Prepare for Turbulence

“The job of the central bank is to worry.”

– Alice Rivlin

“The central bank needs to be able to make policy without

short-term political concerns.”

– Ben Bernanke

“… from the standpoint of the overall economy, my bottom line is

we’re watching it closely but it appears to be contained.

– Ben Bernanke, repeatedly, in 2007

“Would I say there will never, ever be another financial crisis?

You know, probably that would be going too far, but I do think we’re much

safer, and I hope that it will not be in our lifetimes, and I don’t believe it will be.”

– Janet Yellen, June 27, 2017

“My good friends, for the second time in our history, a British

Prime Minister has returned from Germany bringing peace with honor. I believe

it is ‘peace for our time.’ Go home and get a nice quiet sleep.”

– Neville Chamberlain, September 30, 1938

Photo: Monica Muller via Flickr

The way we assess problems depends on our perspective. People can

look at the same set of facts and reach quite different conclusions based

simply on their circumstances. This is why it’s good at times to get away from

your normal environment. Listen to a wide variety of opinions. Read books

outside of your comfort zone. You’ll see things differently when you return.

I had that feeling on returning to the US from Shane’s and my

honeymoon in St. Thomas. We’re now officially married, and we thank everyone

for the congratulations and kind wishes. I saw a little bit of news while we

were there but spent more time just relaxing with my bride and reading books.

Re-entering the news flow was a jolt, and not in a good way.

Looking with fresh eyes at the economic numbers and central bankers’ statements

convinced me that we will soon be in deep trouble. I now feel certain we will

face a major financial crisis, if not later this year, then by the end of 2018

at the latest. Just a few months ago, I thought we could avoid a crisis and

muddle through. Now I think we’re past that point. The key decision-makers have

(1) done nothing, (2) done the wrong thing, or (3) done the right thing too

late.

Having realized this, I’m adjusting my research efforts. I believe

a major crisis is coming. The questions now are, how severe will it be, and how

will we get through it?

With the election of President Trump and a Republican Congress, your naïve analyst was hopeful that we would get significant tax reform, in addition to reform of a healthcare system that is simply devastating to so many people and small businesses. I thought maybe we’d see this administration cutting through some bureaucratic red tape quickly. With such reforms in mind I was hopeful we could avoid a recession even if a crisis developed in China or Europe.

With the election of President Trump and a Republican Congress, your naïve analyst was hopeful that we would get significant tax reform, in addition to reform of a healthcare system that is simply devastating to so many people and small businesses. I thought maybe we’d see this administration cutting through some bureaucratic red tape quickly. With such reforms in mind I was hopeful we could avoid a recession even if a crisis developed in China or Europe.

Six months in, the Republican Congress that promised to repeal and

replace Obamacare, cannot even agree on the process. For six years they

discussed what to do, and you would think they might at least have a clue.

Tax reform? I’ve been talking with several of the Congressional

leaders about tax reform, pointing out that without major tax reform

this country is in danger of falling into a recession. No tinkering around the

edges. Real change requires real change.

There is now talk of having a tax bill of some kind ready to discuss in September and possibly pass in November, which, with this Congress, means that the process is likely to drift into next year sans a major push by the leadership. There is no consensus. No less an authority on the actual political process than Newt Gingrich wrote a very sharply worded column this week, declaring, “That legislative schedule is a recipe for disaster.” As Newt points out, if we are going to see any positive economic effect from tax reform, a bill has to be passed soon and implemented. Newt’s column was actually fairly discouraging to me. Knowing him as I do, I can tell you he wasn’t happy to have to write it. While I disagree with him on some of his tax-reform proposals, I agree that we need something significant and soon.

There is now talk of having a tax bill of some kind ready to discuss in September and possibly pass in November, which, with this Congress, means that the process is likely to drift into next year sans a major push by the leadership. There is no consensus. No less an authority on the actual political process than Newt Gingrich wrote a very sharply worded column this week, declaring, “That legislative schedule is a recipe for disaster.” As Newt points out, if we are going to see any positive economic effect from tax reform, a bill has to be passed soon and implemented. Newt’s column was actually fairly discouraging to me. Knowing him as I do, I can tell you he wasn’t happy to have to write it. While I disagree with him on some of his tax-reform proposals, I agree that we need something significant and soon.

