The Fed Apologizes, And The Outlook Improves

by: Calafia Beach Pundit

Summary

- The Fed and the market are dancing together again, with both participants expecting no further Fed tightening moves for the foreseeable future, but with a possibility of an ease later this year.

- If Trump can turn down the tariff-war heat, the entire world will be breathing a huge sigh of relief, and risk markets will move decisively higher.

- In addition to a pickup in US jobs growth, we also are seeing a pickup in the growth of the labor force, which increased 1.6% last year - up significantly from 0.5% growth in 2017.

- There are still a lot of concerns out there, but we are moving in a positive direction.

- If Trump can turn down the tariff-war heat, the entire world will be breathing a huge sigh of relief, and risk markets will move decisively higher.

- In addition to a pickup in US jobs growth, we also are seeing a pickup in the growth of the labor force, which increased 1.6% last year - up significantly from 0.5% growth in 2017.

- There are still a lot of concerns out there, but we are moving in a positive direction.

Two weeks ago I noted that the Fed had screwed up badly. But all was not lost: "all it takes is a few words to put things right. The damage done to date is not significant or permanent, and it is reversible." Today, we got those words: according to Powell, the Fed is "listening carefully to the markets." The threat of an overly-tight Fed has now all but vanished. The Fed and the market are dancing together again, with both participants expecting no further Fed tightening moves for the foreseeable future, but with a possibility of an ease later this year (i.e., the market is relieved, but still cautious).

Prior to this welcome Fed news, the Labor Dept. earlier today released a surprisingly strong December jobs number which was way above expectations (+312K vs. +184K). This put the kibosh on concerns the US economy was slowing down, at least for the foreseeable future. Credit spreads have rallied from their highs, though they are still somewhat elevated.

For the time being, some of the market's worst fears are being calmed. What remains to be seen is the result of the ongoing negotiations with China, which get underway next week (and in which my good friend and excellent economist David Malpass will be participating). If Trump can turn down the tariff-war heat, the entire world will be breathing a huge sigh of relief, and risk markets will move decisively higher. Already, the Brazilian and Argentine stock markets are up some 15% in just the past week in dollar terms, though they remain deeply depressed.

It bears repeating that what Trump hopes to achieve is NOT higher tariffs, but rather lower or zero tariffs, lower or reduced export subsidies on the part of China, and a reduced likelihood that China will continue to expropriate US intellectual property. Any move in this direction will be a direct benefit to global trade, and that in turn will benefit all concerned. Trump is putting at risk US prosperity (by raising tariffs as a negotiating tactic) in order to force China to do something that in the end will be of great benefit to both China and the US. It's a risky gambit, to be sure, but the potential rewards are Yuge. It's also worth repeating that it seems China must be threatened in order to do the right thing, and the threat must be not only palpable but terrifying. And China won't feel that kind of pressure unless you and I (and the market) also get to the point that we are terrified of the consequences of a tariff/trade war. With luck, we may have seen the worst of this deal-making process.

