Gold and Silver: Time to Take Profits?

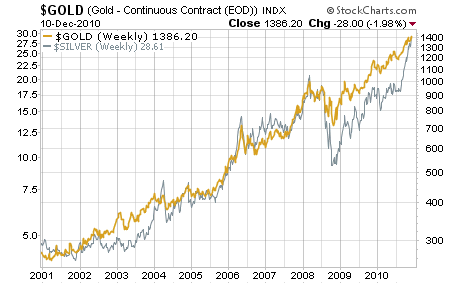

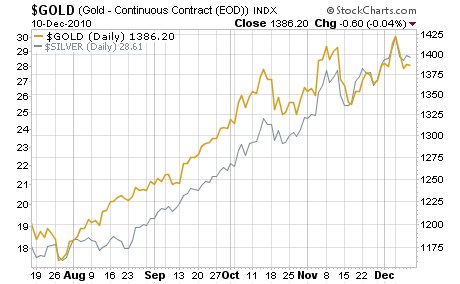

To be sure, we’re talking about some serious gains here. And it’s not like those who invested in 2010 missed out on the fireworks: Thanks to the Fed’s QE lite and QE 2 programs, both precious metals have gone into hyper-drive in the last five months, rising 14% and 66% respectively.

Now, no investment can move this much in so little time without needing a breather, which is why precious metals investors are peppering me with questions about whether or not to lock in their gains.

My answer is: It all depends on why you own gold and silver. If you own these precious metals because you want to hold them as catastrophe insurance or as a hedge against inflation, then issues like short-term drops in price should be seen as buying opportunities. Indeed, gold bulls have already ridden out 13 corrections of roughly 7%, six corrections ranging from 10%-16%, and three full-scale crashes of 22-23% since the gold bull market began in 2001.

So if you’re a long-term bull, you’re used to seeing some serious dips in the price of gold holdings. And if you bought more gold during those dips, you’ve profited handsomely.

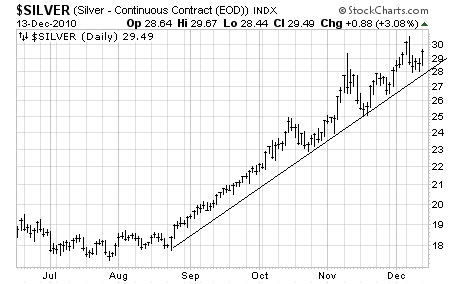

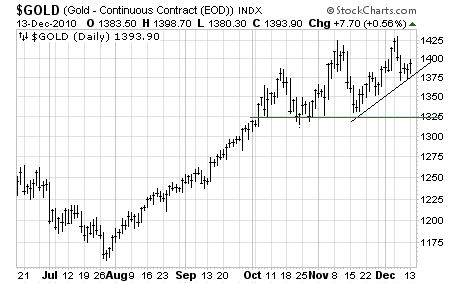

In contrast, if you currently own gold or silver for trading purposes, you need to closely watch the below trend-lines when gauging when to take profits .

First off, silver has exploded higher since August, rallying over 60% since that time. The below chart shows the clear trend-line for silver today. If we take out this line, then we’re likely going down to at least $27 per ounce, if not $26.

Gold hasn’t gone on anything like the vertical jump that silver has. However, it has formed a defining trend-line over the last few months (see black line below). A break here would likely take us down to support at $1,325 per ounce. And if we break that line, the next real line of support is $1,250 per ounce.

Again, keep your eyes on these trend-lines; they’re the best means of determining when it’s time to take profits.

0 comments:

Publicar un comentario