3,453 days and $18tn later, the US bull market hits record run

From battered banks to tech titans, the historic milestone in seven charts

Nicole Bullock and Brooke Fox

© Bloomberg

The US bull market is now officially the longest ever. From the depths of the financial crisis, revived by central bank stimulus, fuelled by technological innovation and finally given a shot of tax cuts, the S&P 500 has gone 3,453 days without a drop of 20 per cent, the decline typically associated with a bear market. That edges it past the 1990-2000 bull run that culminated in the dotcom boom.

Like the bull market it surpasses, the rally from March 9, 2009, has also coincided with a technological revolution; in this case the rise of the digital economy and reflected in the reshuffled leadership of the S&P 500.

In March 2009, the largest companies in the index by market capitalisation were ExxonMobil, Walmart and Microsoft, respectively. Now topping the leaderboard are Apple, Amazon and Alphabet. Facebook, in the No 6 spot, was not even a public company when this bull run first got under way. Microsoft may have weathered the transition to the cloud to retain a top slot; IBM has not been so successful.

The stock market stars of the digital economy were even given a nickname as the bull market got longer in the tooth: the Faangs. If you had dropped 99 per cent of the S&P 500 and focused on the behemoths that seem to have taken over consumers’ everyday lives — Facebook, Apple, Amazon, Netflix and Google’s parent Alphabet — you would have outperformed the bull market handsomely. Concerns about privacy, heightened regulation and growth prospects of these tech companies are not just important questions for the durability of their share price gains. They are now central to the prospects for the overall bull market.

But 3,453 days ago, all eyes were on the banks. Brought low by excessive risk taking and then the bankruptcy of Lehman Brothers, they had only just been recapitalised with injections of taxpayer bailout cash and their futures were in doubt. Investors who picked through the rubble wisely beat the S&P 500 on some of the biggest banks.

The market value of the S&P 500 is up 312 per cent from March 9, 2009, a thumping $18.4tn.

But measured another way, the market is shrinking. The number of shares in the S&P 500 has fallen 3.1 per cent — a factor that some say creates a scarcity value that has added to the gains.

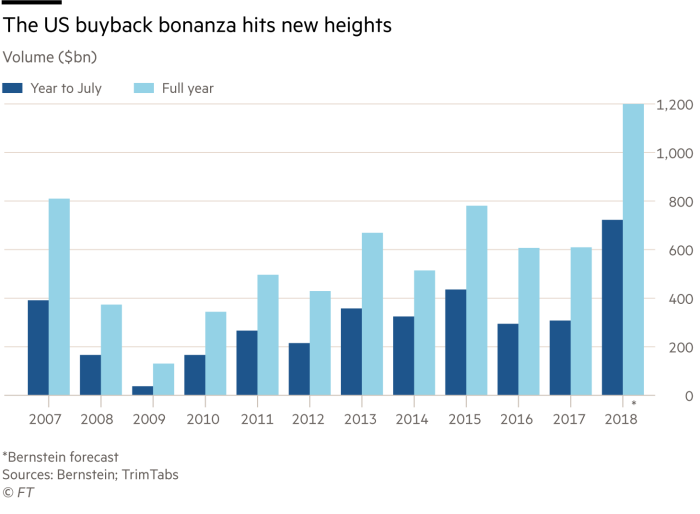

After a burst of equity issuance in the wake of the financial crisis, particularly by banks rebuilding balance sheets, the number of shares has been declining sharply. The reason? A surge in companies buying back their own stock.

That spree has underpinned stock prices and propped up all-important earnings per share numbers. Economic growth and the big tax cuts enacted at the end of last year are the biggest factors, but buybacks have also helped the S&P 500 companies report back-to-back quarters of nearly 25 per cent earnings per share growth this year. The buyback trend has been accelerated by the repatriation to the US of profits once held overseas to avoid taxes; Goldman Sachs believes US companies will repurchase a record $1tn of their own shares this year.

Have a glass of champagne to celebrate the record length of the bull run, for sure, but consider that it has significant ground to go before becoming the most lucrative.

The index closed on Wednesday up 323 per cent from the start of the bull market, shy of the 417 per cent gain for the 1990-2000 run. The latest rally has actually been quite sluggish, at an annualised pace of 16.5 per cent compared with the 22 per cent average for bull runs in the US.

The fastest? The 35.5 per cent annualised pace of the 1932-1937 bull market that followed the 1929 stock market crash.

0 comments:

Publicar un comentario