In 2023, Russia Paints a Picture of Economic Success

There’s reason for optimism, but Moscow’s prospects aren’t as rosy as it says they are.

By: Ekaterina Zolotova

The World Bank has published a forecast for Russian economic growth in 2023, and the results aren’t pretty.

According to its calculations, Russia's gross domestic product in 2023 is expected to decline again by 3.3 percent thanks to the full implementation of an EU oil embargo, and to Moscow’s declining natural gas exports to Europe.

But Moscow is more optimistic than the World Bank.

The government considers its current plight a period of adaptation to unique challenges rather than a total disaster.

Partly this is because it believes 2023 may be easier on the economy overall, with a less than 1 percent contraction, according to the Ministry of Economic Development.

The question, then, is: Who is right?

Is Moscow naive?

Is it fudging its numbers?

Or does it really have a larger safety net than the West believes?

The answer matters because the Kremlin's foreign policy decisions – such as how to conduct the war in Ukraine – will depend heavily on how its economy fares.

Poor economic activity and social instability will require more financial influence and assistance from the state since many sectors depend on government payments. According to Rosstat, about 33 percent of the Russian population, excluding state employees, receives social benefits from the state.

This creates a direct line between poor economic performance and potential instability.

On the other hand, if the economy survives the sanctions and logistical difficulties arrayed against it, then the West will have to explore new ways to weaken Russia.

In time, it may even think about how to start negotiations and seek compromises on the war in Ukraine.

Regardless of the actual state of the economy, the Kremlin will therefore want to demonstrate to the West and to its people that its economy can survive despite its alienation and its hardship.

Its negotiating position on Ukraine depends on it.

Demonstrative Success

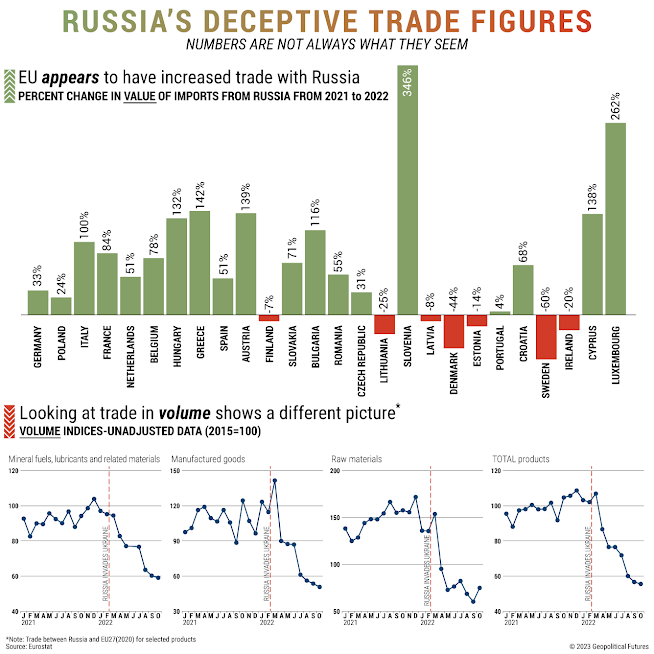

Indeed, over the past six months, Moscow has begun to demonstrate that the Russian economy can do without the U.S. and Europe.

European sanctions and restrictions hurt the financial sector, the market for components and semi-finished products, logistics and the consumer goods market.

Russia adapted in a variety of creative ways, including by redirecting part of the flow of oil and gas to the east and by creating parallel imports that allow companies to keep their shelves stocked and gain access to the necessary components.

More, the departure of some foreign companies allowed domestic industries to develop in their place.

The growth in the use of national currencies in settlements made it possible to ease the dependence on the U.S. dollar in trade transactions.

Import substitution has been notably successful in the textile, service and food industries.

Most important, the price of resources such as oil and gas stayed high, which allowed Moscow to survive lower levels of overall export.

To be sure, the Russian economy has its problems. Sanctions and supply chains aside, modest consumption, reduced investment and increased emigration are particularly problematic.

Since December, the Ministry of Digital Transformation has held meetings with representatives of specialized associations and IT companies to discuss ways to return IT specialists who left Russia.

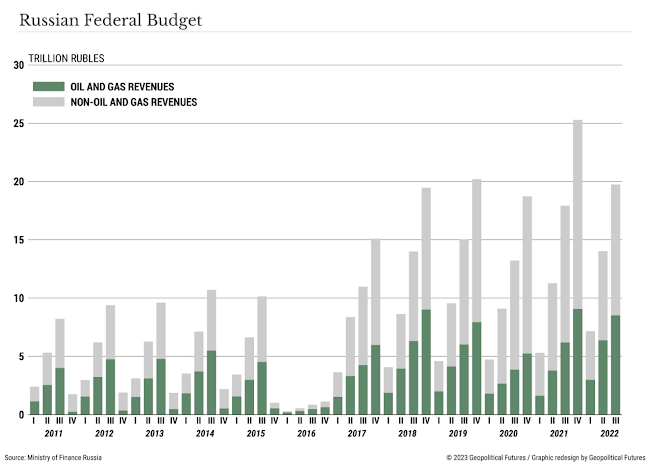

Moreover, the Kremlin isn’t especially happy with the state of the budget.

