What

Should Trump Do?

By John Mauldin

“The

problems of victory are more agreeable than those of defeat, but they are no

less difficult.”

– Winston Churchill

“Crying

is all right in its way while it lasts. But you have to stop sooner or later,

and then you still have to decide what to do.”

– C.S. Lewis, The Silver Chair

“I

must have a prodigious amount of mind; it takes me as much as a week,

sometimes, to make it up!”

– Mark Twain

No

matter who won the presidency, the economic way forward was not going to be

easy. The Republican team understands they must “stand and deliver.” But as

we will see in today’s letter, that is not going to be easy. I’m going to

depart from the normal format of my letters, where I talk about the economic

realities we face and how we should invest, and instead offer my view of what

I think the Trump administration and the GOP-led Congress should do.

Please

note, this is not necessarily what they will

do. In complete candor, what I’m proposing will be remarkably difficult for

certain members of the Republican and Democratic Congress to countenance. It

requires accepting some significant philosophical heresies that are anathema

to all politicians (different heresies/anathemas for different politicians,

according to their philosophical bent), but I see it as the only way forward

if we want to dodge a deep recession and/or a greater crisis in the future.

I

know for a fact that many of the people you have seen listed on the Trump

economic transition team will be reading this. That is one reason I’ve been

taking so long to put these thoughts to paper. And some of the ideas I’ll

share are quite frankly things I have come around to in just the last week. I

will readily admit to having already mentally written my post-election letter

based on the assumption that Hillary Clinton was going to win; and on

Wednesday morning I had to throw out everything I had thought about and start

all over. And it’s not just you and I who had to shift gears quickly: I know

that quite a few people on the transition team had speaking engagements and

other projects arranged for later that week, and they had to scramble to redo

their schedules.

I’ve

done a lot of talking with a lot of people and listening and reading in the

last 10 days.

This letter is where I currently come out. What I’m going to

propose is something that I think is politically possible (in terms of

gaining bipartisan support, which will be necessary for certain portions of

what I’m suggesting). I also think it has the potential to solve the

deficit/debt problem and provide the funding needed for healthcare, Social

Security, and the other necessary categories of government spending. It would

also be a massive stimulus to the economy – boosting jobs, new business

creation, and entrepreneurial activity.

Up

front we must face the fact that the American people want several

incompatible things at once: They want lots of expensive healthcare

provisions for everyone; they want tax cuts; and they want a balanced budget.

As we will see below, we can have relatively universal healthcare (no matter

how it’s funded and delivered), tax cuts, or

a balanced budget; but we can have only two of the three. Most Americans want

all three and don’t see why they shouldn’t have them. There are some

exceptions – there are, for example, some economists who don’t care about tax

cuts or a balanced budget. They are working from an economic theory that says

deficits and debt don’t matter; but in practice, in the observable, empirical

world, they do matter. Greatly. Maybe not this year, but sooner or later the

piper has to be paid.

Let’s

look briefly at where we are now – at the constraining facts that any

economic proposal must take into consideration.

The

US federal

government debt will be slightly north of $20 trillion before Obama

leaves office in January. Add in local and state debt of another $3 trillion

(plus), for a total of more than $23 trillion of government debt. The US

economy will be a few hundred billion dollars under $19 trillion at the end

of this year. That is a debt-to-GDP ratio of somewhat over 121%. For the

record, when you are trying to determine the effects of total government debt

on the economy, not to include state and local debt is disingenuous. The debt

must all be paid by the same general taxpayers at one level or another.

(Please note: I am rounding out the numbers in this letter because when

you’re talking about trillions and hundreds of billions, anything to the

right of the decimal point is kind of meaningless.)

That

debt has risen roughly $10 trillion under Obama, in just eight years. Last

year the debt rose $1.3 trillion, even though we were told that the budget

deficit was only around $600 billion. Lots of off-budget debt gets added

every year. It greatly annoys me when spin doctors don’t include total debt

when they are talking about the deficit (and they do it on both sides of the

aisle). I wish I could get my banker to adopt the same enlightened view.

