August 11, 2011

The market is putting on a show better than Marx Brothers’ A Day at the Races. One day bulls hate HFTs and the next they’re saviors. You can’t have it both ways and the action is getting downright silly. It’s completely dominated by HFTs.

So, let’s see if I’ve got this week right so far: -635; +430; -520-; and +423 for the DJIA. Who can push these kinds of results? HFTs are the only reasonable answer.

In the end this volatility and manic behavior is a massive turn-off to Main Street. The powers that be (TPTB) are pulling out all the stops to thwart action they don’t like. Margin requirements were raised on gold because rising gold prices are a Bronx Cheer to the Fed, Treasury and Administration. The Swiss National Bank is discussing a “euro peg” in order to stop the franc’s rally. Not only are the Swiss suffering with export difficulties but Swiss banks have been a large creditor to emerging European countries who must pay back loans in francs. And, just released news, France, Italy, Spain and Belgium have announced a 15 day short sale restriction for banks within these countries. This defies a ruling from the EU chief regulator and is being done unilaterally by each country. Will this solve things? It will for 15 days and that’s all you can say. Meanwhile, Sarkozy is having another date with Merkel to make sure they’re on the same page with regard to bailouts. She’s become very unpopular in Germany given the Germans will carry the lion’s share of the bailouts. And so it goes.

Bulls cheered a still pathetic Jobless Claims number which slightly beat expectations and was lower chiefly due to the previous report being revised higher. Further, the four week moving average of claims continues to rise.

Cisco (CSCO) did report a beat in earnings ($.32 vs $.31 estimates) which wasn’t all that spectacular but bullish headline writers will run with anything especially since markets were much oversold. And earnings news for the quarter is coming to an end next week with retailers in the spotlight.

But, Jobless Claims and Cisco earnings mean nothing since the machines and HFTs have taken complete control of the markets. Sorry for being this repetitive. How can they be stopped? A transaction tax would end the practice in a heartbeat but TPTB on Wall Street wouldn’t like this period.

Gold fell 2% with higher margins, crude oil rallied, bonds fell sharply and the dollar was flat overall despite big moves in individual currencies like the Swiss Franc.

Thereafter things “might” settle down into a typically quieter late August vacation period before Labor Day ends summer. And, just like last year, we may get a visit from more QE to lift markets with freshly printed cash.

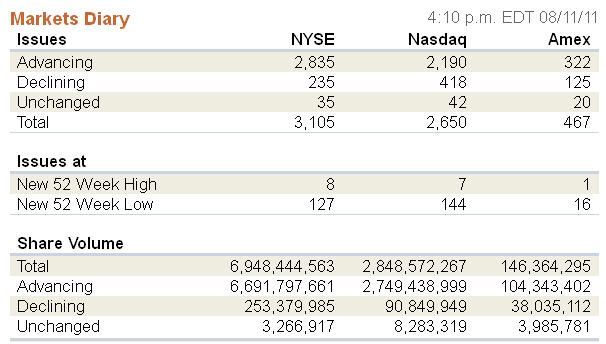

Volume continues along at a high level while breadth per the WSJ reversed course again but perhaps missed a 90/10 day.

Retail Sales, Consumer Sentiment and Business Inventories will be featured Friday.

The HFTs and their algos have taken over. That’s it there’s nothing further to say.

0 comments:

Publicar un comentario