Gold is flat in U.S. dollars and New Zealand dollars but marginally lower in most currencies Wednesday as increased risk appetite has seen risk assets rally despite poor fundamentals. Most Asian indices were higher, except the Chinese and Indian markets, and European indices have also risen.

.

(Click to enlarge) Bloomberg Chart of the Day from Korea Investment

Respite has also been seen in euro-zone debt markets with bond yields falling. Rumours of ECB intervention through peripheral bond buying have helped steady things but the ECB has not given any indication that it is supporting vulnerable European sovereign debt markets.

For now markets appear more interested in Apple’s (AAPL) massive profits than Uncle Sam’s massive debts.

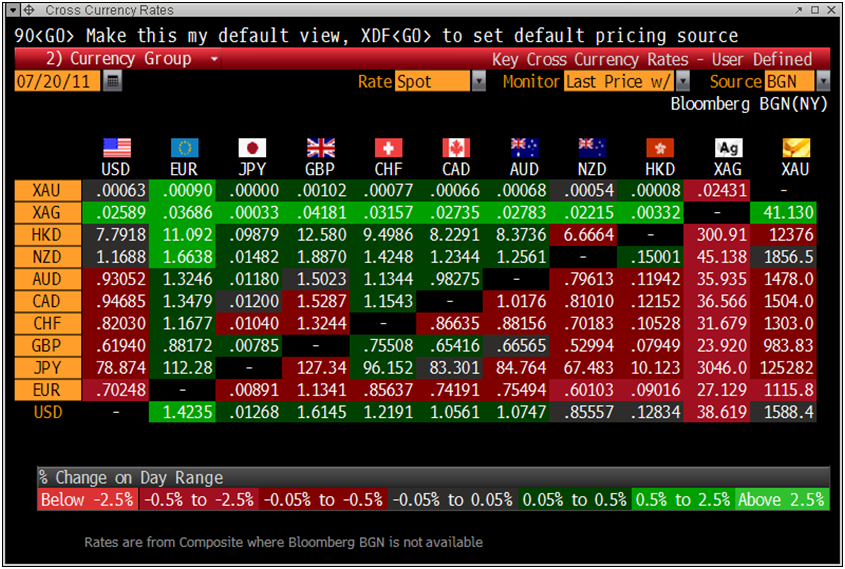

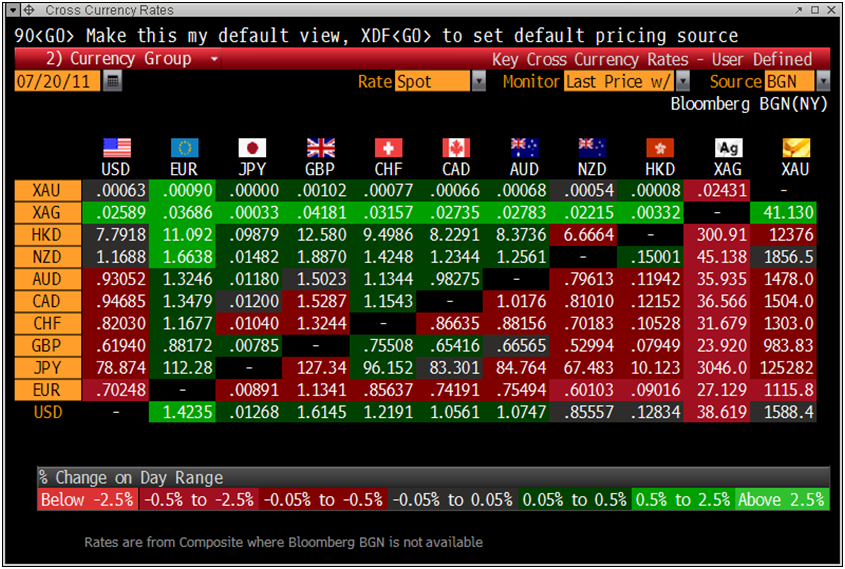

(Click to enlarge) Cross Currency Rates

(Click to enlarge) Cross Currency Rates