There has been some progress on the bureaucratic and regulatory

fronts, but nowhere near what I’d expected. Appointments haven’t been made, and

the bureaucracy is still in control of most of the levers of the economy.

I’d love to be wrong. Nothing would make me happier than having to

eat all these words. But without significant changes, and soon, the economy

will drift sideways and down. While second-quarter GDP growth will come in

above 2%, the figure for the first six months of this year will remain below

2%. A host of indicators show a softening of the economy. For instance, , with

a glut of more than 7 million previously leased cars clogging the auto market,

new-car production is projected to continue to fall. Consumers are financially

stretched, and credit card and student loan defaults have begun to rise. While

there are bright spots, without major reforms the economy will drift lower,

toward stall speed. Any outside shock – and several may be in the offing –

could push us into recession.

And then we come to central banks.

One news item I didn’t miss on St. Thomas – and rather wish I had

– was Janet Yellen’s reassurance regarding the likelihood of another financial

crisis. Here is the full quote.

Would I say there will never, ever be another financial crisis?

You know probably that would be going too far, but I do think we’re much safer,

and I hope that it will not be in our lifetimes and I don’t believe it will be.

I disagree with almost every word in those two sentences, but my

belief is less important than Chair Yellen’s. If she really believes this, then

she is oblivious to major instabilities that still riddle the financial system.

That’s not good.

She may be right in that the future financial crisis will not look

like the last financial crisis, at least in the United States. We have repealed

the law passed under George W. Bush that allowed major banks to lever up 30 to

1. (What were they thinking?) We have required banks to recapitalize and to

reduce their market-making activities in the bond market, theoretically

reducing their risk of insolvency. And we have put in place all sorts of profitability-

and productivity-reducing regulations. While these may be appropriate for

larger financial institutions, they are choking the life out of smaller

community banks, and thereby reducing the availability of capital to small

businesses. Is it any wonder that we are seeing more businesses failing than

being launched?

But like generals fighting the last war, central bankers will find

that the next financial crisis will be fought on different fronts, with

entirely different components and opponents. There is an appalling lack of

liquidity and market-making available in the major fixed-income markets,

something the banks used to provide, and now by regulatory statute they can’t.

Oh, everything is just fine right now, but the moment we hit a speed bump, the

liquidity and market-making capability that is left will simply dry up.

In theory, the Fed probably can’t provide liquidity for that type

of market, but I will bet you a dollar to 47 doughnuts that they will find some

loophole that authorizes them to step in somehow; otherwise there will be a

spiral downward in the debt markets.

Some markets will spiral up, and some will spiral down. We have once again created all kinds of new debt instruments as investors reach for yield in this low-rate environment, and there will simply be no market liquidity for them in a crisis. A flight to safety will ensure that long-term Treasury rates will plunge to levels that we have not yet seen.

Some markets will spiral up, and some will spiral down. We have once again created all kinds of new debt instruments as investors reach for yield in this low-rate environment, and there will simply be no market liquidity for them in a crisis. A flight to safety will ensure that long-term Treasury rates will plunge to levels that we have not yet seen.

I could list other imbalances in the financial markets, but you

get the picture.

Financial politicians (which is what central bankers really are)

have a long history of saying the wrong things at the wrong time. Far worse,

they simply fail to tell the truth.

Former Eurogroup leader Jean-Claude Juncker admitted as much: “When it becomes serious, you have to lie,” he said in the throes of Europe’s 2011 debt crisis.

Former Eurogroup leader Jean-Claude Juncker admitted as much: “When it becomes serious, you have to lie,” he said in the throes of Europe’s 2011 debt crisis.

They lie because they’re afraid of the impact the truth will have.

This is a problem, because markets can’t function on false information, at

least not indefinitely. The best thing for everyone is to let markets adjust

naturally, even though confronting reality can mean short-term pain for some

participants. And sometimes it does make sense to cushion the blow. It doesn’t make sense to cover

over a problem for years, let it get bigger and bigger, and postpone

acknowledging it until the worst possible time. Yet that’s what usually

happens.

