Ok, Who's Confused?

by: The Heisenberg

- Dissensus seems to be the order of the day again for markets, but now, it seems to be accompanied by a perceptibly bearish bias.

- For my first trick this weekend, I want to take you through curve dynamics in light of the recent shift back to a flattening regime.

- And secondarily, I'll walk you through the buyback "plunge protection" bid.

Along the way, you'll hear from two of the best analysts on the Street.

- For my first trick this weekend, I want to take you through curve dynamics in light of the recent shift back to a flattening regime.

- And secondarily, I'll walk you through the buyback "plunge protection" bid.

Along the way, you'll hear from two of the best analysts on the Street.

So it's Saturday morning as I write this and there's obviously a ton to talk about when it comes to takeaways from the week that was in markets.

Increasingly, documenting the manic news cycle in real-time over on my site is making it difficult to pen quick takes for this platform during the week, but as I mentioned earlier this month, when I sit down to do my weekend posts for my readers here, I never assume that everyone reads Heisenberg across platforms, so to anyone who does, some of this will be a recap. But as usual, I never recycle posts. So even if you know the story, everything you read from me on this platform is freshly written and therefore this weekend's posts should be enjoyable for all of my readership whether you read Heisenberg here, there and everywhere or not.

Again, there's a ton to get to, so I'm going to deploy a strategy I used early last month and try and break it up into several concise posts, this being the first.

There's a sense in which this week felt a bit like a return to a dissensus-driven regime for markets.

That is, a regime characterized by a lack of ability to form consensus about anything, whether on the policy front, from a geopolitical perspective, and/or what the incoming data and price action seem to be conveying about the economy and the near-term trajectory for markets.

Previously, dissensus led to vol. selling, because as Deutsche Bank's Aleksandar Kocic famously put it last summer (and I'm paraphrasing here) when there is no consensus, indecision becomes to order of the day. And what does one do when one cannot make a decision? Well, one waits.

And what is a vol. seller? A vol. seller is a seller of that “waiting time”.

In the wake of the short vol. blowup that unfolded in early February, the predisposition to sell vol. seems to have faded a bit. As one strategist I spoke to on Friday put it:

This has to do with the unwind of the QE trade (everything used to rally, so we are going into an environment where everything wants to selloff). Asset managers, pension funds in particular, have already scaled down on their equity positions - they have bought into this narrative 'sell the rally'.

When it comes to the unwinding of QE, you should note that the whole "flow" versus "stock" argument (i.e. whether it's the ongoing monthly central bank bid for assets that matters or the overall size of the Big 3 banks' balance sheets that's important) is set to become less relevant precisely because both the flow and the stock are in decline. Here's what BofAML wrote on Wednesday:

The flow of global QE peaked a few quarters ago. Now we have likely reached another milestone: per our estimates, the aggregate balance sheet of the G4 central banks peaked this quarter.

Investors have been divided about whether the stock of QE matters more than the flow. Going forward there should be more of a consensus that the aggregate balance sheet effect is one of “tightening” rather than “easing” because the stock is declining and the flow is not just falling, it is negative.

So there's that and what it amounts to is the monetary policy tailwind morphing into a potential technical headwind, which is to be expected. Remember, one of the reasons monetary policy had to remain accommodative over the past several years is because fiscal policy was hamstrung. So when you see people like Jerome Powell and Lael Brainard talking about "headwinds becoming tailwinds" on the economic and fiscal policy front, the flip side of that same coin is that monetary policy will, to the extent possible, do the opposite - morph into a headwind from a tailwind precisely because rate hikes and tapering are the way in which central banks replenish their counter-cyclical ammo in preparation for the next downturn.

What you come away with in an environment characterized by rampant political and policy uncertainty, a slow unwind of accommodation and conflicting data (last month the inflation scare dominated the headlines only to give way to a Goldilocks jobs report and a similarly benign CPI number which itself gave way to a lackluster retail sales print only to give way to ebullient consumer sentiment, and on and on), is a kind of holding pattern with a bearish bias.

Here's what that looked like this week:

(Heisenberg)

One thing that's particularly important to note about the incoming data is that while the headline payrolls print from the February jobs report certainly seemed to underscore the idea that the U.S. economy is still humming along, the retail sales data this week prompted multiple downward revisions to GDP tracking estimates (including from the Atlanta Fed). And while the CPI print and the AHE number that accompanied the jobs report put to rest (for the time being anyway) the notion that inflation was set to accelerate rapidly, it's abundantly clear that price pressures are building, and when taken together there are concerns that while "Goldilocks" is still viable as a framework, she's on her last legs.

The worry here is that the Fed is going to make a policy mistake by trying to squeeze one "too many" hikes in. Recent comments from Powell and Brainard and others clearly suggest that Fed hike risk is to the upside, and whereas last month equities were jittery amid aggressive bear steepening of the curve, this week equities were shaky amid aggressive flattening. I flagged this over at Heisenberg Report on Wednesday afternoon, writing the following:

It’s starting to seem like stocks are worried more about a recession than they are runaway inflation – the curve is starting to flatten pretty aggressively.

Bloomberg’s Ye Xie said the same thing, noting that “in early February, the stock correction was accompanied by a steepening yield curve, as the surprisingly strong wage growth caused a simultaneous selloff in Treasuries and equities [but] now, stocks are falling as the yield curve flattens.”