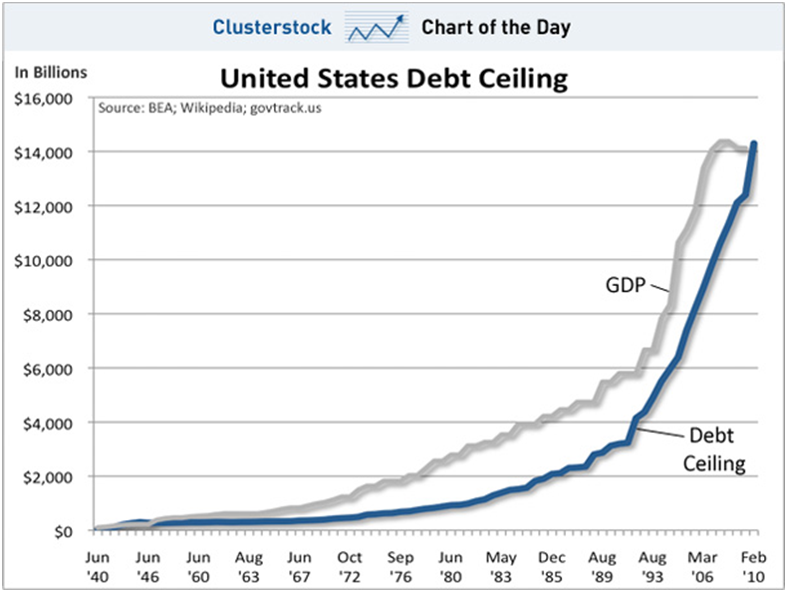

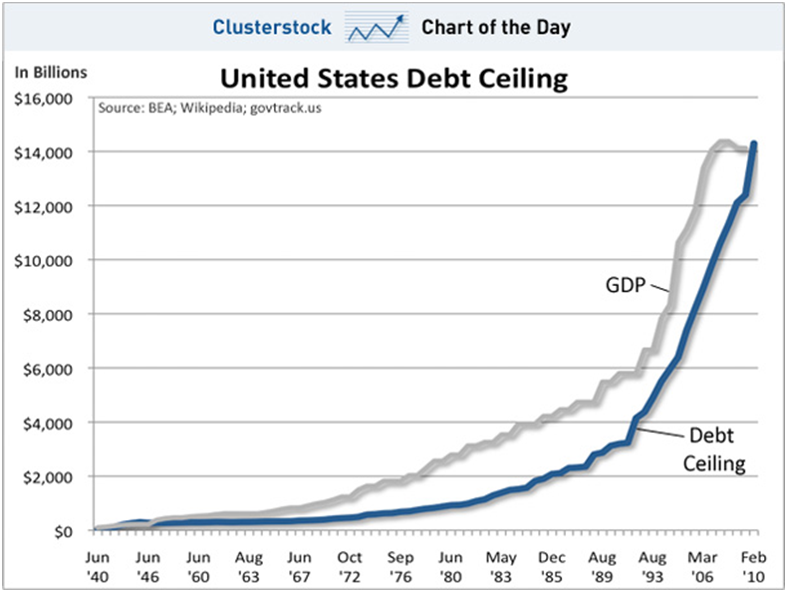

The Republican controlled U.S. House, defying a veto threat, voted (234-190) to slice federal spending by $6 trillion and require a constitutional amendment for a balanced budget to be sent to the states in exchange for averting a threatened Aug. 2 government default.

Treasury Secretary Timothy Geithner has said the government will run out of options to prevent a default by August 2 – in 13 days time.

Standard & Poor’s Ratings Services and Moody’s Investors Service have said they are likely to downgrade the U.S.’s credit rating if Congress doesn’t act.

An increase in the $14.3 trillion U.S. debt ceiling is inevitable and is a question of when rather than if.

The Bloomberg Chart of the Day (see above) shows how gold in dollars is correlated with increases in the U.S.’s debt limit, particularly in the last 10 years.

.

