario