APPLE WORLD DOMINATION

September 19, 2011

Usually investors seek safety in bonds, gold or even other currencies. But now Apple (AAPL) given its large $75 billion in cash and popular product line up now is also becoming a safe-haven. Investors must be frantic in search of just where to park their cash in this current environment. But, it also begs another question: Where does Apple park all that cash anyway? U.S. banks? I doubt it. No, even they must invest it in Treasurys or well-regarded commercial paper.

Of course this just leads us to wonder what really is safe nowadays. Apple and Treasurys seem a safe place while gold and commodities seem to have lost some of their luster at least lately. Obviously the euro zone has plenty of troubles to work through. Even venerable Siemens (SI) withdrew $500 billion from French banks and placed it with the ECB. So maybe Siemens is bailing out Italian banks indirectly?

In the meantime, German Chancellor Angela Merkel’s party lost another local election and clearly public pressure is building to stop all these bailouts financed mostly by Germans. The Greek bailout situation is now descending into a receivership sort of situation with the IMF and ECB acting as trustees overseeing monthly loans based on mandated conditions. This in turn creates too much drama for markets to handle. Stock markets globally rise and fall with each passing deadline. This is becoming tiresome. Therefore it shouldn’t surprise that U.S. investors have withdrawn $75 billion from equity funds since April per the Investment Company Institute.

U.S. stocks opened sharply lower following their European counterparts as the Greek drama continues to bob to the surface. Rumors of some deal in the works lifted stocks off their lows but we still closed down on the day. Only Apple (AAPL) continued to move higher while just about everything else fell once again. Bonds were higher, but commodities including oil, base metals, agriculture and precious metals all fell. The dollar rose but closed well off its intraday highs.

The only economic data came from the NAHB Homebuilders Index which was negative at 14 vs 15 expected. Remember, breakeven for this index is 50! Weakness in new housing might be a good thing since the last thing we need is more inventory.

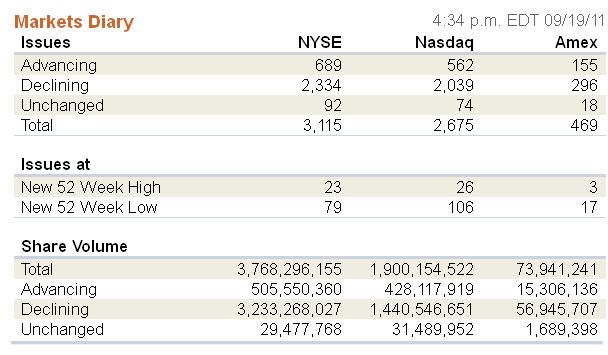

Volume was lighter than on previous trading day’s but it was Monday after all. Breadth per the WSJ was negative.

Barring anything unusual there probably won’t be a posting tomorrow given Wednesday’s highly anticipated Fed announcement. Nevertheless these have been unusual trading days so you never know what will be coming down the pike.

It’s been a very difficult market to position but an easier market for day-trading if that’s your thing. Most investors want risk management tools more than ever and sometimes just being out of the market is wisest. At least many must feel this way since they’ve withdrawn over $75 billion from equity funds since April. This confirms they don’t trust markets and being on the sidelines is their risk management tool. Equity markets are nervous (high VIX) and jumpy with rumors creating volatile conditions.

Apple (AAPL) must seem as the only safe haven or investment for portfolio managers these days. It’s an incredibly good company but also much over-owned. This could lead to a problem eventually.

Oracle and Adobe report earnings Tuesday. Theoretically there should be some news for the monthly Greek money advance. It does seem a slow motion and managed default no matter how they spin it. Housing Starts data will also be reported Tuesday.

0 comments:

Publicar un comentario