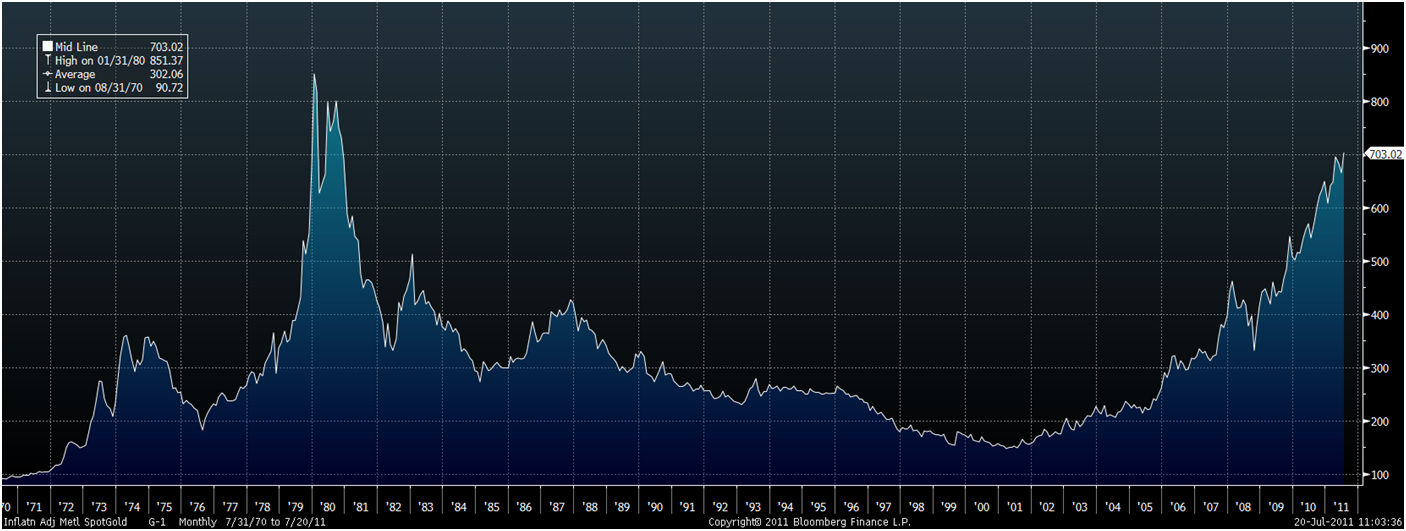

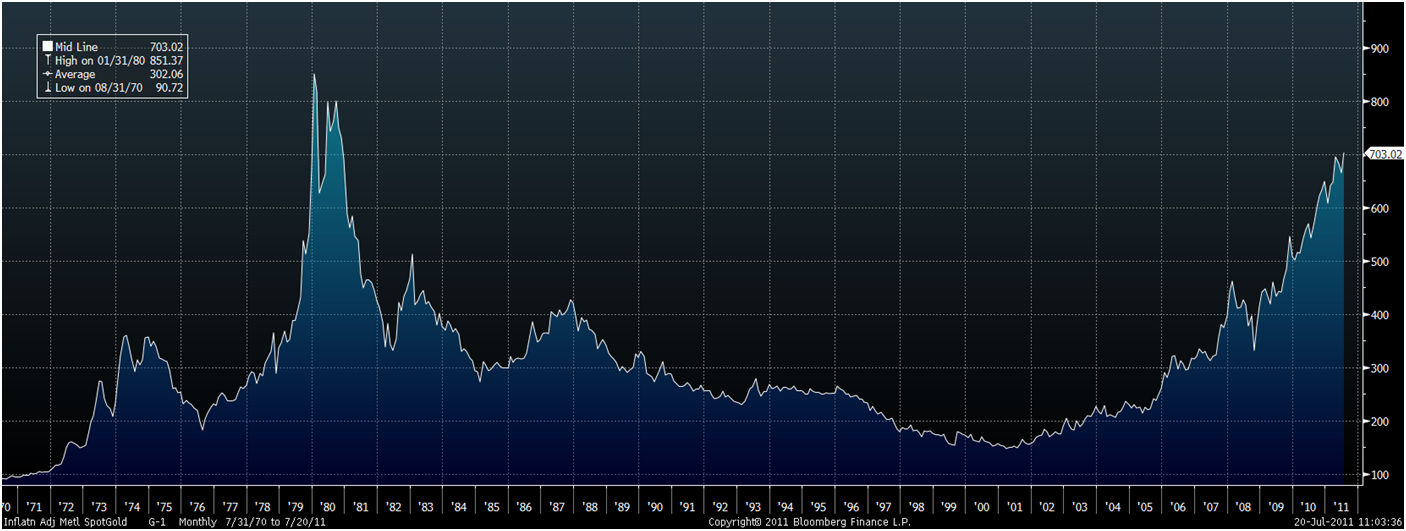

(Click to enlarge) Bloomberg Composite Gold Inflation Adjusted Spot Price – 1970-2011

(Click to enlarge) Bloomberg Composite Gold Inflation Adjusted Spot Price – 1970-2011

Julia Yoo, a Seoul-based analyst at Korea Investment told Bloomberg that “gold’s rally is quite explosive.”

“Increasing the debt limit means you print more dollars, which will weaken the dollar and consequently lift the gold price,” adding to gains this year that were driven by demand from countries including China.

Gold is 12% higher in dollar terms so far in 2011 and is the best performing currency in the world in the last 12 months.

Gold has risen 33% against the U.S. dollar over the past year, outpacing all of the more than 150 currencies tracked by Bloomberg.

.

(Click to enlarge) United States Debt Ceiling 1940-2011

(Click to enlarge) United States Debt Ceiling 1940-2011

However, over the long term gold remains undervalued or at worst fairly valued.

Admittedly, gold has risen by nearly 6.5 times in the last 11 years.

