by: QuandaryFX

Summary

- Short-term fundamentals suggest that we may be entering a period of bearishness, but I believe we have a few more months before that is felt.

- The economy is a huge driver of demand for petroleum products and crude pricing, and we are likely to see a recession within a year.

- The technical trend is still in force, but investors need to respect stops and have exit plans for getting out of trades.

- The economy is a huge driver of demand for petroleum products and crude pricing, and we are likely to see a recession within a year.

- The technical trend is still in force, but investors need to respect stops and have exit plans for getting out of trades.

This week, the EIA reported a few potentially bearish short-term fundamental metrics for the oil markets (USO). Despite the immediate short-term fundamentals, crude prices have turned higher and appear to be turning a profit for long traders for the week. In this article, I will take a step back and examine the current fundamental developments of crude oil as well as economic indicators which will likely call the top of the market for oil within the year.

Short-Term Fundamentals

Short-Term Fundamentals

This week's Petroleum Status Report contained a few data points which all investors in oil should take note of due to the fact that they could potentially be indicating that the underlying supply and demand situation is changing. Over the past year, we have seen the supply and demand situation in crude oil oscillate between lagging supply and unseasonal strength in supply.

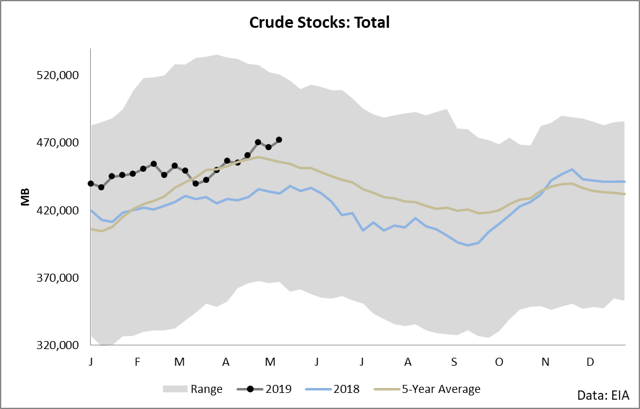

From January through late April, inventories bucked the seasonal trend of strong builds as crude imports substantially lagged the amount needed to balance the market. This set the case for fundamental bullishness as inventories closed the distance to the 5-year moving average.

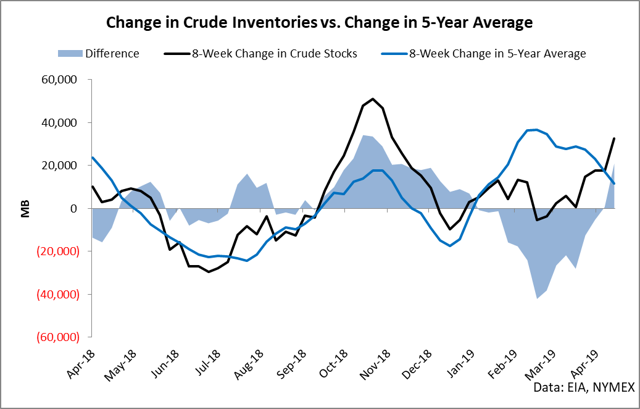

However, over the last month, we have seen a potentially worrying signal for the bull thesis in that inventories have risen at a time of the year when they typically flatten out and fall. Seen graphically, here is this relationship as expressed by the difference between the 2-month change in inventories and the 5-year average.

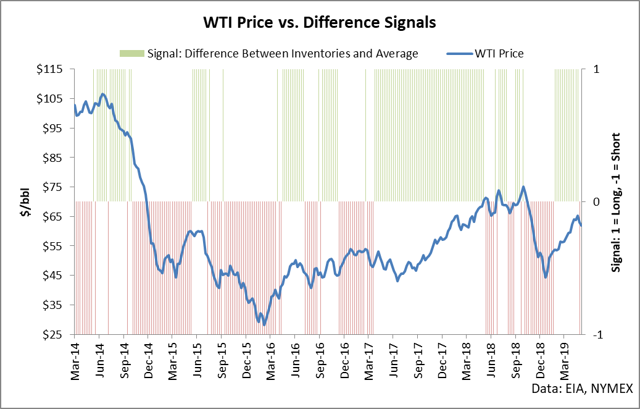

The basic idea behind this indicator is that it shows when the market is seasonally strong or seasonally weak. From January through late April, the market was drawing stocks versus the average and flat price rallied during this time period. However, over the last two weeks, we have seen a switch in which inventories are gaining against the average. The following chart shows the predictive nature of this relationship as it relates to WTI futures.

The metric is imperfect (as are all such tools) but it does a fairly good job of capturing substantial and sustained trends. For example, crude inventories began drawing in relation to the 5-year average in March of 2017 (green shaded area) and sustained this relationship through June of 2018 and flat price rallied by several dollars per barrel. Likewise, inventories began gaining versus the 5-year average (red shaded area) in late 2018 and flat price fell through most of the time this relationship was in force.

The reason I point out these historic calls is this: this short-term fundamental indicator has just switched into "bearish" mode over the last two weeks as we have seen unseasonal builds in crude stocks. For example, the latest inventory reading of a 5.4 million barrel build in stocks comes at a time when inventories typically are falling. This is potentially troubling if this relationship continues and gives a warning sign that something is not as it should be.

