‘We Are Still Headed for a Pretty Hard Landing,’ Ex-Treasury Secretary Larry Summers Says

By Lisa Beilfuss

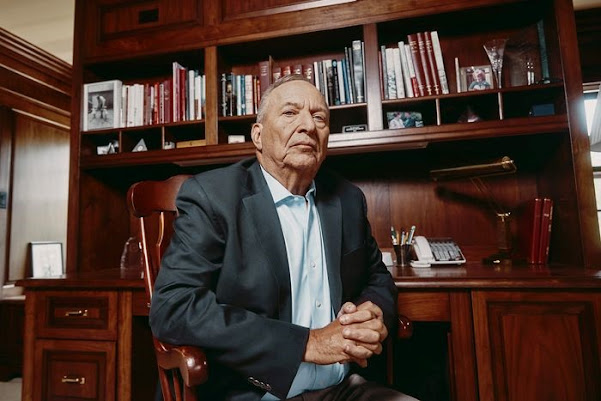

Lawrence Summers explains why a soft economic landing might be out of the Fed’s reach. / Photographed by Simon Simard.

Lawrence Summers explains why a soft economic landing might be out of the Fed’s reach. / Photographed by Simon Simard.Economist Lawrence H. Summers never joined Team Transitory, or the economists, investment strategists, and members of the Federal Reserve who thought inflation would be a temporary phenomenon.

Instead, he warned early and often that massive fiscal and monetary stimulus unleashed in response to the impact of the Covid pandemic would result in the economy overheating.

He was right: Consumer prices rose 8.6% year over year in May, the fastest pace in 40 years.

Summers is the Charles W. Eliot University Professor at Harvard University, president emeritus of the university, and former secretary of the Treasury under President Bill Clinton and director of the National Economic Council under President Barack Obama.

Long worried about secular stagnation, marked by sluggish growth and weak inflation, Summers is now concerned that the U.S. economy is headed for a hard landing as the Fed fights inflation.

Summers recently spoke with Barron’s by phone about where monetary policy, and the economy, go from here.

An edited version of the conversation follows.

Barron’s: You have been right about inflation from the start.

How did you get it right when the Federal Reserve and most Wall Street economists got it wrong?

Lawrence Summers: I used a fairly straightforward method.

I looked at the size of the output gap, or the shortfall of the economy compared with its maximum potential output, and I looked at the degree of stimulus being applied.

What I saw was a shortfall of payroll incomes of perhaps $30 billion a month compared with fiscal stimulus of $150 billion, even $200 billion, a month.

I saw the substantial overhang of savings that would be available in 2021, in addition to the consequences of negative real, or inflation-adjusted, interest rates and a substantially expanding Fed balance sheet.

I performed some calculations comparing the excess of stimulus to past episodes, including the 2008-09 financial crisis.

In retrospect, too little stimulus was applied back then.

But the stimulus this time relative to the output gap was about five times as large as in 2008-09, and no one believed that we should have had five times as much stimulus in 2008-09.

Then, I accounted for the risk that, in a post-Covid environment, supply would be reduced.

Between the demand and supply factors, which reinforce each other, significant inflation seemed a substantial likelihood.

Before the pandemic, you were concerned about a lack of inflation and sluggish long-term growth.

How did that prior focus affect your inflation view?

I was influenced by the fact that I had been dismissive of previous periods of inflation alarm, when some monetarists and conservatives had been very concerned about inflation.

When former Fed Chairman Ben Bernanke initiated quantitative easing, or large-scale bond purchases, in 2009, he dismissed the inflation potential of QE.

I had also dismissed those fears.

When Janet Yellen as Fed chair raised interest rates in 2017, I didn’t see the inflation threat.

After the pandemic response, I saw a kind of inflation threat that we hadn’t seen in 40 years, and I knew that I hadn’t in general been someone who saw inflation around every corner.

Treasury Secretary Yellen recently said she got inflation wrong. Does our current problem trace back to her tenure at the Fed, and that of her predecessor, Ben Bernanke?

There are people who believe that we’ve had a decadelong era of excessively easy money, and that it set the stage for our current problems.

I reject that belief.

My belief, up until the Covid moment, was that the economy was in a situation of what I labeled secular stagnation, where a chronic excess of savings over investment meant that you needed very low interest rates to keep the economy moving and growing.

If anything, the risks were on the side of deflation.

I saw a gap that I could never quantify precisely, but perhaps on the order of 4% to 5% between savings and investment.

The problem came when, in response to the pandemic, we decided to inject 12% or more of gross domestic product in fiscal stimulus.

You’ve been skeptical that the Fed can engineer a soft landing, or cool inflation without causing a recession. Why?

My judgment isn’t about the competence of the Fed.

It’s a judgment about the difficulty of the task.

The discouraging fact is that, when you have unemployment below 4% and inflation above 4%, recession always follows within two years.

And historically, when we get significant inflation, we really haven’t avoided a significant downturn in the economy.

Monetary policy famously has worked with a lag of nine to 18 months.

One of the reasons I worry about the Fed’s prospects for generating the soft landing we all want is that I like to compare the Fed’s problem to the challenge of adjusting the shower in an old hotel, where there’s a lag of 20 or 30 seconds between the time you turn the faucet and the time the water temperature changes.

