STRATEGIES TO BUY MORE TIME IN EUROPE

September 26, 2011

At the end of last week we had a G20 statement which was long on words but short on action. The IMF followed on Saturday with another statement in the same manner. IMF head Christine Legarde held a news conference which was frankly useless but typical as these things go. Her most significant answer came from a question posed by a Greek reporter: “What will the IMF do with these demands should there be great social unrest in Greece?” Her response: “Implementation, Implementation, Implementation.” (This statement meant previous agreements must be taken seriously.) The WSJ was kind enough to post a description of just what’s going on as to the calendar and conditions in simple terms. The three primary Greek agreements include “slashing pensions” (“implementation” = riots); cutting public sector jobs (“implementation” = bloodshed) and raising taxes on the poor (“implementation” = all out war). Further, whatever actions are to take place will be strung out over the next few months as in “buying time”. The odd thing is so-called “troika” is going to give Greece its October payment even with the likelihood they may not get any more money in November.

Asia markets Monday saw this for what it was and sold-off. But Europeans were more hopeful and bid their oversold stocks higher. U.S. investors (whoever is left) took the bait and rallied stocks erratically with a dramatic short squeeze into the close. What’s not to like about this situation? Well, we’ll just have more drama and events strung out perhaps through the end of the year. That’ll sell more soap and keep everyone on edge.

U.S. investors liked the big stock buyback plans from Warren Buffett as he creates more wealth for himself which he can perhaps give to the Treasury since he seems so inclined. His action conveyed the message to HFT algos that stocks were cheap. That got the talking heads to repeat the “stocks are cheap” mantra and even got them to cheer Dow 11K again.

Gold and silver continued to slide but rallied off their lows. Base metals rallied some which helped the materials sector (still in a bear market) rally. Even a rumor that Apple (AAPL) was going to cut back on iPad production hit that stock for a bit only to see investors seeing any dip as a buying opportunity.

Amusingly perhaps is the SEC is contemplating a civil action against S&P for its previous poor ratings performance on CDOs, and I just can’t but think this is political payback from the administration. Silly me, eh?

Bonds saw significant profit-taking from last week’s gain. And, you’ll never guess what technical indicator indicated this—DeMark. Further, weekly DeMark 9s littered European stock ETFs like EWG and EFA for example indicating “buy to close short” positions if you had them.

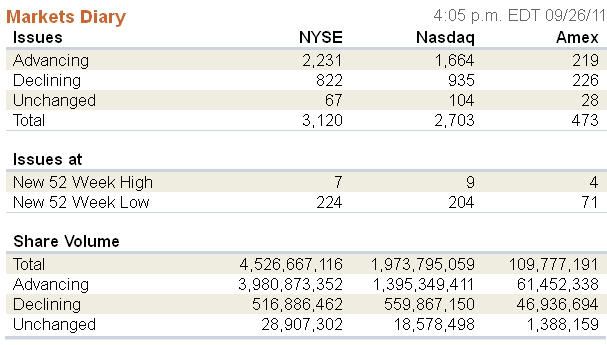

Volume was modest making the short-squeeze relatively easy for HFTs. You won’t hear many complaints about these programs when markets rise. Breadth per the WSJ was quite positive.

Monday was a classic short squeeze and with equity market correlations high DeMark instructed us to stay away from the short side and even close bond positions. We follow this advice.

There wasn’t much in the way of bullish news beyond Buffett’s stock buyback plans. Further, if anything, news from Europe was a nonevent with lots of pretty statements but no concrete action. Worse still was the idea that “fixes” are going to be dragged-out.

Tuesday will feature Case-Shiller Home Price Index and Consumer Confidence data. Further just about every day a Fed governor is scheduled to speak and jawbone markets.

Let’s see what happens.

0 comments:

Publicar un comentario