How the Green Economy Will Be a Gold Mine for Copper

By Andrew Bary

Copper rods used to machine parts are stacked on a shelf / Scott Olson/Getty Images

Copper, a linchpin of the old energy economy, will play a crucial role in the new green one, too.

Cables made of the metal are still the most cost-effective means of transmitting electricity from solar and wind sources, and it is a key material in charging stations and the electric vehicles that use them.

Indeed, Goldman Sachs analysts say, there is “no decarbonization without copper,” which they call “the new oil.”

Supplies, already tight as the global economy recovers, could be further strained by a predicted fivefold rise in green energy demand in the current decade, leading to significant shortages, starting in the mid-2020s, according to a report by Goldman commodity analyst Nicholas Snowdon.

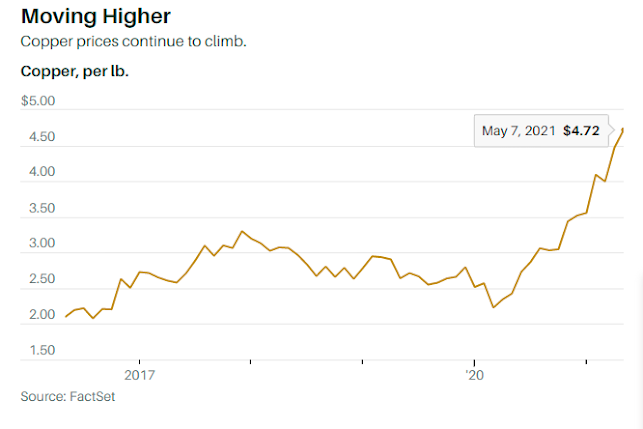

He sees copper, now around $4.50 a pound, hitting $6.80 by 2025.

Bank of America commodity strategist Michael Widmer thinks the price could hit $6 this year.

Shares of copper producers, up sharply in the past year as the metal’s price has doubled from a post-Covid low, still have room to advance.

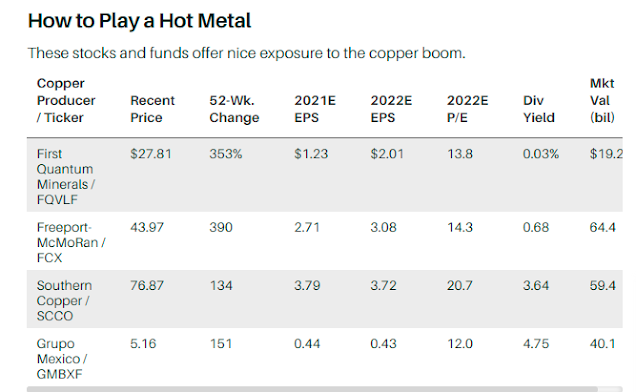

Freeport-McMoRan (FCX), with mines on three continents, is the top play and the S&P 500’s only major copper stock.

Barron’s wrote favorably on copper and Freeport in January.

Other notable producers are First Quantum Minerals (FQVLF) and Southern Copper (SCCO), 89% owned by the Mexican conglomerate Grupo Mexico (GMBXF).

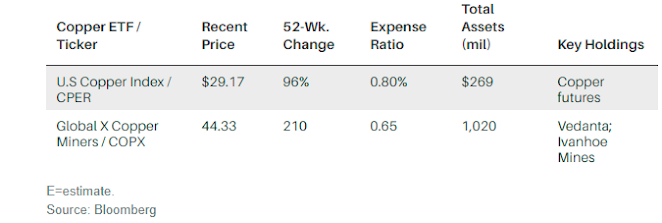

The Global X Copper Miners exchange-traded fund (COPX) holds mining stocks, while the U.S. Copper Index fund (CPER) offers a direct play on the metal through ownership of futures contracts.

The main risk to copper is unexpected weakness in the global economy.

China is critical; it accounts for about half of worldwide demand.

However, a pullback seems unlikely, given that green power-related demand, just 3% of copper usage in 2020, could hit 16% by 2030, the Goldman analysts estimate.

An electric vehicle contains as much as 180 pounds of the red metal, four times the amount in an internal- combustion-engine vehicle.

Onshore wind turbines use about four times as much copper as power plants fired by fossil fuels per megawatt of electricity.

Offshore wind farms are even more copper-intensive; they need thick copper cables to transmit power onshore.

In commodity markets, higher prices normally elicit greater production, but copper might have to hit $6 a pound to convince miners to add new capacity, argues Jefferies analyst Chris LaFemina.

“The supply constraints in copper are the worst they have ever been. Combine that with recovering demand, and you have a recipe for higher prices,” he says.

Copper mines annually produce about 21 million metric tons—about 45 billion pounds.

Freeport noted last month that only 2 million metric tons of new annual supply are being developed.

Miners are cautious after being burned when copper collapsed from a peak $4.70 a pound a decade ago.

There are a limited number of good mining locations left worldwide, and lead times for new projects can stretch from six to eight years, due to permitting and environment reviews.

All this benefits copper-rich companies like Freeport, which has 30-plus years of reserves.

At a recent $44, its stock was quoted at 16 times projected 2021 earnings of $2.71 a share and 14 times estimated 2022 profits of $3.08.

“Freeport has world-class assets and it’s a good operator,” says LaFemina, who has a Buy rating on the stock, with a price target of $55 and an above-consensus 2022 earnings forecast exceeding $4 a share.

Freeport is expected to produce almost four billion pounds of copper this year.

It owns mines in Arizona, has interests in two in South America, and owns 49% of Indonesia’s massive Grasberg copper and gold mine.

Canada-based First Quantum has three main mines, two in Zambia and one in Panama.

It produces about half as much copper annually as Freeport does and is more leveraged, with net debt of $7 billion.

At a recent $28, its U.S. stock was fetching 23 times projected 2021 earnings of $1.23 a share and 14 times 2022’s estimated $2.01.

LaFemina rates the stock a Buy, with a $38 price target and a 2022 EPS estimate above $3.00.

First Quantum’s earnings should rise in 2022 when below-market copper hedges roll off.

With mining operations in Mexico and Peru, Southern Copper has the industry’s largest reserves and some of its lowest production costs.

Its stock, at around $77, trades for 20 times projected 2021 net of $3.79 a share.

It aims to double production in 2028 from a projected 2021 output of about two billion pounds.

John Tumazos of John Tumazos Very Independent Research, favors Grupo Mexico as a play on Southern Copper.

Controlled by billionaire German Larrea Mota-Velasco, Grupo Mexico owns 89% of Southern Copper and 70% of Grupo Mexico Transportes, which owns a top Mexican railroad.

“Through Grupo Mexico, you’re able to buy Southern Copper at a big discount and get the railroad for free,” Tumazos says.

With copper potentially in a long bull market, there still is time for investors to get aboard.

0 comments:

Publicar un comentario