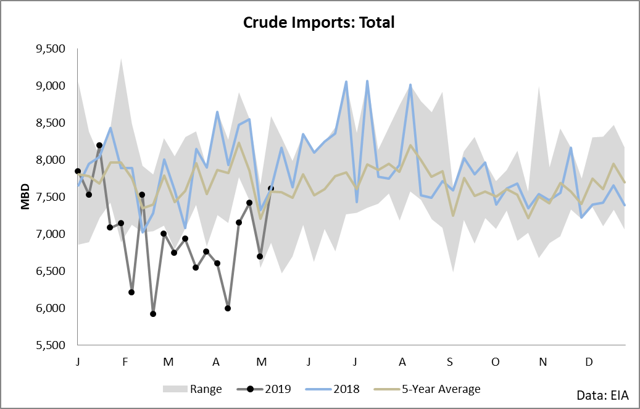

The basic catalyst which has been causing the unseasonal behavior in crude oil this year has been a decrease in imports.

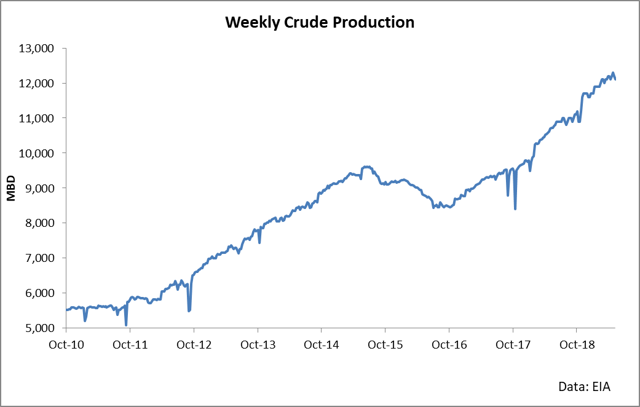

Imports have been historically low for most of this year, but over the last few weeks, we have seen them return to the 5-year range. Since supply has continued to grow…

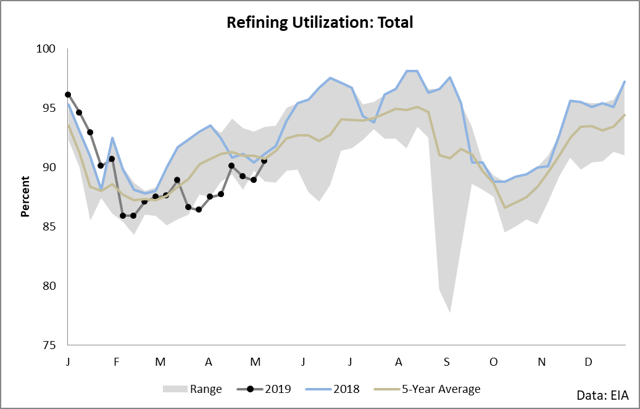

…and refining utilization has remained weak…

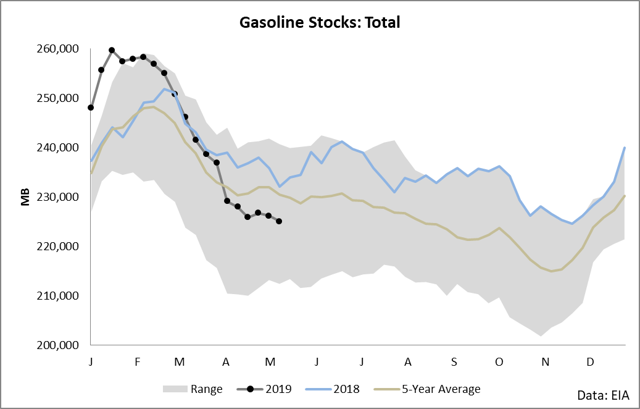

…the lower level of imports has been a life-saver for the bulls in the market. However, since it appears the current import situation has been resolved, all eyes are on refining runs to see if they will be able to soak up the extra demand. My opinion is that we will see a healthy refining yield in the immediate future due to the fact that we are entering driving season with low gasoline stocks, and for that reason, I am bullish the flat price of crude oil.

However, there is a larger issue which may cause the bullish case to end in the coming months: the economy.

As I wrote in a piece yesterday, I believe that we will see a recession within the next year due to a few key fundamental indicators. When it comes to the oil markets, the relationship is incredibly straightforward. Most of what refiners make is used in travel in the form of gasoline, distillate, and jet. When the economy contracts, fewer people are on the road to work, fewer people go on business trips, fewer families go on road trips or distant vacations. This overall means that when recessions hit, oil demand collapses.

If we see a recession hit within the next year, we will see a collapse in the price of oil in all likelihood. The reason is simply because the price of oil represents the balance between supply and demand and supply is basically on a constant march upwards through at least 2023 (according to the EIA's projections). If we see the supply side of the equation collapse, we will see inventories build against norms, the market switch into contango to incentivize storage, and prices fall until the supply side comes back into line.

The immediate trend remains up, however.

As I have mentioned in earlier articles this week, we are in a pullback which is finding a confluence of support which indicates that at least for the next few weeks, we are likely to see continued price upside. This situation leaves me both technically and fundamentally bullish in the short run (0-4 months). However, with an economic slowdown approaching, I believe that bullishness needs to be guarded and stops need to be tight.

0 comments:

Publicar un comentario