Jun. 19, 2015 8:17 AM ET

Summary

- The consensus view on Wall Street is that the Fed will raise rates in September or December of this year.

- The IMF and others have warned the Fed that raising interest rates this year could be problematic to the U.S. and global economy.

- Many are not considering the weak economic data, and large GDP gap that points to the reality that a lengthy period of ZIRP is still warranted.

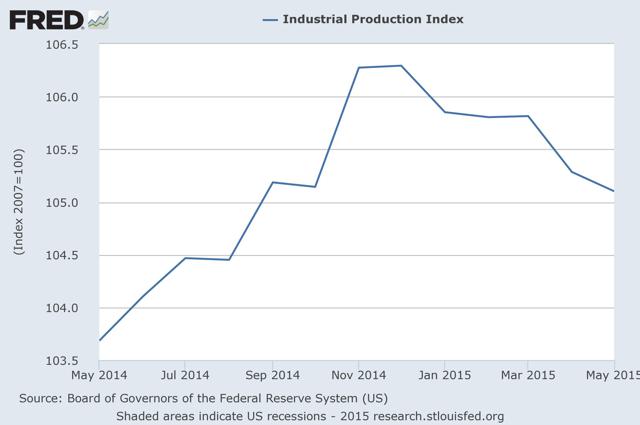

Productivity Remains Weak

Industrial production has lagged since November, lending evidence to the thesis that the economy remains weak.

(click to enlarge)

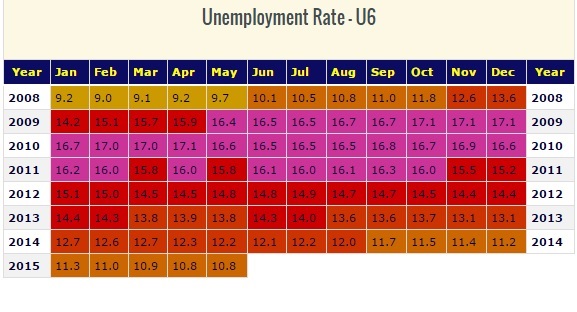

Employment Remains Weak

While many tout the progress we have made on the unemployment rate, the U-3 remains a distorted measure of the health of the nation's employment market. Indeed, a more thorough analysis of the U-6 combined with the labor force participation rate shows a weak employment market with double digit U-6 unemployment of 10.8%, and the lowest labor force participation rate since the 1970s.

(click to enlarge)

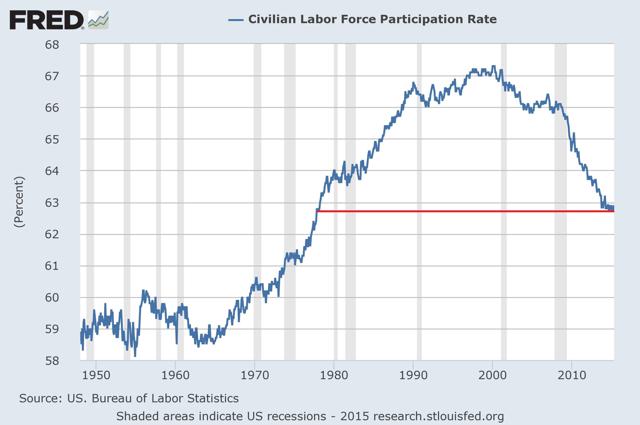

GDP Remains Weak

The U.S. has averaged a mere 2.2% GDP growth rate throughout the entire recovery. First quarter GDP clocked in at -0.7%, and estimates for the second quarter by the Federal Reserve Bank of Atlanta are at 1.9%. If this proves accurate, the total growth rate for the first half of 2015 will be 1.2%, in line with the average for the recovery. The most dynamic and powerful economy in the world, growing at an average rate of 2.2% for the last 6 years, is hardly a sign of a robust economy in need of a rate rise.

