The coronavirus concern in equity markets has been sharpened by a realization that the Fed can’t save our portfolios

By Justin Lahart

For quite some time, many investors operated under the assumption that Fed policy was sure to keep pushing stocks higher. / Photo: Mark Lennihan/Associated Press .

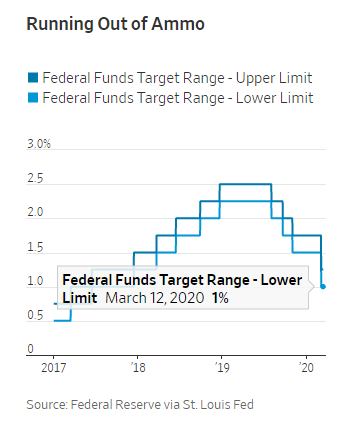

In the widespread disruption sown by the novel coronavirus epidemic, investors find themselves facing an economic problem the Fed can’t solve for them. Because rates were already so low, the central bank’s ability to help bolster the economy using conventional tools is severely limited.

After next week’s meeting, when the Fed is likely to cut rates deeply, it will have even less or, if it cuts its target range on overnight rates by a full percentage point, none at all.

.

Up until last month, many investors were operating under the assumption that the Fed’s easy-money policy was destined to keep pushing stocks higher.

They had, after all, just come through a year in which Fed policy-makers reversed their rate-hike plans and then, worried about what trade disputes and slowing global growth might do to the U.S. economy, lowered their target range on rates three times.

It was back to the Fed put, in other words—the notion that, like a put option on a stock, the Fed effectively was insuring investors against market downturns. To some, it seemed the Fed was actively boosting stocks.

Even as the trade and global slowdown worries faded, and even though the unemployment rate was at its lowest level in more than 50 years, the central bank showed no inclination to take last year’s rate cuts back.

In fact, the central bank was in the midst of rethinking its approach to inflation. It seemed to be moving toward a policy of not raising rates until inflation stayed over its 2% target for a while.

Nor would the Fed lean against stocks even if valuations kept pushing higher, since the politics of doing that would be so fraught—especially with all the criticism the central bank had already been getting from President Trump.

It was part of why stocks rallied by so much starting in the latter part of last year, pushing valuations sharply higher. That placed equities at a much higher starting point as investors began to understand the seriousness of the coronavirus pandemic.

Worse, as stocks tumbled investors realized that the net they thought Fed policymakers were holding out for the market as it performed its high-wire act wasn’t there at all.

It is yet another reason why so many are assuming the brace position at the same time.

0 comments:

Publicar un comentario