by: Get Rich Brothers

Summary

- Buffett's Letter to Shareholders was released today.

- Succession planning is of the utmost importance.

- Share repurchases are actively being pursued.

- Succession planning is of the utmost importance.

- Share repurchases are actively being pursued.

It’s that wonderful time of year again when Warren Buffett releases his annual Letter to Shareholders.

I view this as the single most important document published on an annual basis for investors.

As with the letters from 2014, 2015, 2017, and 2018, I will once again share what I see to be the three vital components of this year’s Letter.

Key Takeaway No. 1

Succession planning is one of the hottest topics at Berkshire Hathaway (BRK.A), given the advanced ages of both Warren Buffett and Charlie Munger, the current and long-standing leaders of the company. Two of the leading candidates to succeed Buffett and Munger are Ajit Jain and Greb Abel.

Jain effectively manages the insurance operations at BRK while Abel runs the non-insurance business. In this year’s Letter, Buffett revealed (though this had been floated previously) that Jain and Abel would be joining Buffett and Munger for the Q&A period at the shareholder meeting in Omaha this May.

While this does not guarantee that these two will be next in line to run the company, it is a strong endorsement of their value to the company and suggests they will indeed be with us for the long term. Given their strong track record over the past years in their respective areas of the business, I view this is as a hugely positive development.

Beyond succession planning directly—though with an eye to future governance at BRK—Buffett also detailed the importance of having a strong, devoted Board of Directors, devoid of conflicts of interest. As part of this discussion, he assured investors that BRK will continue to pursue directors who are also shareholders of the company as a result of making purchases out of their own savings.

As always, this assurance comes as no surprise given Buffett has always emphasized the alignment of interests between investors and management.

Finally, Buffett outlined the details of how his BRK stock should be managed after his death. A portion of his A-Class shares are to be converted into B-Class shares, which will then be distributed to a number of foundations with the directive to “deploy the grants” shortly thereafter.

Buffett estimated that it will take 12-15 years for all of his shares to make their way into the market. Given Buffett’s huge position in BRK, this provides assurance that the stock itself will not be impacted directly through a large sale in the time after his passing.

Key Takeaway No. 2

One of Buffett’s key tenets to successful investing is to be able to approximate the intrinsic value of a prospective company. When it comes to BRK itself, Buffett has often noted that even between himself and Munger, they would arrive at different numbers if they were to value the company independently.

When it comes to repurchasing shares of BRK itself, they will consider this course of action only if they believe the company is selling for considerably less than it is worth and that following the purchase, the company will still have plenty of cash on hand (the ultimate financial strength of BRK is among Buffett’s top priorities).

Through 2019, Buffett revealed that $5 billion of BRK was repurchased, representing ~1% of the company. Furthermore, he actually urged shareholders with $20 million or more of stock to give the company a call directly if they are looking to sell. This suggests that Buffett may still be interested at current prices.

While he doesn’t quote an actual amount that he would view as the intrinsic value for BRK, the actual share repurchases and call-to-action from prospective sellers speaks volumes.

Key Takeaway No. 3

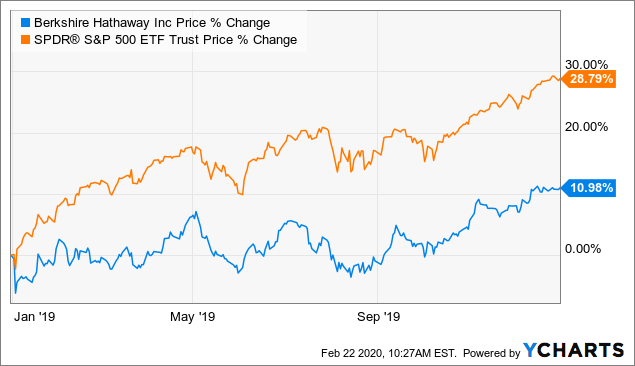

There has been plenty of commentary over the past month in terms of speculation as to how Buffett might address the large outperformance of the S&P 500 in comparison to BRK stock.

From Page 2 of the Letter, BRK’s market value clocked in with 11.0% growth while the S&P 500 shows a whopping 31.5% (with dividends) through 2019.

Data by YCharts

Data by YChartsWhile he didn’t tackle this topic explicitly, Buffett went to great lengths throughout the Letter to highlight the power of retained earnings and the differentiation of BRK from other companies given its huge combination of controlled and non-controlled businesses all housed under a single roof.

On Page 5, he detailed the importance of recognizing the retained earnings within the huge portfolio of marketable securities owned by BRK. Under GAAP accounting, only the dividends are reported as earnings, yet Buffett outlines how the retained earnings will in most cases either be used to further grow the companies themselves or, through share repurchases, passively increase BRK’s ownership stake (and thus its future claim on dividends and earnings).

I believe Buffett’s intent with this theme was to again emphasize that BRK is a different beast altogether when it comes to effectively valuing it. Its real strength comes from the diversity of its high quality businesses, most of which are able to effectively retain their earnings to compound for long-term growth.

Though he didn’t restate it in this Letter, Buffett has never been shy about recognizing that the S&P 500 is likely to outpace BRK on the upswing. The strength of BRK is to persist and succeed through all market conditions.

On that note, it is worth digging up a Buffettism from the 1992 Letter to Shareholders:

It’s only when the tide goes out that you learn who’s been swimming naked.

Conclusion

The theme I detected with this year’s Letter was around assuring investors that BRK will be healthy and growing well into the future, regardless of market conditions and the eventual change in leadership.

Giving us a view into his will is just one example of how extraordinarily devoted Buffett is to ensuring shareholders truly do feel they have all of the information they need to make informed decisions. It is, once more, Buffett walking the walk in terms of giving us the information he would want if he were in our shoes.

Reading through the Letter this year was particularly enjoyable for me as I took the opportunity to attend the Berkshire Shareholder weekend last May in Omaha. Seeing Buffett in the flesh and observing first-hand the community he has built on the back of timeless investing principles was inspirational and something I will never forget.

This year’s Letter once again provided plenty of food for thought as we move forward into a new decade.

0 comments:

Publicar un comentario