A Presidential Intervention In The Dollar?

by: The Heisenberg

- Over the past two weeks, speculation has grown that the Trump administration could attempt to actually intervene in the currency market to drive the dollar lower.

- As it stands, the U.S. is running a series of policies that are all dollar positive and are self-reinforcing.

- Unless the Fed takes a pause, the only other option appears to be an intervention by the Treasury.

- Here's why that (probably) won't work.

- As it stands, the U.S. is running a series of policies that are all dollar positive and are self-reinforcing.

- Unless the Fed takes a pause, the only other option appears to be an intervention by the Treasury.

- Here's why that (probably) won't work.

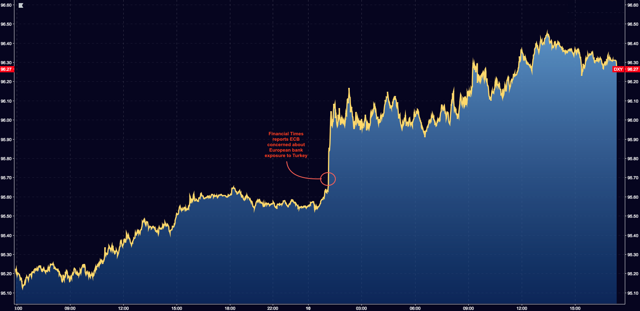

Just after midnight on Friday, the Financial Times reported that the ECB is concerned about some European banks' exposure to Turkey amid the ongoing collapse in the lira.

(Heisenberg)

The greenback would go on to build on those gains throughout the session and is now sitting at a 13-week high.

(Heisenberg)

If you're bullish on the dollar right now, you're not alone. I've spent quite a bit of time both here and elsewhere documenting the extent to which the Trump administration has found itself caught in a self-feeding loop that's pushing the greenback higher. Late-cycle fiscal stimulus is helping to prolong what is already the second longest expansion in U.S. history, and although the Citi Economic Surprise index is trending lower, the data is still solid and continues to support a U.S.-centric growth narrative, in stark contrast to the "synchronous global growth" story that defined 2017. That's dollar positive.

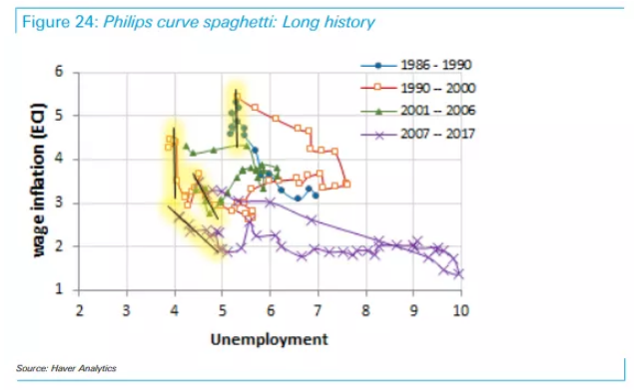

At the same time, piling fiscal stimulus atop an economy operating at or near full employment risks overheating the economy and history shows that late-stage expansions are vulnerable to sudden steepening episodes in the Phillips curve (yellow highlights in the chart below).

(Deutsche Bank)

The Fed is cognizant of the above, and with the data coming in strong and fiscal stimulus raising the specter of an inflation overshoot, the FOMC has every reason to stick to its guns on gradual rate hikes. That relative hawkishness pushes up the dollar, and as the policy divergence with America's trade partners widens, the Trump administration's tariffs become commensurately less effective.

The President is acutely aware of this, which is why he expressed his disdain for current Fed policy on CNBC last month, and why he took to Twitter the very next day to suggest that Fed hikes are serving to offset both his domestic economy policies and his tariffs.

So far, the administration's "solution" when it comes to the strong dollar helping China and America's other trade partners weather the tariff storm has been to simply ratchet up the protectionist measures.

But there's a problem with that; namely that protectionism is inflationary in the short-term (i.e., until it leads to demand destruction, at which point it becomes disinflationary, which is when the real trouble starts).

