Rate cuts would mitigate the economic impact of the dollar’s strength, says US Fed

Eva Szalay in London

The dollar’s strength is proving resilient — despite all of US president Donald Trump’s attempts to talk it lower.

Policymakers at the US Federal Reserve signalled in meeting minutes published last week that the rate cuts Mr Trump has lobbied for are expected to offset the greenback’s appreciation.

However, Mr Trump has shown no sign of easing off on his rhetoric about the exchange markets. In recent weeks the US president has accused a host of countries of being currency manipulators and threatened to levy sanctions on them, and has repeatedly cited the dollar’s strength in a bid to put pressure on Fed chair Jay Powell to cut rates.

In May the US Treasury added Ireland, Italy and Germany to its currency manipulator watchlist, placing them alongside China, Vietnam and Singapore — even though they are part of the eurozone and have no direct national control over monetary policy.

For the first time in a decade, the beggar-thy-neighbour tactics of competitive currency devaluation are making a comeback.

“It feels like we are looking at a broader monetary policy war and the currency issue is a symptom of that,” said Geoff Yu, head of the UK investment office at UBS Wealth Management.

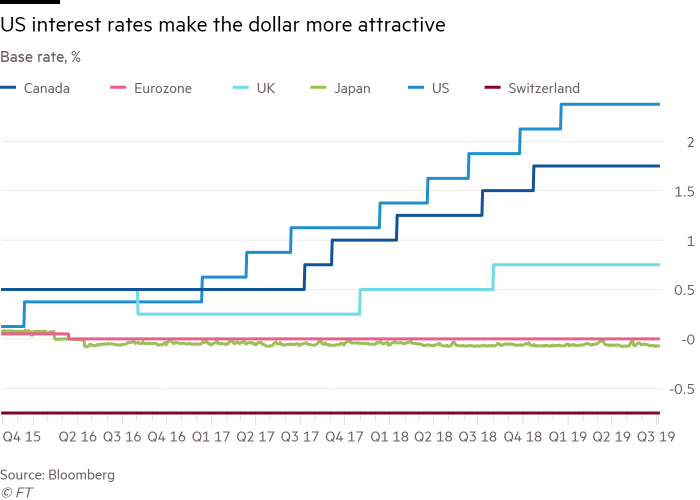

But this stems from a fundamental misunderstanding of what drives the currency markets, analysts say. The strong dollar is the result of the US outperforming other economies and the fact that its interest rate is higher than in most other developed nations — triggering capital inflows.

Alessio de Longis, a senior portfolio manager at OppenheimerFunds in New York, said US policymakers had been able to raise rates at a time when growth outside the US remained weak, leading the dollar to appreciate.

“[The strong dollar] is not an anomaly,” he said, adding that since Mr Trump took power the threat of a currency war had been looming over the global economy, and so “we are in a permanent state of negotiating trade deals”.

Ed Al-Hussainy, a senior currency and rates analyst at Columbia Threadneedle, said the inclusion of Ireland and Italy in the Treasury watchlist report “almost amounts to malpractice” and that the report contained “some insane stuff” — even China is clearly not manipulating its currency any more.

“Where the rubber hits the ground is the renminbi [and] there is no evidence that the Chinese central bank intervened or manipulated its currency so . . . the White House language has to be interpreted from a re-election [perspective],” Mr Al-Hussainy said.

Mark Sobel, a US Treasury veteran and US chair of think-tank OMFIF, said that although there had been a case to label China a currency manipulator a decade ago, that was no longer the case.

In the US Treasury’s latest twice-yearly report, the Asian behemoth only ticked one of the three criteria — having a significant bilateral trade surplus with the US, a “material” current account surplus, and “persistent, one-sided intervention” in foreign exchange markets — and, he said, that was not enough to deserve the label.

Maximillian Lin, emerging markets strategist with NatWest Markets in Singapore, said Mr Trump’s accusation against the renminbi might have held water up until around 2014, but data on China’s forex holdings since then showed the People’s Bank of China selling dollars, not hoovering them up.

“The Chinese [renminbi] is a casualty of the trade war, not a weapon,” he said.

It is a remarkable turnround from the situation a decade ago — the last time that currency manipulation raised its head in geopolitical circles.

Then, in the aftermath of the financial crisis, aggressive policy easing by the Fed plunged emerging economies into turmoil.

At the time US policymakers showed little sympathy to the plight of countries such as Brazil, pushing ahead with easing measures regardless of the impact a weak dollar had on other economies as surging exchange rates ate away at their export revenues.

By 2010 central banks in Brazil, Japan, South Korea, Taiwan and China were all regularly intervening to stem the appreciation of their currencies, leading Brazilian finance minister Guido Mantega to declare that the world was in the middle of an international currency war.

The situation today, by contrast, has the US painting itself as the markets’ victim.

“It’s a different type of currency war when America thinks it’s losing,” said Kit Juckes, a currency strategist at Société Générale.

In addition to rate cuts and sanctions, there are other tactics that Mr Trump could apply.

Joseph Gagnon and Fred Bergsten of the Peterson Institute for International Economics suggest that the White House could consider a retaliation through the currency market itself: when a G20 country intervenes to devalue its currency, the US could deploy a countervailing market intervention.

For example, if Switzerland acted to weaken its currency by selling the franc, the Treasury could step in to buy the same amount of the Swiss currency, cancelling out the intervention. “No one in the world has bigger firepower than the US Treasury,” said Mr Gagnon.

George Saravelos, a strategist at Deutsche Bank said an intervention in the dollar “would not be unprecedented” and that previous administrations under Carter, Bush and Clinton all undertook “frequent and meaningful interventions”.

“It has gone in and out of fashion over the last decades,” said Mr Saravelos.

When it comes to taking action, though, some analysts suspect that the Trump administration does not have a unified stance.

Mr Gagnon said that “the Treasury is trying to find reasons not to do anything” — but, he added, “whether the White House will force them to take action . . . is another question”.

Additional reporting by Hudson Lockett in Hong Kong

0 comments:

Publicar un comentario