ECB´S BALANCE SHEET CONTAINS MASSIVE RISKS / DER SPIEGEL ( A MUST READ )

05/24/2011 12:46 PM

The Hidden Cost of Saving the Euro

ECB's Balance Sheet Contains Massive Risks

By Matthias Brendel and Christoph Pauly

While Europe is preoccupied with a possible restructuring of Greece's debt, huge risks lurk elsewhere -- in the balance sheet of the European Central Bank. The guardian of the single currency has taken on billions of euros worth of risky securities as collateral for loans to shore up the banks of struggling nations.

.

On the green fields near Carriglas, halfway between Dublin and Ireland's west coast, the wind whistles eerily around rows of half-finished houses. Most of these buildings are roofless, leaving their bare walls unprotected against the elements. Even the real estate brokers' for-sale signs and the project offices are gone. Hardly anyone in Carriglas believes that the houses will ever be finished.

.

There are many of these ghost towns in Ireland, including 77 in small County Longford alone, which includes Carriglas. They could end up costing German taxpayers a lot of money, as part of the bill to be paid to rescue the euro.

That bill contains many unknowns, but almost none of them is as nebulous as the giant risk lurking in the balance sheet of the European Central Bank (ECB), in Frankfurt. Many bad loans have now ended up on that balance sheet, including ones that were used to build houses like those in Carriglas and elsewhere. No one knows how much they are worth today -- and apparently no one really wants to know.

Since the beginning of the financial crisis, banks in countries like Ireland, Portugal, Spain and Greece have unloaded risks amounting to several hundred billion euros with central banks. The central banks have distributed large sums to their countries' financial institutions to prevent them from collapsing. They have accepted securities as collateral, many of which are -- to put it mildly -- not particularly valuable.

.

Risks Transferred to ECB

.

These risks are now on the ECB's books because the central banks of the euro countries are not autonomous but, rather, part of the ECB system. When banks in Ireland go bankrupt and their securities aren't worth enough, the euro countries must collectively account for the loss. Germany's central bank, the Bundesbank, provides 27 percent of the ECB's capital, which means that it would have to pay for more than a quarter of all losses.

For 2010 and the two ensuing years, the Bundesbank has already decided to establish reserves for a total of €4.9 billion ($7 billion) to cover possible risks. The failure of a country like Greece, which would almost inevitably lead to the bankruptcy of a few Greek banks, would increase the bill dramatically, because the ECB is believed to have purchased Greek government bonds for €47 billion. Besides, by the end of April, the ECB had spent about €90 billion on refinancing Greek banks.

Former Bundesbank President Axel Weber criticized the ECB's program of purchasing government bonds issued by ailing euro member states. In the event of a bankruptcy or even a deferred payment, the ECB would be directly affected.

But even greater risks lurk in the accounts of commercial banks. The ECB accepted so-called asset-backed securities (ABS) as collateral. At the beginning of the year, these securities amounted to €480 billion. It was precisely such asset-backed securities that once triggered the real estate crisis in the United States. Now they are weighing on the mood and the balance sheet at the ECB.

No expert can say how the ECB can jettison these securities without dealing a fatal blow to the European banking system. The ECB is in a no-win situation now that it has become an enormous bad bank or, in other words, a dumping ground for bad loans, including ones from Ireland.

.

Ireland Not Yet Rescued Yet, Despite Bailout

.

The Emerald Isle experienced an unprecedented boom that ended in 2007, followed by an equally severe crash. Irresponsible real estate sharks, unscrupulous bankers and populist politicians had ruined the country's finances. It was forced to spend €70 billion to support its banks, even as the government itself was all but bankrupt. In November 2010, the Europeans came to the rescue of the Irish with €85 billion from their joint bailout fund. But Ireland is still far from being rescued.

Bank branches line the main street in the small town of Longford. Loans are no longer available here, says an employee with the EBS Building Society, noting that nowadays the bank only accepts savings deposits. A blue information brochure on the table explains what borrowers can do if they encounter financial difficulties. "Please do not ignore the problem," the brochure implores.

But more and more Irish are indeed ignoring the problem and have simply stopped making payments on their loans. Like other banks in Ireland, EBS -- which issued more than a fifth of all Irish mortgages -- had to be rescued by the Irish government.

The fact that EBS, a relatively small bank specializing in home loans, was able to issue so many mortgages is the result of a practice that was commonplace before the crisis and ultimately almost led to the collapse of the financial system.

Mortgage loans were bundled into packages worth billions, allowing the associated risks to be transferred to the international capital markets. They disappeared from the banks' books, allowing lenders like EBS to provide funding for even more real estate in the island nation. By 2007, German insurance companies and savings banks, in particular, were buying up Irish residential mortgage-backed securities.

However, in 2008, the international investors became increasingly nervous. The asset-backed securities at EBS -- known as Emerald 1, 2 and 3 -- suddenly slid into negative territory.

.

An Irish Time Bomb

.