I

know that Krugman and others call me a debt scold (scornfully, as if I am

some kind of troglodyte coming out of my cave to issue unnecessary warnings),

but there are 160 historical instances of major countries having to

renegotiate their bonds because they had too much debt, and in the recent

century some countries that did so ended up in serious financial crises. I

don’t for a minute think that the US will not pay every dollar of its debt;

but getting those dollars, whether through taxation or printing, will impact

the economy significantly. And if we wait too long, the ensuing crisis could

be ruinous to many.

I

start with the premise that to get the deficit and debt under control is an a

priori condition for avoiding a future crisis. Avoiding that crisis – even if

it is 10 years out – is important. The solution doesn’t have to be

implemented all at once, but there has to be a clear trajectory along the

lines of the Clinton/Gingrich budget compromises that gave us balanced

budgets and even deficit reduction.

Standard

Republican thought is that we have to engender enough growth to overcome the

deficit. The Reagan tax cuts certainly increased the deficit, but when they

were combined with the Clinton/Gingrich budget controls, we were soon paying

down the debt and growing much faster. The debt became far less of a problem,

at least in terms of GDP. It was when Bush II and the aggressively enabling

Republican Congress basically abandoned budgetary controls (we could have used

a deficit hawk like Gingrich as Speaker of the House to control the spending

urges), combining tax cuts with large spending programs, that the deficit and

debt once again began to get out of hand. Then along came the recession,

triggered by the housing bubble brought on by interest rates held too low for

too long by the Federal Reserve; and seemingly all of a sudden the deficit

exploded – $10 billion in just eight years.

Sidebar:

Everyone focuses on the size of the federal budget as if that is the government.

The US federal spending budget is $3.88 trillion as of this year. State and

local outlays are $3.3 trillion, bringing us close to $7 trillion of total

government spending. Very few people realize that state and local spending is

almost the same size as total federal spending.

Total

US debt, including private and business debt, is $67 trillion, or just under

400% of GDP. We have 95 million people not in the labor force, 15 million of

whom are not employed (twice the number officially unemployed). We have

almost 2 million prison inmates, 43 million living in poverty, 43 million

receiving food stamps, 57 million Medicare enrollees, and 73 million Medicaid

recipients. And 31 million still remain without health insurance.

(You’ll find a treasure trove of information like this at the US

Debt Clock.

This

US debt total does not even take into account the over $100 trillion of

unfunded liabilities at local, state, and federal levels, which are going to

have to be paid for out of current revenues at some point (see more below).

I

bring up the size of the debt because unproductive debt is a limiting factor

on growth. 10 years ago it wasn’t that big a deal. Today it is. The more we

increase our debt, the more difficult it is going to be to grow our way out

of our problem with the debt. That’s just an empirical fact. Both Europe and

Japan have much larger debt ratios than we do, and both have much slower

growth rates. Note also that the velocity of money in both those regions is

much lower than ours, and the velocity of money in every developing portion

of the world continues to drop. (More about that below.)

Something

like $5.5 trillion is “intergovernmental debt.” The theoretical Social

Security trust fund is an example. We “owe it to ourselves,” and so many

economists simply deduct that money when they talk about the size of the

total debt. And technically it is true that we pay interest on that debt,

which comes back to the government. But that doesn’t mean those debts aren’t

going have to be paid.

The

Social Security trust fund assumes as part of its future budgeting process that

the interest will be paid. So do most other intergovernmental debtors. Think

of it like borrowing against the cash value of your life insurance. You

technically owe the money to yourself, and you are (typically) paying

interest on the amount you borrowed, but if you die your outstanding debt

reduces the amount of your life insurance. If you want the life insurance,

you’re going have to pay that borrowed debt. For economists to talk about

this portion of the debt as irrelevant is economic malpractice. It is smoke

and mirrors economics of the worst kind. But even if we did dismiss $5.5

trillion dollars of internal debt, the government’s debt-to-GDP ratio would

still be almost 100% when you include state and local debt. And that is

definitely in the range where all the data and economic analysis suggests

that debt is a detriment and a drag on growth.