In fairness to the financial politicians, they often deal with

situations where all the choices are bad. More often than not, that’s because

their predecessors made similarly bad choices under similarly difficult

conditions. The string of mistakes goes back decades. That is our situation

today. We think governments and central banks are powerful, and they are in some ways, but they

aren’t omnipotent. They don’t have monetary magic wands.

They also face enormous pressure to “do something,” even when the

right thing is to do nothing and just let the market clear.

To understand what will be the mindset of central bankers all over

the world during the next financial crisis, I can think of no better

illustration than a debate that was conducted at the annual gathering of

economists that David Kotok convenes in Maine in August. This debate provided

an “aha!” moment, one that has been fundamental to my understanding of how

central banks work in the midst of a crisis. Let’s rewind the tape to four

years ago, when I wrote about that moment while it was still fresh in my mind.

On Saturday night David scheduled a formal debate between bond

maven Jim Bianco and former Bank of England Monetary Policy Committee

member David

Blanchflower (everyone at the camp called him Danny)….

The format for the debate between Bianco and Blanchflower was

simple. The question revolved around Federal Reserve policy and what the Fed

should do today. To taper or not to taper? In fact, should they even entertain

further quantitative easing? Bianco made the case that quantitative easing has

become the problem rather than the solution. Blanchflower argued that

quantitative easing is the correct policy. Fairly standard arguments from both

sides but well-reasoned and well-presented.

It was during the question-and-answer period that my interest was

piqued. Bianco had made a forceful argument that big banks should have been

allowed to fail rather than being bailed out. The question from the floor to

Danny was, in essence, “What if the Bianco is right? Wouldn’t it have been

better to let banks fail and then restructure them in bankruptcy? Wouldn’t we

have recovered faster, rather than suffering in the slow-growth,

high-unemployment world where we find ourselves now?”

Blanchflower pointed his finger right at Jim and spoke forcefully.

“It wasn’t the possibility that he was right that preoccupied us. We couldn’t

take the chance that he was wrong. If he was wrong and we did nothing, the

world would’ve ended, and it would’ve been our fault. We had to act.”

Blanchflower’s explanation made me realize that central bankers

are quite human and so are their reactions in the middle of a crisis. They feel

that they have to do

something.

The present challenge arises because our central bank monetary

heroes allowed QE, ZIRP, and in some places NIRP to persist far longer than was

wise. You can make the case that these measures were necessary in 2008 and for

a short period thereafter; but these policies should not have remained in

place, much less been expanded, for 7-–9 more years. Yet they were. That this

was a mistake is now clear to almost everyone. Iin hindsight. What to do about

it is less clear.

On the positive side, our central bankers are talking about the

problem. The kool kids’ new buzzword is policy

normalization. Everyone (except the Bank of Japan) agrees that

abnormality has outlived its usefulness. That’s important: Admitting your

problem is the first step to solving it.

However, solutions are difficult when that first timid step runs

you smack into a brick wall that you yourself built because you waited too long

to act.

It was mid-2013 when Ben Bernanke first suggested the Fed might

“taper” down its bond purchases. The Taper Tantrum ensued and stopped him from

implementing the policy he clearly thought was right. It fell to Janet Yellen

to implement the taper and then make one very tiny rate hike in December 2015.

Another tantrum followed, this one centered in China. Plans to raise rates

further were again postponed. As I noted in “Mad

Hawk Disease” two weeks ago, Fed governors were clearly mindful of

what would happen to the then-current Democratic administration if a policy

error precipitated a recession. “We couldn’t take the chance.” They ignored Ben

Bernanke’s admonition that “The central bank needs to be able to make policy

without short-term political concerns.”

Now, with a Republican administration and Congress, the FOMC

apparently feels no such concern about the potential for a policy error. We

will never know, but I wonder if they would now be raising rates under a

Clinton administration. It’s actually a serious question.