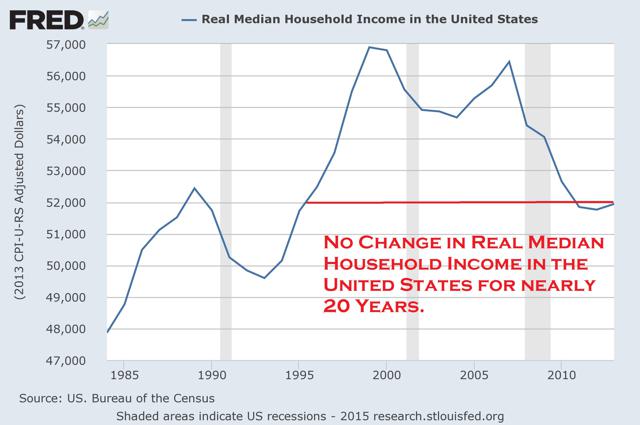

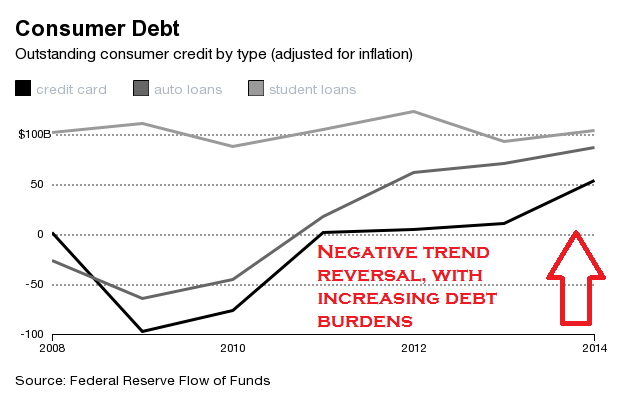

Lack of Wage Growth + Increase in Aggregate Debt = Lower Future GDP Growth

Academic research continues to explain the low GDP growth rates as being brought on by high aggregate debt loads. GDP will likely be held down as a result of the continuing rise in aggregate debt levels, which will lower consumption and investment in the future. Increase in debt brings future consumption into the present, and ultimately results in lower consumption in the future. Seeing as the average American has not seen a rise in wages in over 20 years, and is increasingly relying on debt to finance their lifestyle, we are encroaching on dangerous territory in terms of the negative effects on future GDP growth rates.

(click to enlarge)

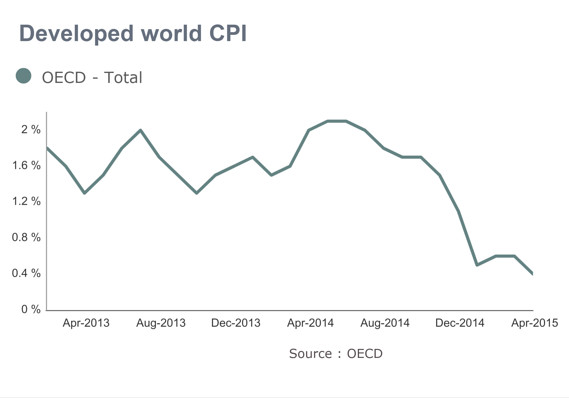

PCE Remains Weak

The PCE indicates that deflationary pressures are exhibiting far more force on the U.S. economy than inflationary pressures, all of this despite a multi-trillion dollar massive QE program, and yet velocity on M2 is at the lowest levels in more than 50 years. The following data from the Dallas Federal Reserve indicates just how far from target the PCE remains:

| One-month PCE inflation, annual rate | ||||||

| 14-Nov | 14-Dec | 15-Jan | 15-Feb | 15-Mar | 15-Apr | |

| PCE | -1.9 | -2.8 | -5.4 | 2 | 1.9 | 0.3 |

| PCE excluding food & energy | 0.7 | 0.1 | 0.5 | 1.6 | 1.6 | 1.3 |

| Trimmed Mean PCE | 1.8 | 0.8 | 0.4 | 2 | 1.8 | 1.9 |

| Six-month PCE inflation, annual rate | ||||||

| 14-Nov | 14-Dec | 15-Jan | 15-Feb | 15-Mar | 15-Apr | |

| PCE | 0.4 | -0.5 | -1.6 | -1.1 | -1 | -1 |

| PCE excluding food & energy | 1.3 | 1 | 0.9 | 1 | 1 | 1 |

| Trimmed Mean PCE | 1.6 | 1.4 | 1.2 | 1.3 | 1.4 | 1.5 |

| 12-month PCE inflation | ||||||

| 14-Nov | 14-Dec | 15-Jan | 15-Feb | 15-Mar | 15-Apr | |

| PCE | 1.2 | 0.8 | 0.2 | 0.3 | 0.3 | 0.1 |

| PCE excluding food & energy | 1.4 | 1.3 | 1.3 | 1.3 | 1.3 | 1.2 |

| Trimmed Mean PCE | 1.6 | 1.6 | 1.6 | 1.6 | 1.6 | 1.6 |

| NOTE: These data are subject to revision. | ||||||

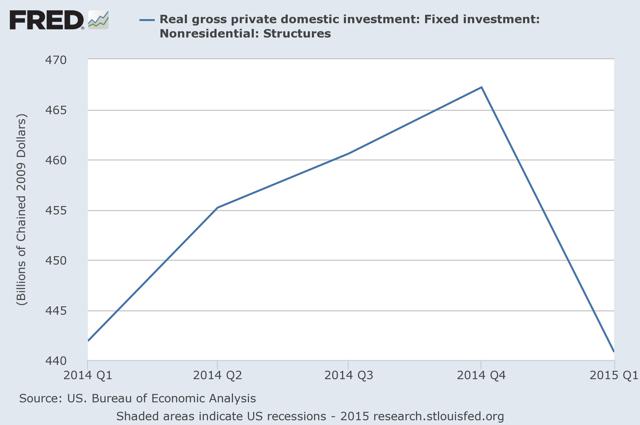

Business Investment Remains Weak

Business investment remains weak as the chart below shows, this will continue to keep the Fed on hold as businesses keep cash instead of investing in productive ends.

