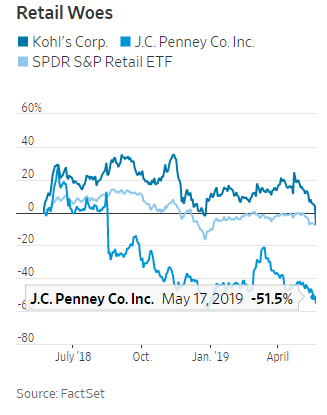

Kohl’s and J.C. Penney reported disappointing quarterly results, setting off a tumble in the sector

By Elizabeth Winkler

A shopper prepares to pay for items at a Kohl's department store in Peru, Ill. Photo: Daniel Acker/Bloomberg News

Retailers got a so-so start to earnings season last week when Macy’sreported earnings that narrowly beat expectations. The tone got much worse on Tuesday. Kohl’s KSS -9.31%▲ and J.C. Penney JCP -6.09%▲ both reported earnings that disappointed investors, triggering a drop in their shares and a broader selloff in department store stocks.

Kohl’s reported adjusted earnings of 61 cents a share, compared with analyst expectations for 68 cents a share. Sales at stores open for at least 12 months fell 3.4%—far steeper than the 0.2% drop analysts were expecting. The company has sought to build up its brands, particularly in athletic wear, but as shoppers continue to turn to Amazon.com ,or go directly to brands themselves, that hasn’t been sufficient to get shoppers in stores and merchandise off the shelves.

Meanwhile, J.C. Penney has been struggling quarter after quarter to turn its situation around, shutting stores and cutting costs to improve profitability. There was some hope that it might benefit from the fall of Sears, but J.C. Penney’s sales continue to fall. On Tuesday, the company reported an adjusted loss of 46 cents a share, compared with expectations for a loss of 38 cents a share. Same-store sales fell 5.5%—worse than the 4.2% decline analysts expected.

J.C. Penney attributed the steep drop to the company’s decision to stop selling appliances and limit furniture to e-commerce only. That J.C. Penney appears to be going the way of Sears, rather than benefiting from its downfall, isn’t so surprising. It has failed to invest in e-commerce and store updates. Stuck in old and out-of-the-way malls, it is struggling to bring back foot traffic.

Shares of both retailers were down around 10% in recent trading. Kohl’s slashed its outlook for the fiscal year ending in February 2020, saying it now expects earnings to fall within a range of $5.15 to $5.45 a share. Analysts had been expecting earnings of $6.04 a share, according to FactSet.

The results draw a contrast not only with Macy’s but also Walmart ,which saw its same-store sales grow 3.4% in the first quarter as it continues to grab market share, thanks partly to its ambitious investments in e-commerce.

No doubt Kohl’s and J.C. Penney’s dim start to the year sets a negative tone for other retailers reporting this week, including Nordstrom and Target .Those with superior e-commerce capabilities are faring better, but all retailers have the threat of tariffs hanging over them, too. Investors have been put on notice.

0 comments:

Publicar un comentario