How our low inflation world was made

The picture is one of weak growth and pervasive populist politics

Martin Wolf

If we are to make sense of where the world economy is today and might be tomorrow, we need a story about how we got here. By “here”, I mean today’s world of ultra-low real and nominal interest rates, populist politics and hostility to the global market economy. The best story is one about the interaction between real demand and the ups and then downs of global credit. Crucially, this story is not over.

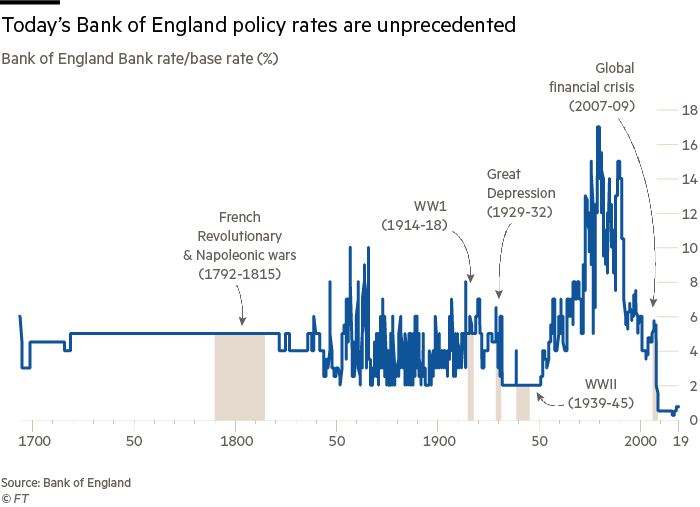

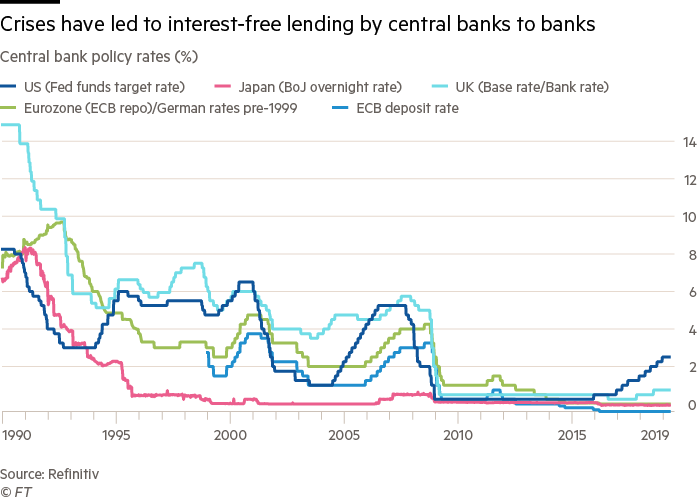

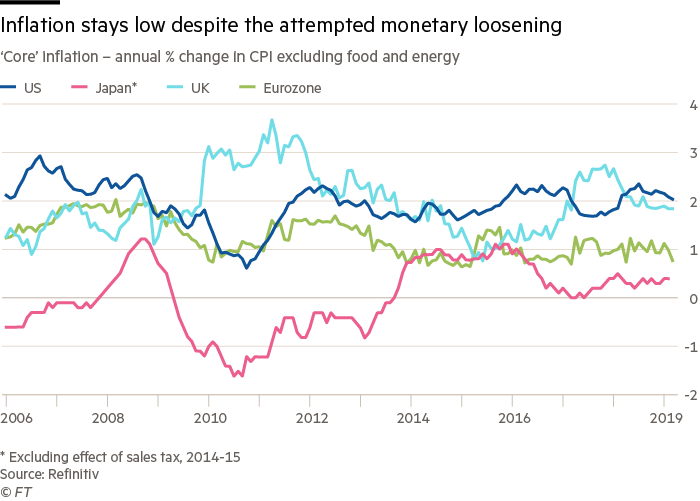

Amazingly, prior to 2009, the Bank of England never lent to banks at a short-term rate below 2 per cent. That had been low enough to cope with the Napoleonic wars, two world wars and the Depression. Yet, for a decade its rate has been close to zero. The bank has been in good company. The US Federal Reserve has managed to raise its federal funds rate to 2.5 per cent, but only with difficulty. The European Central Bank’s rate is still near zero, as is the Bank of Japan’s. The latter’s rate has been close to zero since 1995. Yet the BoJ has still been unable to get inflation much above zero. Weak inflation is not Japan’s problem alone. It remains strikingly low elsewhere, too. (See charts.)

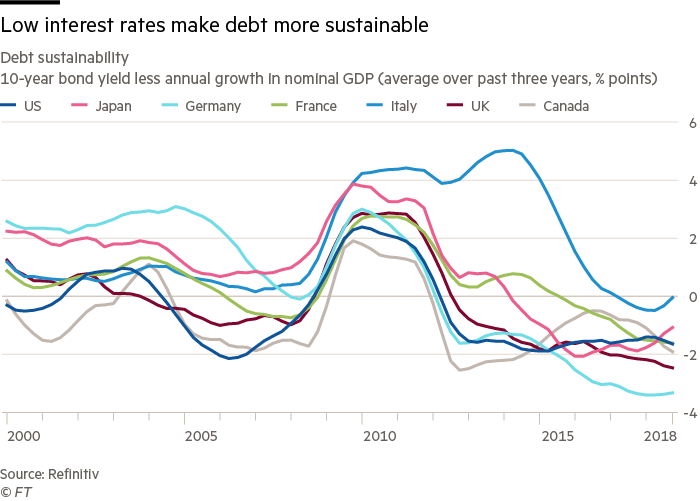

In fact, we should not be that surprised by this world of persistently weak inflation and ultra-aggressive monetary policies, including outright asset purchases by central banks and favourable long-term lending to banks. Ray Dalio of Bridgewater has laid out the logic in his important recent book Principles for Navigating Big Debt Crises. The central point is that governments of countries whose debts are denominated in their own currencies can manage the aftermath of a crisis caused by excessive credit. Above all, they can spread out the adjustment over years, thereby preventing a huge depression caused by a downward spiral of mass bankruptcy and collapsing demand. Mr Dalio calls this a “beautiful deleveraging”. It is achieved by a mixture of four elements: austerity; debt restructuring and outright default; money “printing” by central banks, not least to sustain asset prices; and other transfers of income and wealth. An important element in this deleveraging is keeping long-term interest rates below growth of nominal incomes. That has in fact been done, even for Italy.

US policymakers were the most successful in reacting comprehensively. In the 1990s, Japan took too long to adopt the right combination. So did the eurozone after 2008, largely because of obstacles to active fiscal policy in such a currency union, but also because of ideological resistance to using the full capacities of the central bank. The UK’s response fell between that of the US, on the one hand, and of Japan and the eurozone, on the other.

Even if the needed policies are successfully adopted, they are always unpopular. So, not least, is the aftermath of any financial crisis. Sharing out losses generated by a financial crisis, followed by the inevitably weak recovery, always creates public rage.

Where has this left us today? Not where we would like to be, is the answer, in three respects.