(click to enlarge)

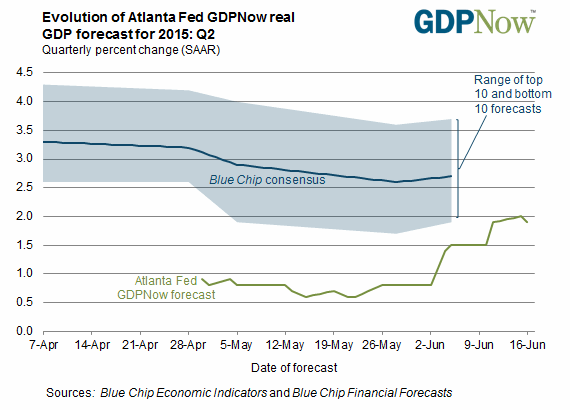

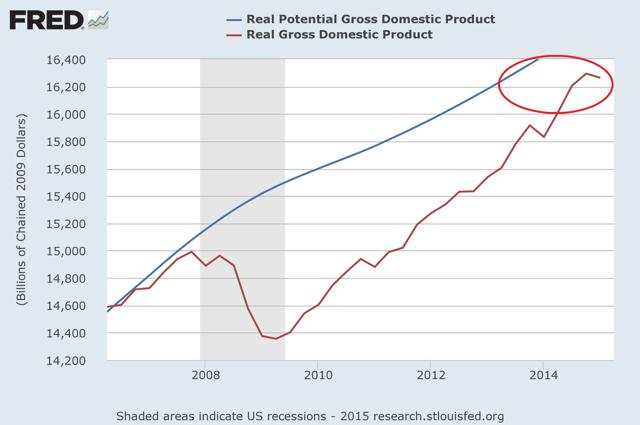

GDP Gap Remains Extended

The GDP gap continues to be the clinching piece of evidence in the case of why the Fed will likely not raise interest rates until far into the future. As I have articulated in previous pieces, if we continue growing at a mere 2.2% the GDP gap does not close until 2020 at the earliest, which is a precursor to the beginning of an inflationary cycle. The lack of inflationary pressure and expected inflationary pressure is largely due to the large GDP gap. Many prognosticators fail to analyze these indicators in their call for an imminent rise in rates. Many look only at the U-3 unemployment rate of 5.5% as an indicator that the Fed must raise rates now on an economy that can clearly stand on its own, so they say. However, the data presented illustrates that the economy is not yet capable of standing on its own, and is still in need of extraordinary interest rate policy, especially with the global economic uncertainty that continues to plague much of the globe.

(click to enlarge)

Conclusion

Obviously this analysis is based on moving data points. Increases in the GDP growth rate would obviously close the GDP gap sooner, and thus move up the time table for expected inflationary pressure and the expected date of a Fed rate hike. But in the current economic environment, I do not see the Federal Reserve raising interest rates this year or any time in the near future.

Given this analysis I continue to believe in 30-year zero coupon U.S. Treasury bonds as a wonderful place to invest money for the long term, especially seeing that the expected returns for risk assets is near 0% for the next 10 years, according to the P/E 10. In such an environment, earning 3.10% on a 30 year Treasury seems like a reasonable alternative.

Furthermore, with inflationary expectations so low, the yield on a 30 year Treasury is far higher in real terms. Algebraically, we can see that the real yield is equal to nominal yield-expected inflation rate, so if we see inflationary expectations continue to decrease; this would result in a much higher real yield on Treasury bonds. Thus I continue to believe in the current economic environment the Fed is unlikely to raise interest rates any time soon, and long term U.S. Treasury bonds remain an attractive place to hide out for at least part of investor's portfolios.

With the consensus on Wall Street continuing to be that the Fed will raise rates this year or next year at the latest, I believe that the data tells us that the economy remains weak and the Fed will likely not move until at least 2020 if data continues to come in weaker than expected.

The Fed's main objectives are to maintain maximum employment within a context of price stability, with the main two measures of real unemployment and inflationary expectations continuing to show weakness, the odds of the Fed issuing a rise in interest rates is slim to none.

0 comments:

Publicar un comentario