Vice

President Dick Cheney once remarked that “Deficits don’t matter” as he

defended his spending on the Iraq and Afghanistan wars. And when he said it,

he was more or less correct. Then, the deficit as a percentage of GDP was

less than nominal GDP growth, which meant that the country was growing faster

than the debt was. (Later, it turned out that deficits did matter, when the

spending on everything else plus defense spun out of control.) And for those

people who say that tax cuts create growth, I would suggest that 2% growth

for 16 years is not exactly what we were expecting. And much of the growth we

did get during the housing bubble years was clearly spurious.

Yes,

the US economy has grown at something like an average 2% for the last 16

years. Inflation was higher in the early years, but now it is about 1.5%,

which gives us nominal GDP growth of about 3.5%. Total debt this year rose by

6.8%, or almost double our growth rate. Not the right direction. After eight

years of the slowest economic recovery in history, we are growing our debt

dramatically faster than we are growing our country – even when we include

inflation.

Remember

that seemingly innocuous “velocity of money” bit of detail that I threw in

earlier? You need the velocity of money to begin to increase so that you can

actually get inflation. Ask Japan about how much money you can print without

getting inflation. That also suggests it is going to be harder to create

inflation than many economists would like. I know that many establishment

economists would like to see inflation closer to 4%, with GDP growth of 3%,

so that we could begin to quote “grow our way” out of the debt. That’s not

impossible, but it’s highly unlikely. Frankly, we will be lucky to get 2%

growth and 1.5% total inflation for the next four years.

Republicans

want to cut corporate and individual taxes to help stimulate growth. That is

a necessary but not sufficient condition to stimulate growth. Significant

regulatory rollback will help. It is also necessary but not sufficient.

Fixing the Affordable Care Act and bringing costs and benefits into alignment

is another necessary but not sufficient condition for growth.

There

is a major lag time for any economic programs that are enacted. Even if they

are enacted in the first 100 days of the Trump administration, it will be

months if not years before we see actual results. A $19 trillion economy does

not turn on a dime.

My

friend Raoul Pal, in his latest Global

Macro Investor, talks about the potential for a recession in

2017:

I

recently noted that since 1910, the US economy is either in recession or

enters a recession within twelve months in every single instance at the end

of a two-term presidency… effecting a 100% chance of recession for the new

President.

The

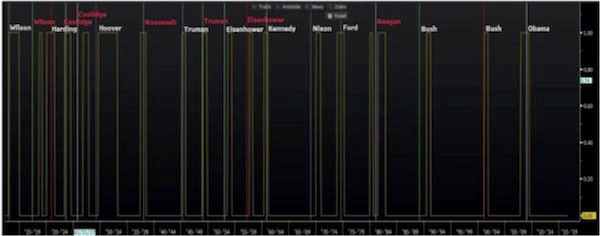

following chart shows every NBER recession since 1910 (in yellow) with the

new President after a two-term election marked in white and the new

presidents after a single-term presidency in red. Wilson and Eisenhower

appear as both. Only Coolidge saw more than a year (sixteen months) from his

second-term election and the onset of the subsequent recession at the end of

WWI...

Every single US recession bar one

(with explainable circumstances) occurred around an election. Only two Presidents

in history did not see a recession, and they were inaugurated after

single-term Presidents.

You

can see the whole piece here. There are a

few caveats and some slight curve fitting, but his general observation of

recessions after a two-term presidency pretty much holds as far as I can see.

A

proper objection many will have to this finding is that there are not enough

data points to make it a really accurate predictor. There is nothing that I

can think of economically about a two-term presidency that requires a

recession to follow it.