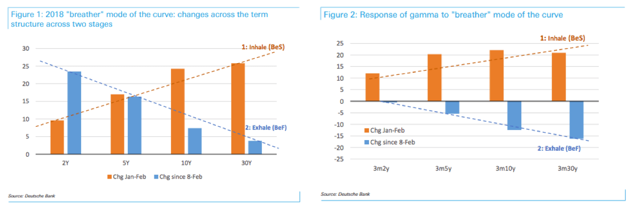

Fast forward to Thursday and the above-mentioned Aleksandar Kocic was out with a new note called "Waiting To Inhale". Here's an excerpt:

It started with bear steepening (BeS) from mid-Jan to 8-Feb, followed by bear flattening (BeF) after that. The reaction of vol reflects this mode of the curve: a bid for long tenors as the market inhales followed by partial retraction, its mirror image.

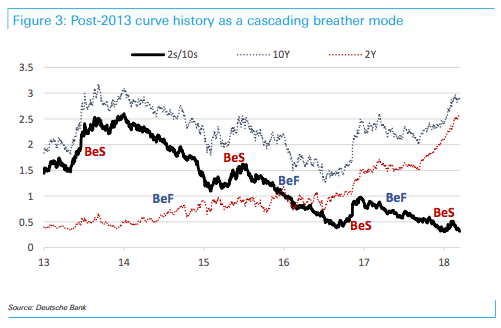

That pattern has been going on for years as illustrated in the following additional chart from Kocic (note: this is the swaps curve):

(Deutsche Bank)

While bear steepening episodes are prone to catalyzing cross-asset vol. spikes like we saw in February, and while those same episodes are thus conducive to a quick and painful unwind of multiple crowded trades, it's entirely possible that the more likely risk is the Fed inadvertently overtightening and inverting the curve. You can read more about that here, but suffice to say an inversion brings with it undesirable consequences for the economy and for risk assets.

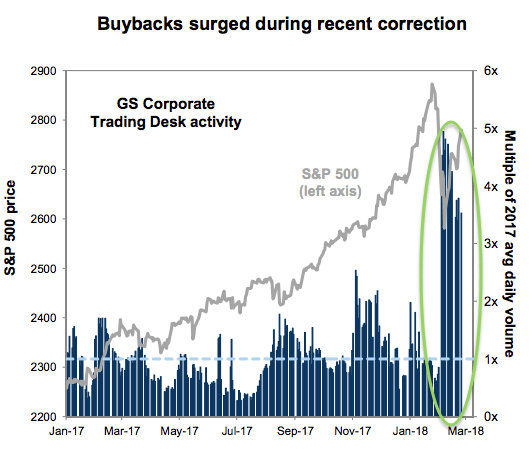

So what's the good news? Well, the good news is that there is indeed a "plunge protection team" that has your back if you're in equities and when I say "plunge protection team", I'm not talking about any conspiracy theories that involve Janet Yellen coming out of retirement to run a shadowy futures trading operation from her living room. Rather, I'm talking about buybacks. Have a look at this:

(Goldman)

As you can see, that's a chart of activity at Goldman's buyback desk and volume during the February pullback was multiples of the average 2017 daily volume suggesting companies were voraciously buying the dip.

On Goldman's estimates, buybacks are set to surge 23% in 2018 to $650 billion and that's hardly the highest Street estimate. According to JPMorgan, buybacks will total more than $800 billion, and with that in mind, consider this excerpt from the latest note from JPM's Marko Kolanovic (that would be the Marko Kolanovic, who's affectionately known as "Gandalf" on the Street):

This year, we expect $800bn of buybacks vs. ~$600bn in 2015. The difference ($200bn) on its own, equates to all the value of all recent systematic strategies’ selling. And while systematic strategies will buy back most of what they sold, buybacks will not reverse. This is all supportive of the market reaching new highs relatively soon (e.g., with the onset of Q1 earnings season), and is consistent with our previous fundamental and quantitative research.

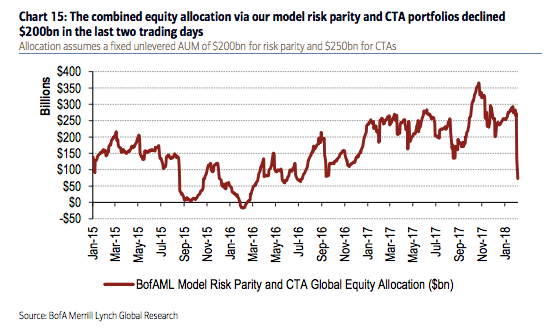

What he's doing there is comparing the market turmoil that accompanied the August 2015 Chinese yuan devaluation to the February pullback that was catalyzed and exacerbated by some $200 billion in de-risking from systematic strategies like CTAs and risk parity. Here's that $200 billion figure visualized:

(BofAML)

Kolanovic's point is that the difference between the corporate bid in 2015 and what JPMorgan anticipates for buybacks in 2018 (i.e. ~$800 billion this year minus $600 billion in 2015 equals $200 billion) is itself enough to offset the entirety of the systematic deleveraging we witnessed last month.

If you needed a bullish technical, you'd be hard pressed to find a more powerful one than that.

Coming full circle, I should state the obvious which is as follows. The political turmoil in Washington has reached a fever pitch. The staff shakeups and the extremely contentious decision to fire Andrew McCabe two days before his retirement add to what was already an exceptionally fraught backdrop on the domestic political front. At a certain point, markets may simply become exhausted with that situation and assume the worst. Or perhaps the "noisy status quo" will return. On that note, I'll leave with you with a throwback quote from the above-mentioned Kocic because it seems more relevant this weekend than ever:

But shocks, if they are predictable, lose their spell and gradually become facts of life. Predictable political shocks feed back into their source. Due to their antagonistic character, they gradually erode the ability to make consensus. We are stuck with the status quo, albeit a noisy one.

0 comments:

Publicar un comentario