Major Buying Opportunity Developing in Precious Metals

January 24, 2011

.

Rather than discussing every asset class under the sun, this week I want to focus on a MAJOR buying opportunity that is developing in the precious metals space.

With that in mind, this week’s edition of my weekly market forecast is titled "Buy With Both Hands".

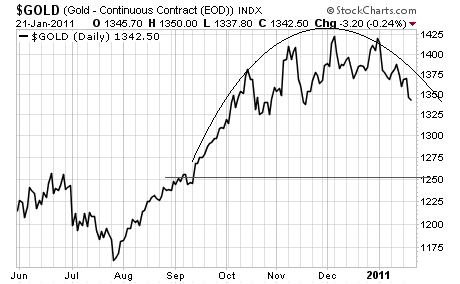

Gold has formed very ugly technical patterns both in the long-term and the short-term.

In the short-term, we have what looks like a dome top forming.

This is one of the cleanest dome top patterns I’ve ever seen. The downside target for it is around $1,250, which coincidentally lines up gold’s long-term chart pattern target as well.

In the long-term, we have a rising bearish wedge forming since the 2008 crash. As I wrote this, gold was right on the lower trendline of this massive pattern. A break here would likely see the precious metal falling to $1,250 before putting in a base for another leg up.

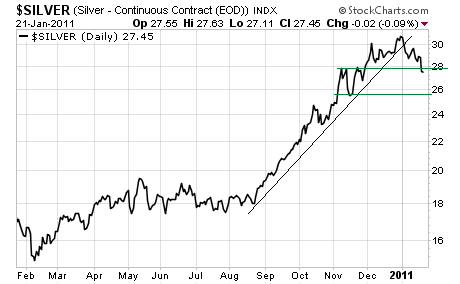

Silver is posting a similarly bearish looking pattern.

As you can see, silver has broken the trendline that supported it during this latest rally. It has since failed to reclaim this line AND broken through initial support at $28. The next real line of support is $26 or so, though we could easily go as low as the $24-25 range if things pick up steam to the downside. Given the steepness of silver rally from August to December, this is quite possible.

Let me be blunt here. If gold falls to $1,250 per ounce and silver falls to $25 per ounce, it’s time to BUY WITH BOTH HANDS.

I want to be clear here. I am SUPER bullish on both precious metals in the long-term. But right now, both are posting extremely ugly, bearish technical patterns. However, rather than seeing this as something to worry about, I view it as phenomenal buying opportunity for both assets.

One of the oddest things about investment psychology is that people only want to load up on an asset class when it’s soaring. Rarely do they view a collapse as a good thing. In some cases, this mentality is beneficial (buying Tech stocks in 2001 when they began to collapse after soaring would have been a HORRENDOUS move).

However, in the case of gold and silver today, a collapse right now would be absolutely FANTASTIC for investors.

For one thing, it would shake out some of the hot money that recently flowed into the sector. And it would also give both precious metals a chance to form a sound base before beginning their next leg up.

Indeed, I expect both assets to be MUCH higher from where they are today this time next year. Why? Because the Fed and the world’s central banks have pumped trillions of dollars into the financial system and have no means of getting back out again.

So, in the near-term, deflation remains the primary risk. In fact, I would venture that Ben Bernanke would LOVE another round of deflation to occur as it would serve as support for his money printing policies and his goal of pumping even more money into the system.

When this happens, gold and silver will begin the REAL explosion upward. So with that in mind, let gold and silver drop now and then BUY WITH BOTH HANDS. After all, the first wave of inflation has already hit the US (the initial stage of rising prices pushed by speculation).

After this comes the REAL stage of inflation: the CURRENCY COLLAPSE.

Remember, the US Federal debt is now at $13+ trillion. And if you include unfunded liabilities like social security and medicare, you're talking about $70+ TRILLION in total debt on the US balance sheet.

Let's be blunt here: the US will NEVER pay these debts and liabilities off. And once the financial world finishes pummeling the Euro, we're going to see the US Dollar and Federal debt markets implode.

I cannot tell you when this will happen. All I can say is that it will happen. And when it does, inflation hedges across the board will EXPLODE higher.

0 comments:

Publicar un comentario