The first round of 301 investigation-related tariffs on $50 billion in Chinese goods was broken up into two tranches, with duties on $34 billion in items taking effect on July 6 and levies on the remaining $16 billion in goods due to begin on August 23. Generally speaking, those tariffs will not have a demonstrable effect on the price of consumer goods in America. But the administration is now threatening to up the ante with tariffs on an additional $200 billion in Chinese imports. That will have an impact on inflation because past a certain point, you can't avoid a rise in consumer prices if you intend to slap tariffs on everything you import from a large trade partner. Here's SocGen's Omair Sharif from a note dated last month:

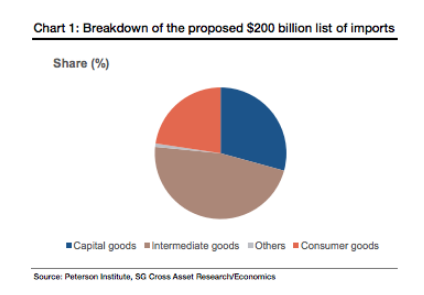

Unlike a similar $50 billion list unveiled in April, which was composed largely of industrial supplies and components, the proposed $200 billion tally includes a slew of finished consumer items. According to the Peterson Institute, consumer goods account for about $44 billion, or nearly 23%, of the proposed list.

However, China has already offset the effects of both the initial round of 301-related tariffs (on $50 billion in goods) and the effect of the proposed 10% duties on an additional $200 billion in imports. Multiple banks have done the math on this and their conclusion is the same pretty much across the board: the yuan's depreciation over the last three months has completely negated the effect of those 301-related tariffs. As Deutsche Bank wrote a month ago, "perhaps this is why the US President's Twitter feed has turned back to talking down the dollar."

If the President intended to talk down the dollar with his CNBC interview and subsequent tweets, he was not successful. So, in an effort to turn the screws on China now that the PBoC has seemingly reached the limit on how much currency devaluation it's prepared to stomach (the reinstatement of a forwards rule two Fridays ago tipped that 6.90 was where Beijing wanted to cut it off), the Trump administration began pondering the possibility of more than doubling the rate in the next round of tariffs (i.e., the next step would be to slap duties on an additional $200 billion in Chinese goods and the rate would be 25% as opposed to the previously suggested 10%).

Do you see the problem with that? If a 10% tariff on $200 billion in additional Chinese goods was already set to push up consumer prices, well then a 25% tariff on those same goods will only supercharge that effect. The above-mentioned Omair Sharif projects that a 25% tariff on the whole list would lead to a 1.1% jump in core inflation in the U.S. to 3.4%.

Needless to say, that would prompt the Fed to hike rates aggressively and what do aggressive rate hikes entail? That's right, more dollar strength and therefore more of an offset for America's trade partners when it comes to the tariffs.

On Friday, the latest read on inflation in the U.S. showed the core index rising at the fastest YoY pace since 2008. If that continues, it means that Sharif's estimate of where inflation will be in the event the 25% tariff is applied to the entire $200 billion worth of goods will turn out to be conservative.

This is, in short, a self-defeating dynamic and there's no way out of it. Consider these excerpts from a great BofAML note out on Friday:

[It's] an oversimplification to ignore how exchange rates respond to policy changes.

The US is running a trifecta of dollar-positive macro policies.

- Easy fiscal policy pushes up the dollar by boosting interest rates and stimulating imports. The new tax laws also create incentives to repatriate cash to the US and if these monies are not already in dollar assets, this could strength the dollar as well.

- Fed tightening also pushes up interest rates, boosting the dollar.

- And actual and threatened US tariffs strengthen the dollar as well. Tariffs tend to weaken imports, reducing US demand for foreign currency, and threatened tariffs add to global uncertainty, pushing up safe-haven currencies like the dollar.

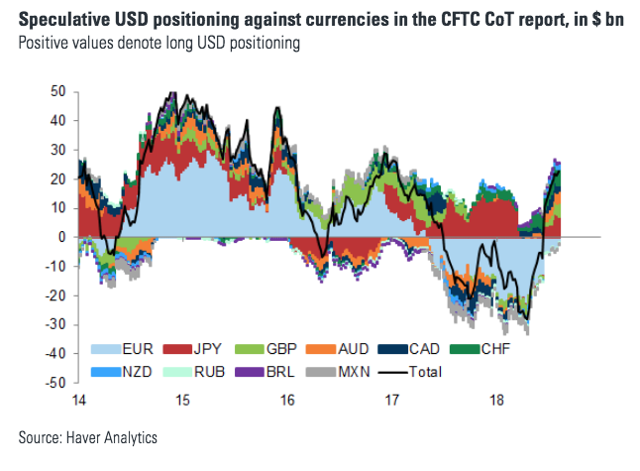

In the week through Tuesday, speculative length in the dollar rose for a seventh week in eight, with the net overall long position now sitting at nearly $23 billion, the highest since January 20, 2017:

(Goldman)

I said above that there's "no way out" of this loop for the Trump administration if what it's aiming at is a weaker dollar. That's not entirely true. There was one way out: a Fed pause. Note that I used the past tense there. The problem with the President's public comments on the dollar is that they expose the Powell Fed to criticism from lawmakers in the event the FOMC did take a pause on hiking rates. There is no domestic economic rationale for not continuing apace with gradual rate hikes, and until there's an emerging market unwind large enough to give Powell some plausible deniability, any deviation from the current path of monetary policy would be criticized (rightly or wrongly) by some as a political move. That's especially true given how adamant Powell has been about painting an upbeat picture of the U.S. economy.

Given that, the only other option for the White House when it comes to pushing the dollar lower and thereby avoiding a scenario wherein America's trade partners are continually benefiting from the stronger greenback is outright intervention.

Recently, a reader on this platform asked why the U.S. couldn't intervene in the currency market to try and offset yuan weakness and I said that wasn't feasible, at least not in the way the commenter was suggesting. I tried to find that comment before I wrote this article, but I gave up after about 30 minutes. Trust me, it exists and hopefully that person will chime in in the comments here and point me back to it.

Ok, so first of all, outright FX interventions by the U.S. are rare, but this week, JPMorgan's Michael Feroli released a note that got quite a bit of attention, primarily for this line:

We cannot rule out a turn toward a more interventionist currency policy.

Feroli went on to detail how an intervention would work, and suffice to say it wouldn't - work that is.

The Treasury only has about $95 billion in firepower in the Exchange Stabilization Fund. That would effectively double with Fed matching (that's assuming the Fed agreed to participate and it likely would because if Powell resisted, the White House would be livid). But here's Bloomberg's Ye Xie explaining the futility of this exercise (this is from a short blog post out several days ago):

It would require a mind boggling amount of dollar sales to have a material influence. The daily turnover in dollar transactions amounted to $4.4 trillion in 2016, more than 20% of the U.S. annual GDP.

Besides that, this usually doesn't work anyway. As JPMorgan's Feroli writes, "in a country with an open capital account and independent monetary policy, like the US, currency interventions are well-known to be ineffective in generating lasting changes in the currency's value."

Getting back to the reader question mentioned above about how the U.S. might go about intervening to weaken the bilateral rate with China, my reply (and I'm paraphrasing here) was that the mechanics simply wouldn't allow it. Here's how Feroli explains this:

Another potential problem is that China maintains capital controls such that any potential intervention by the US would need to be undertaken in the offshore CNH market. While pressures in the CNH market have often been transmitted into the onshore CNY market (via institutions, including corporates, who have access to both markets and can arbitrage any difference in prices), the PBOC, through regulatory and other means, can sustain a wedge between the two markets if it so desires. Of course, such actions come at a cost, including raising questions about China's declared aim to internationalize the use of its currency and continued inclusion in the IMF's SDR basket, but there is nothing intrinsic in the structures of the offshore and onshore yuan markets that guarantee price equalization. Consequently, interventions in the CNH market can have little or no impact on CNY depending on the countermeasures the Chinese monetary authorities undertake.

In other words (and a lot of readers won't like this, but it's just the reality), China can simply decide to not let that kind of intervention work no matter how hard the U.S. tries. The optics would obviously be terrible when it comes to Beijing's ongoing effort to internationalize the RMB and promote it as a global funding currency. Then again, in that scenario, China could simply point to an actual, overt effort on the part of the U.S. to manipulate exchange rates (that's what "intervention" means), and given how contentious U.S. trade policy has become, it's not at all clear that anyone would blame them.

Coming full circle, if you're bullish on the dollar here, you're not alone and if you read everything above correctly, betting on more greenback strength in the near-term seems like a no-brainer.

But as my buddy Kevin Muir from East West Investment Management is fond of saying, it's always the trades that everyone thinks are foolproof that end up making fools of people.

0 comments:

Publicar un comentario