Russian Finance Minister Anton Siluanov said that the budget deficit in 2022 amounted to 3.3 trillion rubles ($48 billion), or 2.3 percent of GDP – except in 2020 at the height of the pandemic, this is the highest budget deficit on record.

The Finance Ministry noted that compared with 2021, spending increased by about 25.6 percent, peaking in December at 22 percent of annual spending.

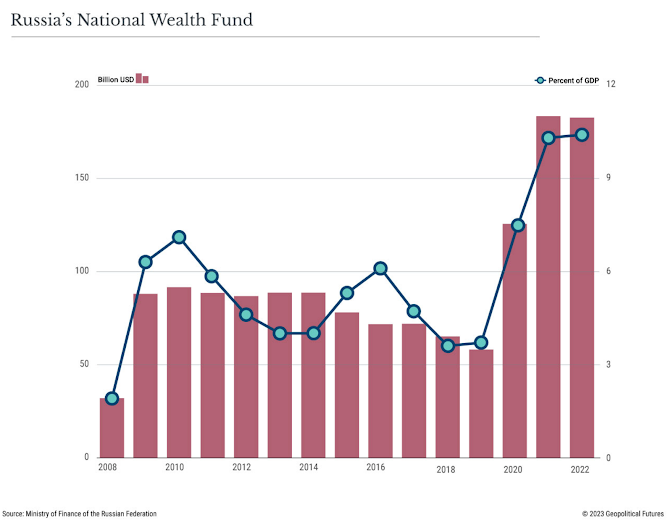

The deficit was covered by government borrowing and the National Welfare Fund, as well as by Gazprom, which temporarily paid increased taxes.

And for all of Russia’s success in creating parallel imports in certain sectors, it has failed to find suitable replacements in complex, knowledge-intensive and high-tech industries.

Take, for example, the Moskvich, a car that is ostensibly meant to be domestically produced.

Though it's assembled in Russia, it's produced using Chinese spare parts.

Put simply, it was impossible for Russia to reliably produce and sell a car in less than a year.

So while Moscow wants to achieve technological sovereignty, it is actually reorienting itself toward Asian markets rather than Western ones.

Representatives of the Moskvich plant said they plan to assemble cars from domestic parts by 2025, which means the Kremlin would need at least two to three years to figure out how to independently produce the necessary parts.

That’s a long time to wait.

February as a Stress-test

In the meantime, the health of Russia’s budget depends mainly on three factors: the price of oil, the volume of hydrocarbon production, and the ruble exchange rate in 2023 – none of which inspires much confidence today.

February – which is when Europe’s petroleum embargo takes effect – will be a particularly telling month.

Though it’s possible that exceptions will be introduced, carriers have become increasingly cautious of running afoul of new legal regulations.

And otherwise reliable destination markets such as China and India that were eager for crude oil and gas may not be as hungry for certain other products since they are major refining centers in their own right.

Russia will of course benefit from the sale of oil, but its profits will be lower because it will likely not be able to sell as much of it.

The uncertainty surrounding the sale could, moreover, affect the price of oil.

There is no consensus on what the price of Russia's Urals blend is expected to be in 2023.

Western countries introduced a price ceiling for Russian oil of $60 per barrel, after which the average price for Urals was $50.47 per barrel – 1.44 times lower than in December 2021, when it sold for $72.71 per barrel.

Oil production will also likely be constrained by Russia itself: President Vladimir Putin’s ban on export of Russian oil and oil products to certain foreign legal entities and individuals that directly or indirectly use the price cap mechanism will take effect in February.

This may raise the price of oil, but it may also curb sales.

All this calls into question Russia’s projected growth rates.

The oil industry plays an outsized role in Russian GDP, and at least for now, conditions bode poorly for production and supply.

With that in mind, the World Bank and Moscow are both right.

The Kremlin’s economic forecasts are rosier than they should be, but there’s reason to believe the economy can absorb more shock than the World Bank says it can.

The budget deficit is small compared to GDP, Russia managed to accumulate cash receipts from oil exports, and there are enough funds in the National Wealth Fund to cover deficits and potentially fund new social programs.

Unemployment is low, and many industries have begun to gradually accelerate their pace of production.

Inflation is gradually decreasing.

Russia isn’t out of the woods, but these signs are enough to convince Moscow that it can survive the next few years as it adapts to new economic realities.

Time is perhaps the biggest variable.

The Kremlin will want to see positive results as soon as possible; it understands that its prospects for negotiating an end to the Ukraine war depend on its ability to withstand Western pressure, and it knows that domestic stability depends on keeping its population happy.

But the World Bank and Moscow agree on one thing: that the Russian economy will contract.

There’s practically no way around it.

All the other uncertainties surrounding it will force Russia to scrimp and save so that it doesn’t waste limited funds, all while painting a picture of greater economic success.

0 comments:

Publicar un comentario