Why our masters insist on breaking the rules

By Jamie Whyte

Published: June 8 2011 22:34

Rules are made to be broken. This is a confusing adage. If you do not want a rule followed, why make it?

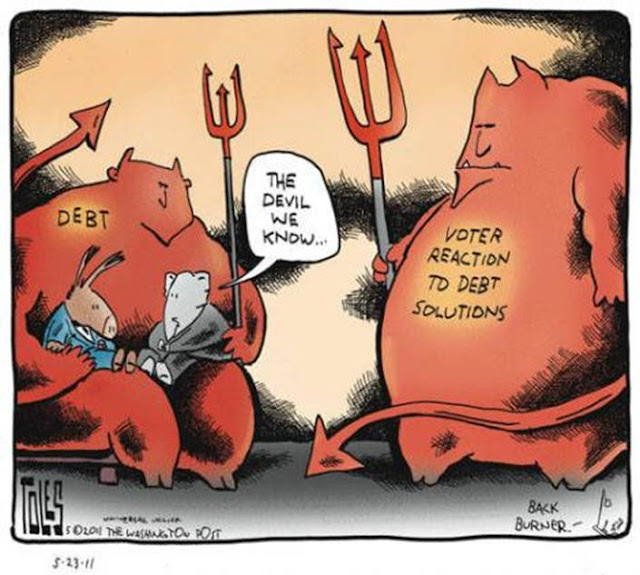

Yet it is clearly a popular idea among the European politicians who are managing the sovereign debt crisis. When they bailed out Greece, Ireland and Portugal they did not merely do something that exceeded their powers, they violated an explicit prohibition on such bail-outs.

Now there is talk of the European Central Bank accepting Greek government bonds as collateral even if it is “restructured” (not repaid in full) or “rescheduled” (paid late). This would violate rules about what the ECB can accept as collateral. But it will be an easy step to take because by currently accepting Greek government bonds as security the ECB is already violating rules about the required credit quality of collateral. And, as another saying goes, you might as well be hanged for a sheep as for a lamb – especially when you will be hanged for neither. European politicians and bureaucrats suffer no punishment when they break the rules that they claimed would make the euro safe in their hands.

Of course, they claim that by breaking the rules they are acting in the interests of the European people. But such judgments ought to be irrelevant. We do not allow an ordinary citizen to decide when the laws against theft should apply to him and when, all things considered, it would be for the best if he stole someone’s property. A thief cannot evade conviction by arguing that he had a good reason to steal. Yet the dear leaders of Europe can and do pardon themselves by declaring the wisdom of their rule-breaking.

It is tempting for those who have attained eminence and power to believe they are a superior kind of person, unhindered by the intellectual and moral limits that make ordinary men get along better when they live under the rule of law. Rules are made to be broken by the anointed; that seems to be the view of our anointed European leaders.

This gets things the wrong way round. A nasty man with a knife can injure people. But the harm he can cause is trivial compared with the misery that can be inflicted by those who wield the power of the state. They, more than anyone, must submit to rules. The use they can make of the force at their disposal must be limited and we must know what the limits are.

For even if politicians and senior bureaucrats – people such as Silvio Berlusconi, John Prescott and Dominique Strauss-Kahn – really are the best of mankind, they are still subject to human frailties. Like the rest of us, they are ignorant, partial, venal and vain. Indeed, politicians may be unusually prone to some of these vices. Ask the people of Greece about the virtue of their recent political leaders. Ask them if these men and women are of such exalted intellect and character that their behaviour ought to be unconstrained by rules.

I recently discovered a fraudulent transaction on my credit card. Someone has imposed a £5,000 debt on me without my agreeing to it. That is against the law and I expect I will not ultimately be forced to repay the debt. During the financial crisis, the British government borrowed tens of billions of pounds, of which they require me to repay my “fair share” through taxation. This broke no law and to avoid paying I will have to emigrate.

Unlike the kings of yore, modern politicians cannot toss you in prison on a whim. But they can still impose debts on you. And, as with the kings of yore, their arbitrary powers are rarely used to benefit the little guy. In recent years, American, British and other European politicians have transferred the cost of poor financial decisions, amounting to trillions of dollars, from the influential people who made those mistakes to taxpayers who did not. If you refuse to cover the losses of those who lent to RBS, the Irish government and all the other failed but favoured enterprises, you will be imprisoned.

You might wish for some constitutional or other legal constraints on this power. But we already have some and the bail-outs of Greek, Irish and Portuguese bondholders broke them. Legal constraints are useless when the authorities believe that rules are made to be broken.

The writer is the author of ‘Crimes Against Logic’

Copyright The Financial Times Limited 2011.

Home

»

Europe Economic and Political

» WHY OUR MASTERS INSIST ON BREAKING THE RULES / THE FINANCIAL TIMES COMMENTARY & ANALYSIS ( VERY HIGHLY RECOMMENDED READING )

viernes, 10 de junio de 2011

Suscribirse a:

Enviar comentarios (Atom)

0 comments:

Publicar un comentario