It’s very difficult to avoid either scalding yourself or freezing yourself.

You turn, and nothing much happens, and so you turn more, and then, all of a sudden, you’re jumping out of the shower.

That’s the kind of problem that the Fed has.

The latest CPI report makes it clear that inflation isn’t simply coming down of its own volition.

Team Transitory is wrong.

It’s going to require substantial economic slack—a substantial increase in unemployment and reduction in GDP growth—to bring inflation, running above 8% and accelerating, down to acceptable levels.

What are the odds the Fed raises its 2% inflation target in order to stop tightening sooner and soften the landing?

The Fed has invested a great deal in the 2% target.

Frankly, I never thought the establishment of a numerical target was wise.

I would have preferred a qualitative commitment to price stability.

But that judgment was made a long time ago.

And I think to step away from it, in the context of the difficulty of achieving it, could be quite problematic.

And so I would not at this point advocate stepping away from the 2% target.

You’ve been critical of the Fed’s new average-inflation targeting framework. Is it behind the current problem?

I thought the 2020 framework was problematic when announced.

It seemed to be a response to a particular set of secular stagnation-type conditions that were in place at that time, when the likelihood is always that the world will change.

The longstanding idea of central banking is what former Fed Chair William McChesney Martin referred to as taking the punch bowl away just as the party starts to get good.

I worried that the Fed’s new framework was saying that the punch bowl was going to flow freely until you started to see people staggering around drunk.

Why do I say that?

First, they said they were comfortable with inflation above 2% because of previously undershooting that target.

Second, they said they would restrict policy not on the basis of expected inflation, but in response to inflation they were already seeing.

Third, they said that even if they saw inflation, they wouldn’t move unless they were convinced that the economy was at full employment.

Those three steps taken together seemed to be a prescription for overheating. Sure enough, within two years, that’s what we had.

What is the best way forward, then, if the current inflation framework doesn’t work?

There’s a phrase that my children use: TMI, or too much information.

It’s an idea that central banks might want to include more in their repertoire.

The Fed should return to a much more modest framework around the objectives of price stability and full employment in the face of changing data.

It should resist the broad idea of forward guidance, which I think is one of those elegant academic ideas that doesn’t work very well in practice because central banks don’t and can’t know what they’re going to do in the future.

And so forward guidance is, the vast majority of the time, folly.

Markets don’t particularly believe it, so it doesn’t have positive effects when you give it.

But having given it, you feel constrained to follow through on it, and so it diverts policy from what would otherwise be the optimal path.

How can the Fed restore credibility it has lost in recent years?

As the old joke has it, forecasting is really hard, especially about the future.

And while my forecasts of inflation a year ago are looking good, I’ve had plenty of forecasts in my life that didn’t turn out right.

I think that it’s important to recognize the difficulty of the task.

It would be valuable for the Fed to undertake a review of its modeling and forecasting procedures.

Some of the techniques that are used in other contexts, such as the use of adversarial collaboration, where different teams consider different possible hypotheses and make the case for those hypotheses, would be very much warranted.

The Fed’s errors were in significant part errors that were widely shared in the professional forecasting community.

For the first six or eight months of 2021, there was substantial agreement with the kinds of things that the Fed was saying, so it is important to understand the paradigms of error.

Then, the Fed clung to the transitory-inflation view after it was being increasingly abandoned in the forecasting community.

That, too, needs to be a matter for some internal soul searching.

Fed Chair Jerome Powell has been candid about how little the Fed knows about quantitative tightening, or balance-sheet shrinkage, as it partially reverses QE. How do you see it playing out?

We don’t know.

And when you don’t know that much about the ground you’re walking on, it’s a good idea to step softly.

I was impressed by a study I saw that observed that researchers within central banks were more likely than outside researchers to find that QE was effective, and those researchers were more likely to be promoted within central banks.

That research suggests to me that the tendency may be to overestimate the strength of QE and QT in terms of their economic impacts.

One of the reasons that my instinct tends to be that we’re going to need larger interest-rate increases than the Fed is signaling, or the market is expecting, is that I don’t think the independent effect of QT is likely to be that large.

[Editors’ note: This interview was conducted before the Fed raised interest rates by 0.75% on June 15, the biggest such move since 1994. Barron’s checked in with Summers again after the Fed’s decision, to get his reaction.] What do you make of the Fed’s big move?

The Fed is showing determination.

I understand the decision to do a 0.75-percentage-point move as a significant policy step.

But I still don’t believe that the Fed has realistic projections.

In March, I said that the dot plot, which charts members’ individual rate forecasts, wasn’t remotely realistic.

While [the dots] were significantly adjusted this time around, unfortunately I still don’t think they are realistic.

Why should anyone think that inflation is going to come down from the 8% range to the 2% range without unemployment rising above the Fed’s estimate of its normal rate, an estimate that is itself too low?

My guess is that you will see further increases in projected inflation, projected unemployment, and projected interest rates.

I think the 0.75-percentage-point move was a desirable move for the Fed’s credibility, but I don’t think the Fed helped itself with the new projections and rhetoric.

We are still headed for a pretty hard landing.

Thank you, Larry.

0 comments:

Publicar un comentario