And if the economy were now growing at 3% to 4%, if

unemployment were truly under 4%, and if we had the deficit under control, I

wouldn’t be worried at all. But Raoul has pointed out a statistic that

appears on my radar just as I’m also watching the country grow rather slowly

(at very close to stall speed) and seeing corporate profits come under

pressure while the post-election US dollar rises seemingly relentlessly

(doing damage to US corporation profits, not to mention emerging markets) and

interest rates climb all over the world. And then there’s Europe, which

could potentially deliver a massive shock to the global economy in the

not-too-distant future…

Patrick

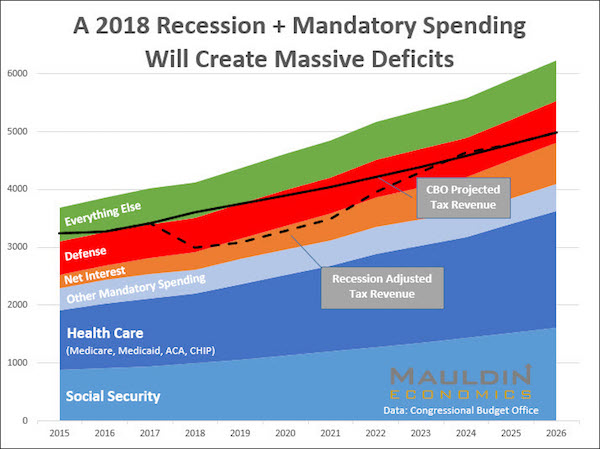

Watson had our team at Mauldin Economics create the following chart, which

shows what would happen to the federal budget if there were a recession in

2018. (If the recession were to move up to 2017 or if it were to hold off

till 2019, the result would be much the same.) Revenues go down, and expenses

go up. Note that taxes actually received under the current system would pay

only for mandatory spending like healthcare and welfare and Social Security

plus interest costs. Money for defense spending and everything else would

have to be borrowed. The on-budget deficit would rise to over $1 trillion –

closer to $1.3 trillion. Add in the off-budget debt that always seems to

increase and you could quickly grow total US debt to $30 trillion before the

end of Trump’s first term.

Obviously,

that doesn’t take into account any of the measures the new administration

will put in place to try to hold off the effects of a recession or to resolve

any of the problems I’ve described. This is just using CBO data for our

current trends. By the way, the chart also shows that we can expect

trillion-dollar budget deficits as far as the eye can see.

I

should point out that federal income tax revenues are basically flat, even

though the jobs numbers are up. That means a lot of people are getting

lower-paying jobs.

The underlying economy is weaker than it appears.

Just

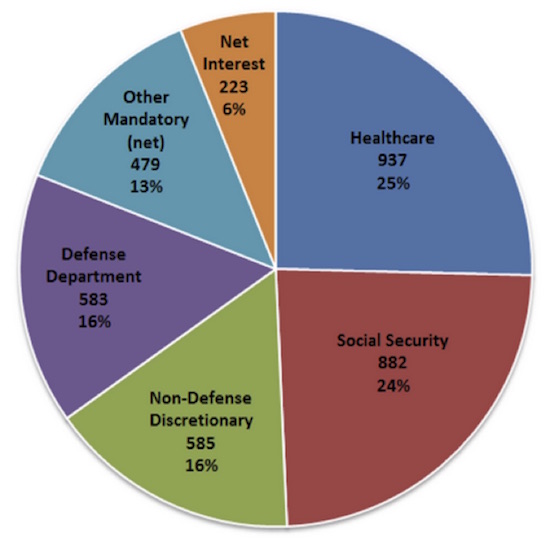

to demonstrate that we can’t balance the budget by cutting out waste and

fraud (which of course we should do), let me offer the following pie chart.

Even if you cut out every single non-defense discretionary item, the budget

still would not have been balanced last year, at the tail end of a recovery.