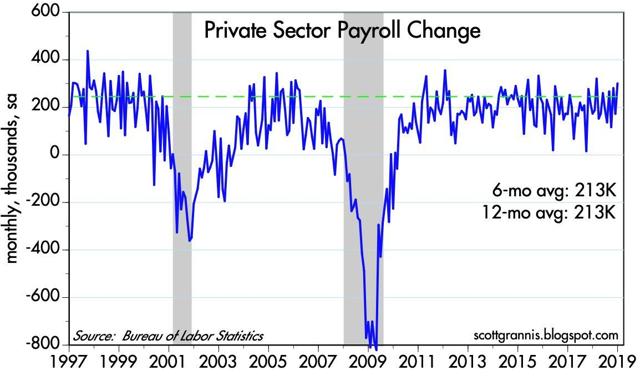

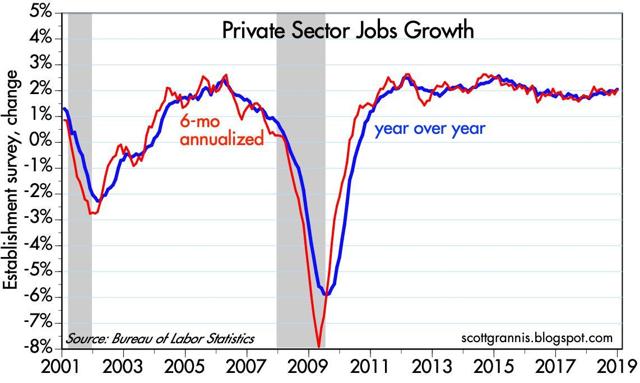

Chart #1

Chart #2

Long-time readers know that I routinely focus on more than just one month's worth of job statistics and on just the private sector job numbers. The monthly numbers are so volatile as to be almost worthless, and private sector jobs are the only ones that matter. But a six- or twelve-month average of the numbers can give us valid insights into the broad trends of the labor market. Charts #1 and #2 show that today's number, however surprisingly strong it was, was not out of line with past experience. Yes, monthly jobs growth was at the high end of its range, but as Chart #2 shows, the trend growth rate of jobs has been only slowly picking up over the past year or so. Both the 6- and 12-month growth rates of private sector jobs are now slightly above 2.0%, but that's up from a low of 1.6% in September 2017. The economy really is getting stronger, albeit slowly. The momentum of a gradual strengthening of the mighty US economy is much more significant than the ongoing marginal slowdown in the Chinese economy.

In addition to a pickup in US jobs growth, we also are seeing a pickup in the growth of the labor force, which increased 1.6% last year - up significantly from 0.5% growth in 2017. It's also welcome news that the unemployment rate ticked up to 3.9%, since that means that despite the outsized growth in jobs, the number of people entering the labor force was even greater (i.e., many of the new entrants to the labor force are still looking for a job). A stronger economy and rising wages are attracting people who were formerly on the sidelines of the jobs market.

This is terrific news, since it means the economy has plenty of untapped upside potential. (Doomsayers had been insisting that the low rate of unemployment meant that it would be difficult if not impossible for the economy to grow at a 3% or better pace.)

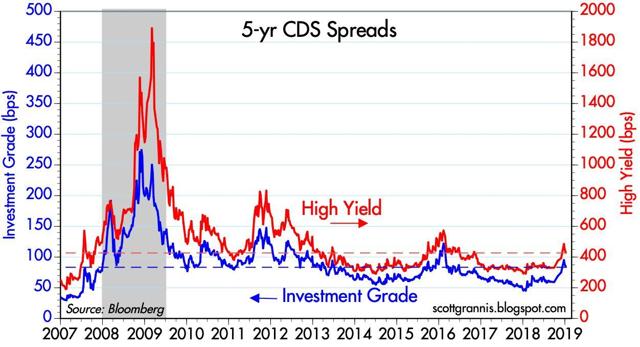

Chart #3

News of a stronger economy has contributed to a meaningful reduction in credit spreads, as Chart #3 shows. High-yield, 5-yr credit default swap spreads (arguably the most liquid and meaningful indicator of the outlook for corporate profits) have tightened by some 60 bps in the past week or so, thanks to perceptions of a stronger economy coupled with rising commodity prices and a reduced threat of an overly-tight Fed. Swap spreads remain very low and firmly in "healthy" territory. So not only is the outlook for corporate profits improving (as indicated by declining credit spreads), but also it is the case that liquidity remains abundant in the financial markets and systemic risk remains quite low. In other words, we are most likely on the recovery side of another case of "panic attack."

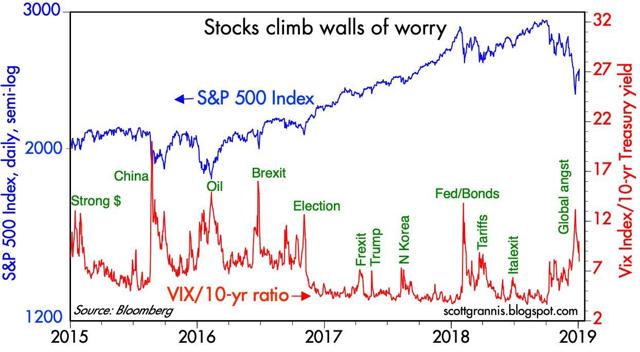

Chart #4

As Chart #4 shows, the market is now much less worried (as measured by the ratio of the Vix index to the 10-yr Treasury yield) than it was just a week or so ago (the ratio has declined from a high of 13.2 just before Christmas to now 8). Last week we had the threats of 1) an overly-tight Fed, 2) a slumping economy, plus sundry other worries: China slump, trade wars, Eurozone weakness, collapsing oil prices, and the federal government shutdown. We can now scratch the first two off this list. There are still a lot of concerns out there, but we are moving in a positive direction.

0 comments:

Publicar un comentario