Prices and Plutocrats

Mark Thoma sends us to Lane Kenworthy on the disconnect between economic growth and median income since 1973:

.

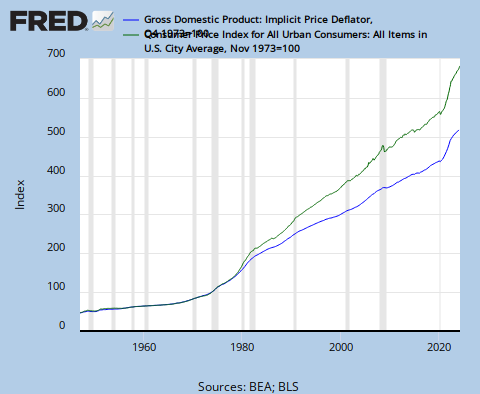

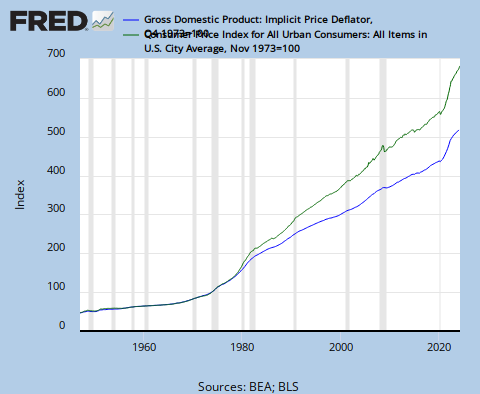

A couple of points here. First, this figure compares real income with real income — but they’re two different versions of reality. The rise in prices implied by real GDP numbers is measured by the GDP deflator, while the rise in incomes as calculated by the Census involves dividing by the CPI. And while those two price measures matched very well pre-1973, since then, not so much:

What’s going on here? It means that we’re either overstating inflation (and hence understating income gains) or overstating economic growth. Both the BEA (which measures GDP and related) and the BLS (which does consumer prices) work hard and honestly at their tasks; the difference probably arises (I’m sure someone has done this more carefully) in how you value new or improved goods. My sense has always been that the GDP accounts overdo their hedonics, but that’s very much a matter of opinion. Maybe the real point here is to remember, always, that economic statistics are a peculiarly boring sub-genre of science fiction; extremely useful, but not to be treated as absolute truth.

Still, statistical issues aren’t the whole story. Rising inequality has, unambigously, contributed to lagging median income. You can see this just by comparing the growth in average and median income according to the Census data:

Census

Census

And the real divergence is surely bigger: Census data tend to miss growth at the very top end, thanks to top-coding.

So why hasn’t family income tracked rising GDP? It’s partly about price indexes, partly about plutocrats (i.e., rapidly rising incomes at the top). It would be nice if the story were cleaner, but that’s life.

.

A couple of points here. First, this figure compares real income with real income — but they’re two different versions of reality. The rise in prices implied by real GDP numbers is measured by the GDP deflator, while the rise in incomes as calculated by the Census involves dividing by the CPI. And while those two price measures matched very well pre-1973, since then, not so much:

What’s going on here? It means that we’re either overstating inflation (and hence understating income gains) or overstating economic growth. Both the BEA (which measures GDP and related) and the BLS (which does consumer prices) work hard and honestly at their tasks; the difference probably arises (I’m sure someone has done this more carefully) in how you value new or improved goods. My sense has always been that the GDP accounts overdo their hedonics, but that’s very much a matter of opinion. Maybe the real point here is to remember, always, that economic statistics are a peculiarly boring sub-genre of science fiction; extremely useful, but not to be treated as absolute truth.

Still, statistical issues aren’t the whole story. Rising inequality has, unambigously, contributed to lagging median income. You can see this just by comparing the growth in average and median income according to the Census data:

Census

Census And the real divergence is surely bigger: Census data tend to miss growth at the very top end, thanks to top-coding.

So why hasn’t family income tracked rising GDP? It’s partly about price indexes, partly about plutocrats (i.e., rapidly rising incomes at the top). It would be nice if the story were cleaner, but that’s life.

0 comments:

Publicar un comentario