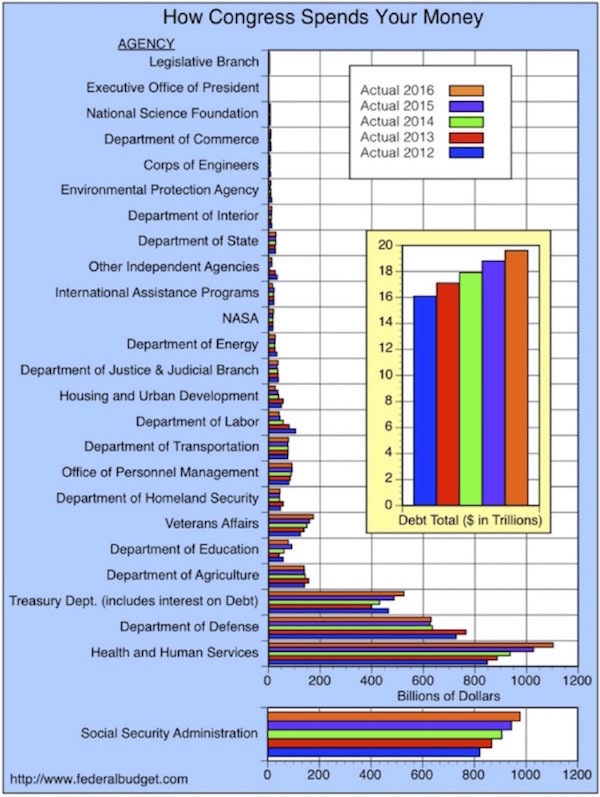

For

some detail, take a look at this bar graph, which shows the growth of

spending in the various branches and departments of government. Which areas

are you going to cut to make any meaningful difference?

For

the purposes of my argument, I am going to assume that the Republican

Congress and administration somehow wrestle with the Affordable Care Act and

bring actual individual healthcare costs down. But the demographic reality of

the Baby Boomer Bulge is that no matter what we do, overall costs are still

going to rise again within a few years unless we ration healthcare, which is

not a viable political option. As Baby Boomers retire in droves, not only

will they need more healthcare, they will also need more Social Security. There

are things we can do to get the whole healthcare process under control and to

improve the general health of the country, but that’s not going to have a

significant effect in the next two or three years.

So

bluntly, if you cut

income and corporate taxes (which is something I think we

should do) without any

offsetting revenue increases, you’re going to make the

deficit and debt problems worse. As one of my readers wrote me last week:

Hi

John,

Very briefly: If Trump “does a Reagan” and makes his voter base happy with unfunded tax cuts that triple the national debt by the time he ends his second term, won’t that just put off tough choices and make everything worse in the long term? Regards, Douglas

Douglas,

while I don’t think the debt will triple, it is easy to imagine that it rises

by 50%, which would, in and of itself, be problematical. It does put off the

hard choices – and make them a lot harder still when we hit the wall.

So

let me offer a program that I think might actually solve the deficit and debt

problems, jumpstart the economy, pay for healthcare and other costs, and do

so with the least damage to the body politic and economy.

Let

me again restate for the record that any one of these suggestions taken apart

from the rest of the body of actions might be useful but would not be

sufficient to ensure recovery and a balanced economy. It is with a somewhat

heavy heart that I offer these proposals, knowing that there will probably

not be one person who doesn’t find some of them extremely distasteful. And that

includes me. But the simple reality is that this is where we find ourselves

today: we are left with distasteful choices. When you’re left with nothing

but difficult choices and bad choices, and you avoid the difficult ones, then

you end up with only bad choices (cf. Greece).

1.

Cut the corporate tax rate to 15% on all income over $100,000. No deductions

for anything. Period. A 10% tax rate on all net foreign income (with

allowances for taxes paid against total income.) That will make us the most

tax-friendly business nation in the world, competitive with Ireland, and

stops all the financial shenanigans that try to avoid taxes. International

companies will not only move their headquarters here, they will bring their

manufacturing and jobs with them. Ask Ireland how that worked out for them. I

can imagine a horde of global companies moving from Europe and elsewhere to

take advantage of the competitive taxes. Frankly, it will put them at a

disadvantage if they don’t.

The

simple fact is we will collect more total corporate taxes under this plan

than we do under the current system with all its deductions and loopholes.

This tax plan will have the side benefit of putting out of work an army of

lobbyists whose sole role is to try to get tax benefits for their clients.

2.

Cut the individual tax rate to 20% (and later I’m going to demonstrate how it

could even be 15%) for all income over $100,000. No deductions for anything.

Period. No mortgage deduction, no charitable deductions. No nothing. Anybody

who makes less than $100,000 will not pay income taxes and will not file.

This will dramatically promote entrepreneurial activity and help small

businesses.

So

far, the above is standard Republican doctrine. Now we’re going to venture

into left field.

3.

I’m working under the assumption that we must make a serious effort to have a

balanced budget and to fund healthcare and Social Security. That requires

money, which is another way of saying that we will need to find taxes from

another source.

I would propose some form of a value-added tax (VAT) that

would specifically pay for Social Security and healthcare. All the other

parts of government are paid for from income and corporate taxes. Given the

monster size of the healthcare budget, we would need somewhere close to a 15%

VAT. That could change somewhat depending on various workarounds.