Having waited four years too long, the Fed, the ECB, and the Bank

of England are finally tightening in a strange combination of caution and

boldness. You may have heard public officials talk of being “cautiously

optimistic.” The central bank version of that is “cautiously aggressive.” Each

passing month makes them less cautious and more aggressive, it seems. Like

kittens, they venture out from their mother gingerly at first but soon are

romping underfoot and destroying furniture.

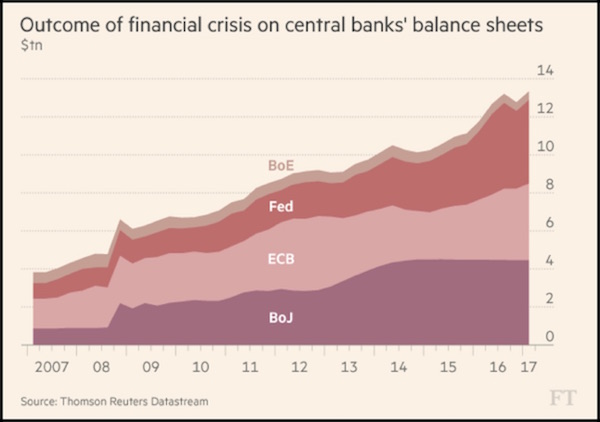

Source: Financial Times

That may be an amusing analogy, but reality is not amusing at all.

The four largest central banks together have about $13 trillion on their

balance sheets, a large portion of which they believe needs to roll off.

Removing it without breaking something important will not be easy.

The central bankers are not unaware of this challenge. They have a

conscience of sorts in the Bank of International Settlements, and it is

whispering in their ears as loudly as it can. BIS economist Claudio Borio, in

the institution’s annual

report last month: “The end may come to resemble more closely a financial

boom gone wrong, just as the latest recession showed, with a vengeance.”

The report’s monetary

policy section was even more direct :

Policy normalisation presents unprecedented

challenges, given the current high debt levels and unusual uncertainty. A

strategy of gradualism and transparency has clear benefits but is no panacea,

as it may also encourage further risk-taking and slow down the build-up of

policymakers’ room for manoeuvre.

That’s obvious, but it’s important that BIS said it.

“Unprecedented challenges” may even understate the magnitude of what the Fed

and other central banks are up against.

More from BIS:

In determining the pace of normalisation, central banks must

indeed strike a delicate balance. On the one hand, there is a risk of acting

too early and too rapidly. After a series of false dawns in the global economy,

questions linger about the durability of this upswing. And the unprecedented period of

ultra-low rates heightens uncertainty about reactions in financial markets and

the economy.

On the other hand, there is a risk of acting too late and too

gradually. If central banks fall behind the curve, they may at some point need

to tighten more abruptly and intensively to keep the economy from overheating

and inflation from overshooting. And even if inflation does not rise, keeping

interest rates too low for long could raise financial stability and

macroeconomic risks further down the road, as debt continues to pile up and

risk-taking in financial markets gathers steam. How policymakers address these

trade-offs will be critical for the prospects of a sustainable expansion.

I think that last part is too gentle. Financial-stability and

macroeconomic risks are already elevated. Debt isn’t simply piling up; it’s up

to the ceiling and pouring out the windows. Risk-taking in financial markets

can hardly gather any more steam without blowing its top.

So yes, how policymakers address these trade-offs is indeed

critical. But even if we assume our central bankers will act calmly and

professionally – which perhaps we should not – the fact remains that they have

no good options because they waited too long. “Least bad” is the best we can

hope for, and I doubt we will get even that.

The brick wall of bad decisions looms.

The brick wall of bad decisions looms.

“Get out of Dodge” was a phrase made popular by Marshall Matt

Dillon on the TV show Gunsmoke

in the ’60s. The phrase slipped into the youth culture and endures as a

shorthand way of saying that you’d better leave town before the stuff hits the

fan.