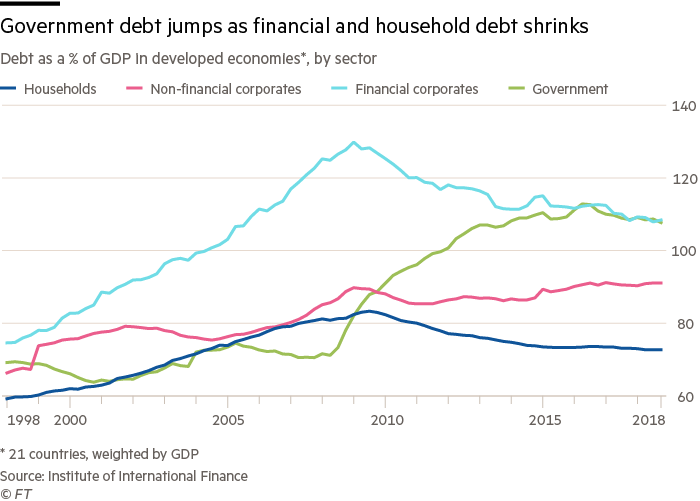

First, while financial and household debt have fallen relative to incomes in mature economies, that is not true for debts of governments or non-financial corporates. Second, the transatlantic crisis triggered offsetting debt explosions elsewhere, notably in China. Third, crisis-hit economies are still far below pre-crisis trend output levels, while productivity growth is also generally low. Finally, the populist politics of left and right remain in full force. All this is in keeping with past experiences with big debt crises, which have always thrown long shadows into the future.

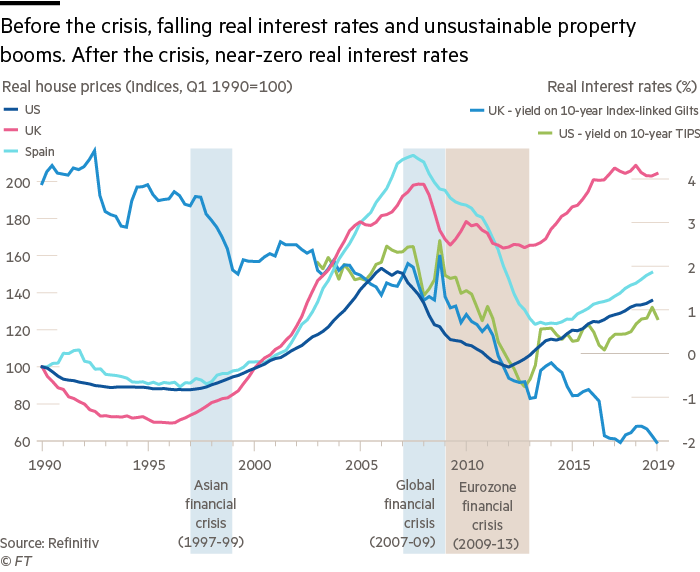

So what might happen next? To answer, we need to consider not only the now familiar post-crisis world but also what came before. Crucially, the world of falling real interest rates on safe assets preceded the crisis. Larry Summers has described that phenomenon as “secular stagnation” — that is, a world of structurally weak aggregate demand. A decisive moment was the Asian financial crisis, after which the world’s most dynamic economies became net exporters of capital.

But there are other significant factors: high gross savings rates in important emerging economies; persistently weak productivity growth in high-income economies; ageing in many economies and so a declining demand for physical capital; and deindustrialisation in high-income economies. Also important have been rapid falls in the relative prices of capital goods and shifts in the distribution of income towards profits and the highly paid. The overall effect has been to shift the balance between potential income and desired spending, against the latter. The result has been falling real interest rates.

Even the financial crisis was the result of this environment. Low (nominal and real) interest rates triggered rising property prices and an associated credit explosion, especially in the US and peripheral Europe. These credit bubbles drove demand worldwide in the early 2000s. They proved unsustainable, so bequeathing the post-crisis world we have lived in since 2008. But that world has not ended. The interest rates we see today demonstrate that.

We can divide the last two decades into two periods. “Pre-crisis secular stagnation” was a world characterised by low and falling real interest rates and hugely destabilising property and credit bubbles. “Post-crisis secular stagnation” has been a world of near-zero real interest rates, partial deleveraging, weak growth and pervasive populist politics.

So what might the next period look like? Will the world economy escape into something less unstable? Or are we risking disruptions from renewed debt crises and political instability. And what, not least, are the best policy options, in response? I plan to address these questions next week.

0 comments:

Publicar un comentario