CORZINE TEBOWING FOR GUIDANCE

November 18, 2011

.

.

It’s been surprising how little MF Global news there is. It’s there, all gift-wrapped for the media. The CFTC Chairman Gary Gensler (former GS managing director) has recused himself from MF investigations given his close relationship with Corzine.

Goldman Sachs, the omnipresent vampire squid, has its tentacles spread globally. Apart from conflicts with MF, Goldman suggested ECB head Mario Draghi (a former GS advisor) encourage the Germans to allow the ECB to print enough money which would be lent to the IMF. In turn the IMF would lend it to euro zone nations in need. German PM Merkel has sternly voted no to this. Italy’s new PM Mario Monti (also a former GS advisor) is also pro-printing. And, Goldman in a note Friday wrote: “There are no easy choices and it would have been, no doubt, better if the ECB had never got in the position it is in now. But the current situation demands a careful weighing of the risk involved with any decision taken. The inflationary risk thereby seems to be getting an unduly high weight in the consideration of German policy makers.”

They clearly have undue influence.

Meanwhile in the U.S. economic data was positive with Leading Indicators up .9% indicating positive growth. Earnings news featured a poorly received report from Salesforce.com (CRM), H.J. Heinz (HNZ) reported subpar results while Boeing (BA) confirmed a mega-order ($21.7 billion) for jets from Indonesia’s Lion Air.

There are many Fed governors on the hustings trying to cheer investors and win their confidence. Every day one or two are on the scene. Friday NY Fed President William Dudley (former GS managing director) cautioned against too much spending cuts from the government thinking it would hurt economic growth. He also gave a gratuitous shout-out to Occupy Wall Street saying: “I completely understand the anger of people on Occupy Wall Street”. Goldman Sachs guys have empathy for common people.

The Congressional Deficit committee continues to meet but seems gridlocked. There are hints a deal might be struck to lower the committee’s goals—always the easier path.

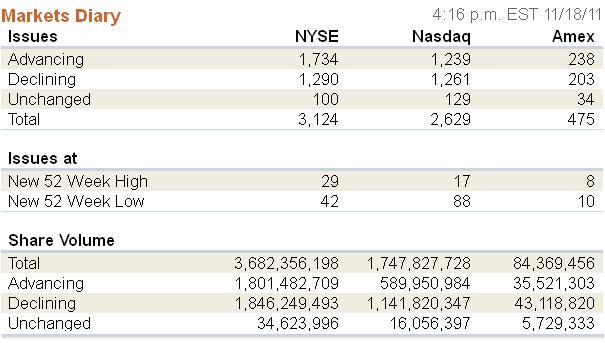

Options expiration wasn’t too eventful and frankly was a rather boring affair. Volume was modest and breadth was mixed.

This concludes a poor week. The October rally seems like a distant memory as the belief from then was the euro zone was “fixed”. This proved incorrect.

There is some wreckage littering the street away from the OWS crowd. How the Corzine led disaster that is MF Global is clearly beyond belief. A former CEO of Goldman Sachs, U.S. Senator and Governor of New Jersey have seen a remarkable collapse. Will he do some jail time? I hope so since there’s $660 million dollars missing from customer accounts. It’s possible he’s just a sophisticated thief. And, it’s quite obvious the planet is littered by former Goldman Sachs insiders manipulating the world’s financial system. This should be exposed.

Next week is supposed to always be a great week for markets. But, Mr. Market hasn’t been up against conditions like these.

There is some wreckage littering the street away from the OWS crowd. How the Corzine led disaster that is MF Global is clearly beyond belief. A former CEO of Goldman Sachs, U.S. Senator and Governor of New Jersey have seen a remarkable collapse. Will he do some jail time? I hope so since there’s $660 million dollars missing from customer accounts. It’s possible he’s just a sophisticated thief. And, it’s quite obvious the planet is littered by former Goldman Sachs insiders manipulating the world’s financial system. This should be exposed.

Next week is supposed to always be a great week for markets. But, Mr. Market hasn’t been up against conditions like these.

0 comments:

Publicar un comentario