I believe the Fed is aware that they should have been raising

rates earlier. They also understand the present risks. While I believe it is

appropriate to raise rates slowly, I simply cannot understand why they would

want to reduce their balance sheet at this late date, at the same time that

they jack up rates. They could have been letting the balance sheet roll off for

four years, but to do so now in conjunction with raising rates simply increases

the risk of a policy error. But I don’t think they will see that as their

problem.

Chair Yellen and I both believe the majority of the current

governors will be gone by the second quarter of next year. It would not

surprise me at all if Vice-Chair Fischer offers to resign before his term is up

in June 2018. This Fed is going to raise rates a few more times, start reducing

the balance sheet, and then get the hell out of Dodge.

Federal Reserve governors basically have a 14-year term, which

reduces the ability of any one president to appoint a majority of the FOMC

within a four-year term. Of course, resignations affect the balance.

Trump is going to have the unusual opportunity to appoint at least

six, and more likely seven, governors by the middle of next year, if not

sooner. Whether he wants it to be or not, this will be the Trump Fed. Without

major reforms in place, the Trump Fed will face a recession, serious global economic

issues, and a resulting major equity bear market. Think they will continue to

raise rates? How long before they start to talk about supplying a little more

QE to appease the markets?

The current FOMC simply hopes that everything holds together until

they can slip out the back way from Dodge. Who do you think will get the blame

for the next crisis? It should be this FOMC, but that’s not the way the real

world works.

The Trump Fed will be politicized and stigmatized by its

Democratic opponents no matter what they do. Howls for outside controls and

oversight will rise in the night.

The parlous state of the economy is not just an American problem,

or a European or UK or Japanese or Chinese one. It is global.

I wonder whether Janet Yellen truly appreciates the degree to

which Federal Reserve policy affects the entire world. Like it or not, the US

dollar is the entire planet’s ultimate medium of exchange. One way or another,

almost every financial transaction eventually settles in dollars. China and

others would like to change that. Maybe they’ll succeed someday, but it won’t

be this year or next.

That being the case, the way Fed policy impacts the dollar could

make the inevitable crisis much worse. Looking only at the US, there’s a strong

case for raising – oops, I mean “normalizing” – rates. Going to even 2% or 3%

won’t kill our economy. But hiking rates will likely create other victims whose

problems will soon become our problems, too.

Think of all the dollar-denominated debt owed by various emerging-market

governments and businesses. Higher US rates will strengthen the dollar and make

that debt costlier to service, almost certainly causing some defaults. In

today’s highly leveraged markets, the pain caused by those defaults will

quickly spread to lenders in Europe, Japan, and the US.

You might respond that more stringent capital requirements mean

today’s banks are better able to withstand such scenarios. That’s partly true.

It’s also true that the bank executives hate those requirements and are working

assiduously to loosen them.

These banks are also far larger than they were in 2008. Yes, they pass the Fed’s stress tests, but the Fed can’t test every possible adverse scenario. Generals always fight the last war. The next crisis probably won’t originate in residential mortgage loans. It will come from somewhere else, and we have no idea whether the banks are actually ready for it.

These banks are also far larger than they were in 2008. Yes, they pass the Fed’s stress tests, but the Fed can’t test every possible adverse scenario. Generals always fight the last war. The next crisis probably won’t originate in residential mortgage loans. It will come from somewhere else, and we have no idea whether the banks are actually ready for it.

You and I can’t control whether banks are ready, but we can

control whether we

are ready. I am working on a number of fronts to help you. My brief time away

convinced me beyond any doubt that a crisis of historic proportions is once

again bearing down on us. We may have little time to prepare. We definitely

have no time to waste.

Barefoot on the Beach

As I mentioned at the beginning of the letter, Shane and I did get

married on the beach in the Virgin Islands last week. We stayed at the fabulous

Ritz-Carlton Hotel on St. Thomas, and I have to tell you it was one of the most

pleasurable hotel/resort experiences of my life. At least for one week, we were

living large. But it’s an important week, got to admit. The entire hotel team

was fabulous; the venue was great; and the food was awesome. Highly

recommended. And not just for getting married – we do hope to get back.

Your beginning to wonder if the nudge over the edge comes from our

own central bank analyst,

John Mauldin

0 comments:

Publicar un comentario