For

instance, if you drop the income tax to 15% but keep the 3.9% Medicare tax,

that would leave the total tax rate under 20% but would offer a portion of

payment for healthcare, which might mean a lower VAT.

I

personally presented this plan to Senators Rand Paul and Ted Cruz, who later

adopted a version of it that they characterize as a business tax; but I don’t

care what you call it. There are multiple variations on the theme, and I only

mention Paul and Cruz to point out that you can actually get serious

conservatives to consider such a tax. Now, to be fair, they were against

increasing the total amount of taxes taken. And that is not what I am

advocating here. To pay for healthcare and balance the budget, we are going

to need to generate more revenue. Not a whole lot in terms of percentage of

GDP, but some.

Let

me reiterate that whatever you call the VAT-like tax, it would be

specifically targeted at paying for healthcare and Social Security. If you

want to hold down the amount of the VAT, then Congress needs to aggressively

figure out how to hold down the cost of Social Security and healthcare. This

does not eliminate the need for aggressive restructuring of both of them. In

fact, it would require it.

4.

Policy wonks are going to note that you would not need a 15% VAT just for

healthcare. I would propose that we eliminate Social Security funding from

both the individual and business side of the equation and take those costs

from the VAT.

Progressive

and liberals will complain that a VAT is a “regressive” tax – it falls more

heavily on lower-income people since they spend much of their income on items

subject to such taxes. For the truly lower-income, you could offer a rebate

to even out the load, but if you get rid of Social Security taxes you give

everybody a 6.2% raise and a 6.2% reduction of employment costs to

businesses.

Getting

rid of individual and business Social Security payments is the opposite of

regressive and so balances out the cost to the working poor rather well.

Those with incomes between $40,000-100,000, who had been making Social

Security payments, would not be paying income taxes, so a VAT would still be

a cost reduction for them.

This

would be a huge stimulus to the economy. Plus, VAT taxes can be deducted by

businesses at the border when they export products. This would make us

competitive with every other country in the world whose companies also deduct

VATs at the border.

As

a general rule, most economists (even guys from Harvard and Princeton) will

tell you that a consumption tax such as a VAT is better than an income tax in

terms of its overall impact on the economy.

5.

We need to jumpstart the economy, and both sides of the partisan divide are

talking about some kind of infrastructure program. The problem with

infrastructure spending is that it still adds to the national debt, which is

already outsized. I do think we need infrastructure spending, as

infrastructure is typically productive as opposed to nonproductive, and the

program would help to jumpstart growth. But I would do infrastructure a

little bit differently. I would create an Infrastructure Commission that

would authorize federally guaranteed bonds for cities, counties, and states.

That’s not significantly different from the guarantee we extend to the $1.7

trillion in Ginnie Mae bond funds.

The

guarantee would let these entities borrow at 30-year Treasury rates, which

right now is around 3%. The program would allow the authorization of up to, say,

$1 trillion in infrastructure bonds for projects initiated within the

succeeding three years. The various political entities that issued the bonds

would have to legally agree to cover the payments to retire the bonds over 30

years. I would prefer that they couch this agreement in the form of a public

vote so that the citizens can see what they’re agreeing to.

Further,

we could subsidize the bonds at 2% for the first 5 years and 1% for the next

five years, which would mean a $20 billion per year expenditure for those

first five years. But also recognize that it would be highly unlikely that $1

trillion would be put to work by the end of the next four years. In the

meantime, millions of jobs would be created by the process, which would

generate GDP growth and tax revenue and would be very likely to produce more

in terms of revenue than the program costs. Plus, our kids get something for

the future – water systems, new ports and airports, roads, bridges, etc.

There

could be some exceptions to the focus on state or local funding for projects

that are truly national in scope. A Smart Grid (that would also hopefully be

EMP-hardened to counter a potentially civilization-ending threat that few

people are talking about) is a good candidate; and frankly, we could save

enough in electrical costs that we could probably work the payments for the

bonds into power bills as a very small-percentage add-on that comes out of

the savings.

The

commission itself should be composed of savvy businessmen and women who are

hopefully not politicians (or who have been retired from politics for at

least six years). Members from a particular state or polity would have to

recuse themselves on any vote that affected that jurisdiction.