However, in the last bull market in the 1970s, gold rose 24 times from $35/oz to over $850/oz in 9 years. Gold remains well below its 1980 record high of $2,400/oz when adjusted for inflation.

The macroeconomic conditions today are even more conducive to gold than they were in the 1970s.

Most industrial nations such as the U.S., Japan, Germany etc. were creditor nations in the 1970s.

Today they are debtor nations with the U.S. the largest debtor nation the world has ever seen. The fiscal situation in the U.S. is appalling and deteriorating – with a national debt of nearly $14.5 trillion and unfunded government liabilities of between $60 trillion and $100 trillion.

As long ago as 2003 we said that this inflation adjusted high price from 1980 would likely be reached and surpassed. We said that at that stage gold could be in a bubble and it would be time to reduce allocations while keeping a core financial insurance holding in gold.

In 2005, we said that the growing property bubbles in the U.K., the U.S. and the massive debt levels in the western world (household, mortgage debt and in the banking system) would likely lead to a deterioration in government balance sheets and sovereign debt crises which in turn could lead to currency crises.

We are entering the late intermediate to final stage of this process and the real risk of a currency crises in any one of the major fiat currencies rises by the day.

.

(Click to enlarge) Bloomberg Chart of the Day from Korea Investment

Respite has also been seen in euro-zone debt markets with bond yields falling. Rumours of ECB intervention through peripheral bond buying have helped steady things but the ECB has not given any indication that it is supporting vulnerable European sovereign debt markets.

For now markets appear more interested in Apple’s (AAPL) massive profits than Uncle Sam’s massive debts.

(Click to enlarge) Cross Currency Rates

(Click to enlarge) Cross Currency RatesThe Republican controlled U.S. House, defying a veto threat, voted (234-190) to slice federal spending by $6 trillion and require a constitutional amendment for a balanced budget to be sent to the states in exchange for averting a threatened Aug. 2 government default.

Treasury Secretary Timothy Geithner has said the government will run out of options to prevent a default by August 2 – in 13 days time.

Standard & Poor’s Ratings Services and Moody’s Investors Service have said they are likely to downgrade the U.S.’s credit rating if Congress doesn’t act.

An increase in the $14.3 trillion U.S. debt ceiling is inevitable and is a question of when rather than if.

The Bloomberg Chart of the Day (see above) shows how gold in dollars is correlated with increases in the U.S.’s debt limit, particularly in the last 10 years.

.

(Click to enlarge) Bloomberg Composite Gold Inflation Adjusted Spot Price – 1970-2011

(Click to enlarge) Bloomberg Composite Gold Inflation Adjusted Spot Price – 1970-2011Julia Yoo, a Seoul-based analyst at Korea Investment told Bloomberg that “gold’s rally is quite explosive.”

“Increasing the debt limit means you print more dollars, which will weaken the dollar and consequently lift the gold price,” adding to gains this year that were driven by demand from countries including China.

Gold is 12% higher in dollar terms so far in 2011 and is the best performing currency in the world in the last 12 months.

Gold has risen 33% against the U.S. dollar over the past year, outpacing all of the more than 150 currencies tracked by Bloomberg.

.

(Click to enlarge) United States Debt Ceiling 1940-2011

(Click to enlarge) United States Debt Ceiling 1940-2011However, over the long term gold remains undervalued or at worst fairly valued.

Admittedly, gold has risen by nearly 6.5 times in the last 11 years.

However, in the last bull market in the 1970s, gold rose 24 times from $35/oz to over $850/oz in 9 years. Gold remains well below its 1980 record high of $2,400/oz when adjusted for inflation.

The macroeconomic conditions today are even more conducive to gold than they were in the 1970s.

Most industrial nations such as the U.S., Japan, Germany etc. were creditor nations in the 1970s.

Today they are debtor nations with the U.S. the largest debtor nation the world has ever seen. The fiscal situation in the U.S. is appalling and deteriorating – with a national debt of nearly $14.5 trillion and unfunded government liabilities of between $60 trillion and $100 trillion.

As long ago as 2003 we said that this inflation adjusted high price from 1980 would likely be reached and surpassed. We said that at that stage gold could be in a bubble and it would be time to reduce allocations while keeping a core financial insurance holding in gold.

In 2005, we said that the growing property bubbles in the U.K., the U.S. and the massive debt levels in the western world (household, mortgage debt and in the banking system) would likely lead to a deterioration in government balance sheets and sovereign debt crises which in turn could lead to currency crises.

We are entering the late intermediate to final stage of this process and the real risk of a currency crises in any one of the major fiat currencies rises by the day.

0 comments:

Publicar un comentario