Copper at 12-month low after mystery investor unwinds $1bn bet

Liquidation of a large position triggers violent sell off in Shanghái

Henry Sanderson and Neil Hume

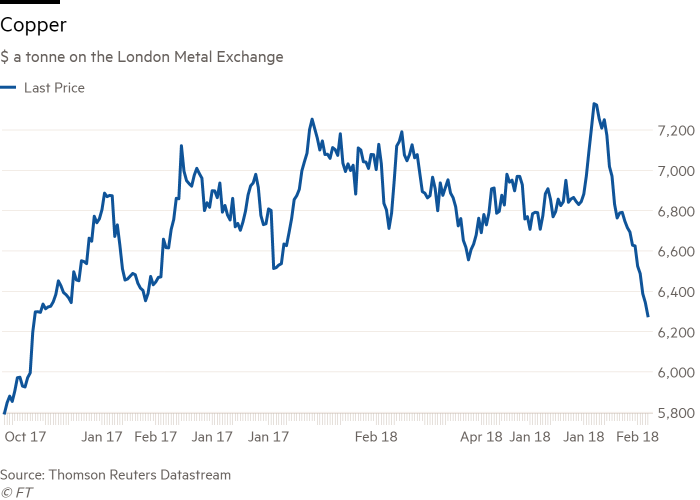

The liquidation of a $1bn bet placed by a mysterious Chinese investor has roiled the copper market, triggering a violent sell off that has seen the metal plunge to a 12-month low.

Data released by the Shanghai Futures Exchange showed the huge futures position held at Gelin Dahua, a Beijing-based brokerage, has fallen from a net long of 36,050 lots last Wednesday to just around 10,000 lots today.

That is the equivalent of 80,000 tonnes of copper worth roughly $800m that has been dumped on the market in the past few trading sessions in China, placing huge pressure on the global copper price.

Since August last year, Gelin has been the dominant buyer of copper, stepping into the market whenever the metal weakened, according Nicholas Snowdon, analyst at Deutsche Bank.

“There was in other words a perceived Gelin put in the copper market,” said Mr Snowdon. “This now appears to be dissipating fast.”

The position is rumoured to be owned by a coal investor in Shanxi, the location of Beijing-based Gelin Dahua’s parent company, Shanxi Securities. But positions on the Shanghai Futures Exchange are only divided by securities companies, not by individuals.

It is not clear why Gelin has started to liquidate the position but local media said it was either a strategic retreat or forced selling.

The price of the copper has been under pressure since of the start June on fears about a trade war between China and the US could economic growth. The metal, used in everything from washing machines to cars, has fallen 14 per cent from the four-and-half year high of $7,348 a tonne.

If Gelin keeps selling — and traders reckon its position is now underwater — the price of copper could fall to $6,000 a tonne. But if it decides to retain a position, copper could bounce back.

“Whilst sentiment has deteriorated on the trade war escalation, the reality is the outlook for the copper market has not materially changed and if anything, the move lower in price will only serve to tighten market conditions as scrap supply will dry up in third quarter on the price move lower and tensions in mine labour negotiations rise as miners generosity rescinds with the copper price,” said Mr Snowdon.

Talks over a new wage deal at Escondida, the world’s biggest copper mine, are still far from being concluded with just left weeks left to conclude negotiations. Failure to reach an agreement last year led to 44-day strike.

Copper for delivery in three months on the London Metal Exchange — the global benchmark — rose $69.50 to $6,378.

0 comments:

Publicar un comentario