The commission

would be responsible not only for determining that there is local buy-in to

the process, but also that the political entity issuing the bonds is capable

of making the payments.

6.

Roll back as many rules and regulations as possible. I would instruct every

cabinet member to find, every year for four years, 5% of the rules and

regulations within their purview and eliminate them. If they want to write a

new rule, they have to find an old one to eliminate. Bureaucrats are like

your crazy old aunt who still has every magazine she has gotten for the last

30 years just in case she might need to go back to some article and read it

again. Time to clean out the attic.

In

particular, I don’t want to reform the FDA; I want to replace it lock, stock,

and barrel with a 21st-century drug regulatory authority that

promotes innovation and allows individuals, in consultation with their

doctors, to opt for potential life-changing and even death-preventing

treatments if they so choose. I’m tired of having friends die of diseases for

which there are cures in the pipeline, but the companies with the treatments

are prevented from even making medications available to dying citizens. To

withhold such aid is, to my mind, a criminal act.

That

would not be a bad approach for every regulatory authority to take:

Forget

about the legacy rules and think about the world as it is today and how it

will change, and design a regulatory system that not only enables and

encourages change but that makes sure everyone benefits.

7.

Trump will have two immediate appointments to the Board of Governors of the

Federal Reserve. He will have another two in another year, giving him four

out of the seven governors. I would also imagine that, given the ambitions of

some of the other current governors, they will opt for the much higher income

available in private practice. Having a Federal Reserve that is more neutral

in its policy making and that realizes that the role of the Fed should be to

provide liquidity in times of major crisis and not to fine tune the economy,

will do much to balance out the future. I have several names in mind that I

would like to submit, but one in particular is Dr. Lacy Hunt, a former

Federal Reserve economist and one of the finest economic minds in the world.

Kevin Warsh or Richard Fisher might come back to the Fed if either were

nominated as chairman (although it would be a large pay cut for them). Janet

Yellen’s term as chairman expires in January of 2018, though s he could

remain on the board if she opted to. I can’t imagine anybody would want to

hang around on the board after they’ve been chair.

8.

Getting trade right will be tricky. It is one thing to talk about unfair

trade agreements – and we have certainly signed a few. But we also need to

recognize that some 11.5

million jobs in the US are dependent upon exports (about 40% of which are

services). Frankly, if we drop our corporate tax to 15% and work on reducing

the regulatory burden, I think we will be pleasantly surprised by how many

jobs are created just by those steps alone.

9.

In connection with trade, as I look around the world I see other countries

experiencing or getting ready to experience economic stress that is going to

force them to allow their currencies to weaken against the dollar. The euro

is already down by over 30%. The potential crisis in Italy (not out of the

question and a topic for a future letter) could easily push the euro below

parity. The value of the dollar relative to the currencies of other countries

comes under the purview of the Treasury Dept., not the Fed. And I can imagine

a time when we will see some strange new policies being suggested because of

the competitive pressures exerted by a strengthening dollar.

A Few Final Thoughts

The

central advantage of the entirety of my proposals is that they offer a path

to a finance the needs of the country and at the same time allow a balanced

budget. The actual increase in the total tax revenue needed will be a

function of the degree to which Congress can get the various budgetary items

under control, especially healthcare and Social Security. I know a lot of

conservatives would like to see no increase in total tax revenue to the

federal government, and if we can do that and balance the budget, I am all

for it. I am decidedly in the camp that government is too large and would be

more than happy to eliminate a few departments here and there.

But

voters clearly want healthcare and Social Security benefits to be paid for,

along with other government services that are actually necessary (especially

defense).

Therefore, we must figure out how to pay for those services. Simply

holding government expenditures flat for four years would go a long way to

solving the problem, but it won’t get us all the way there.

Boosting

growth is going to be difficult. This is not the 1980s and the environment

that Reagan encountered. Stock markets are at highs, not lows, as they were

in his term. Today, the market capitalization is 196% of GDP, versus 40%

when Reagan took office (hat tip Stephanie Pomboy). Reagan also had a falling-interest-rate

environment.

Plus he had a huge demographic shift to work with, from Baby

Boomers coming of age.

Reagan also had his recession at the beginning of his

term, so the economy was coming off its lows. There was a great deal of

pent-up demand, which is not presently the case. All of these factors were a

great help in spurring the economy when combined with tax cuts. Those

conditions all tended to boost growth, yet they don’t exist today.

We

can have growth and create good jobs, but it’s not going to look like the

’80s and ’90s.

Our rebuilding of the economy will have to take a different

path, and a more challenging one in many respects.

Let

me be very clear. If we don’t get the debt and deficit under control – and by

that I mean that at a minimum we bring the annual increase in the national

debt to below the level of nominal GDP growth – we will simply postpone an

inevitable crisis. We have $100 trillion of unfunded liabilities that are

going to come due in the next few decades. We have to get the entitlement

problem figured out. And we have to do it without blowing out the debt. If we

don’t, we will have a financial crisis that will rival the Great Depression.

Not this year or next year, and probably not in Trump’s first term, but

within 10 years? Very possibly, if we stay on our present trajectory.

For

investors, navigating the next few years is going to be tricky. We already

have multiple markets with valuations at the upper end of their historical

trading ranges.

Interest rates are likely to rise, although by less than most

people now assume.

OK,

I’m going to close now, and perhaps in the future letter I can answer

questions and criticisms I’ve provoked here. As always, I look forward to

your comments.

It

is with a heavy heart that I pen a few thoughts about the passing of a man

known to many of my readers and one came to be one of my best friends, Jack

Rivkin. He was a Wall Street legend who ran one major investment group after

another, ending up as head of investment for Neuberger Berman. He was lured

out of “retirement” by friends of his who had made a major investment in a

firm that I work with, Altegris Investments. Jack came in and eventually

became CEO, with the intention of doing what he did so well: creating new

investment practices and themes that end up becoming industry standards.

I

first met Jack in a plane coming back from somewhere overseas (I really can’t

remember where) and then again at various conferences. We both had an abiding

interest in the future and technology and their implications for investments.

I could spend, and often did, hours talking with him on an extraordinarily

wide range of topics. His investment analysis was brilliant, and it was

always delivered with good grace and a lot of humor. He was involved in dozens

of technology startups with no seeming connections among them other than that

they were fun and interesting projects. I can’t remember many occasions when

he wasn’t smiling. He was just generally happy and a fun friend to be around.

With

his involvement at Altegris, we became much closer, as we both believed that

the future of the investment business is going to be much different than its

past, and we were trying to figure out not only what it would look like but

how to be part of it. He began to participate in the annual “Camp Kotok”

fishing trips in Maine. In the summer of 2015 I remember visiting him at his

home in the Hamptons, where we talked earnesting about working together for

the next 10 years and how to make that happen.

And

then, it seems suddenly, he was diagnosed with pancreatic cancer; and after a

typically optimistic struggle, he succumbed to one of the nastiest diseases

known to humanity. Honestly, the outcome is still shocking. We had talked

about how he had great inherited genes and had more energy and was in better

shape than I am.

Our

mutual friend Barry Ritholtz wrote a very good tribute to Jack in his Bloomberg

column, calling him a Wall Street research giant. And he was. But to

those of us who knew him well, he was much more. He was a giant of a friend.

He will be missed.

And

with that, let me wish you a great week. I look forward to reading your

comments on this letter. Last week my staff sent me a Word document that was

23 pages long with your emailed comments. Plus, there were many online

comments.

There is a great deal of passion on every side about the outcome of

this election.

This election was not my first rodeo; but that being said, I

don’t recall there ever being this amount of emotional upheaval and national

drama. The next four years are going to be interesting, and I plan to be

right here with you, trying to figure out and create the way forward.

Your

wondering how the transition will come about analyst,

John Mauldin

|

Home

»

Donald Trump

»

Economics

»

Government Debt Markets

»

U.S. Economic And Political

» WHAT SHOULD TRUMP DO? 7 JOHN MAULDIN´S WEEKLY NEWSLETTER

miércoles, 23 de noviembre de 2016

Suscribirse a:

Enviar comentarios (Atom)

0 comments:

Publicar un comentario