But the Irish seemingly had a solution. "We wanted to preserve our good relations with our old business partners," says one of the loan experts. In the spring of 2008, investors bought back Emerald 1, 2 and 3, and EBS took back the mortgage loans temporarily. The investors could hardly believe their good fortune. Then EBS packaged the loans from the asset-backed securities with other mortgage loans, creating Emerald 5, an Irish time bomb containing about €2 billion in loans.

But, by 2008, international investors were no longer interested in this type of security. Asset-backed securities were already seen as toxic, and the market had collapsed. But EBS knew that the ECB had pledged to accept such securities as collateral for fresh cash.

"We didn't have enough bonds to submit to the ECB, so we built Emerald 5," says the EBS employee. Many others did the same.

According to the Association for Financial Markets Europe (AFME), the face value of asset-backed securities newly launched on the European market in 2010 amounted to a tidy sum of €380 billion. However, the majority of those securities, worth €292 billion, were never offered for sale. Instead, they served one particular purpose: to obtain fresh cash from the central banks.

According to AFME figures, the total value of all outstanding asset-backed securities in the euro zone and the United Kingdom is an almost unimaginable €1.8 trillion. Of course, not all asset-backed securities are toxic. German banks, for example, package together car or small-business loans to ease pressure on their balance sheets. But the securities that end up at the ECB from peripheral countries like Greece or Ireland are often of questionable value. The central bank is supporting lenders that are in fact no longer viable. And the bombs continue to tick.

Three years after it was launched, things are looking grim for Emerald 5. Eight percent of borrowers are more than three months behind on their loan payments, and of those, a third are more than 12 months behind.

The Moody's rating agency has now reduced its rating of Emerald 5 to A1 and announced a further downgrade to A3 unless the security finds new supporters soon. According to current rules, if it slips below a rating of A, it can no longer be submitted to the ECB. And then?

Does The ECB Know How Safe Its Collateral Is?

The ECB maintains a list of "eligible assets," a sort of seal of approval for securities. Every major bank in the euro zone must have such securities, such as bonds or government bonds, or it would be excluded from the money market. There are currently 28,708 securities on the ECB list, with a total value €14 trillion at the end of 2010.

The national central banks determine which securities are placed on the list and under what conditions. "The ECB has no obligation to supervise the central banks, nor does it have the ability to monitor individual central banks," explains an ECB spokesman.

In other words, ECB President Jean-Claude Trichet doesn't even know exactly what kinds of risks he is taking on. In principle, the conditions for ECB investment-grade securities are outlined in a 37-page document, most recently updated in February. To keep the risks for the central banks within reason, some of the haircuts on securities are very high, comprising up to 69.5 percent of the value of a security.

However, the degree to which individual central banks strictly adhere to these rules varies. This leads to irregularities that should simply not occur in a bank, let alone a central bank.

For example, Depfa Bank, the Irish subsidiary of the scandal-ridden German bank HRE, had 78 securities placed on the ECB's list of investment-grade securities in February. According to documents SPIEGEL has obtained, 25 of those securities appear not to have been sufficiently discounted.

Pattern of Overstating Collateral Values

An inquiry about these incorrectly valued securities elicited the following nonchalant response from the Central Bank of Ireland: "Thank you for the information. The discount for XS0226100310 should be 46 percent. We will apply this discount in the next few days." This meant that the owners of the security could borrow about 20 percent less money from the ECB.

Only after a second inquiry did the Irish central bankers wake up. On Feb. 28, they almost doubled the discounts on 21 additional Depfa securities. Only three securities, for which the Central Bank of Luxembourg was responsible, initially escaped this fate. As a result, the owners of the Depfa securities were initially spared losses of up to €10 million -- until April 1, when Luxembourg also caught up. "The rating of the Depfa securities was changed in early April, which resulted in an updating of the discount," says the Central Bank of Luxembourg, noting that this is in conformity with the current rules of the euro system.

Ireland's central bank turned a blind eye for weeks to two other debt instruments issued by Irish mortgage lender EBS, with a total face value of €1.3 billion. Even though the instruments had only a B rating, they were valued as first-class securities. "We are not aware of this," says the central bank.

After being repeatedly queried about this discrepancy, EBS finally engaged Fitch Ratings, which promptly provided both securities with its rating of "A-" on April 11. This pattern was repeated several times. The quality of a security was tested, the central bank was contacted, it thanked us for the tip and then adjusted the balance-sheet value of the collateral.

Such inadvertent or intentional sloppiness doesn't cast the ECB and its affiliated central banks in a very good light. It also shows that the incentives for rating agencies, which collect large sums of money each time they rate such asset-backed securities, are still questionable.

Although stricter guidelines for the central banks came into effect on March 1, 2011, no one seems to have paid much attention to them. The Central Bank of Luxembourg, for example, still placed 197 asset-backed securities on the ECB list on March 4. After several inquiries were made, the number was reduced to 179 on March 8 and to 146 on March 16.

The quality of securities used as collateral with the Dutch central bank is apparently much higher. On March 8, Fitch rated 281 asset-backed securities held by the central bank, giving its top rating of AAA to 54. These securities were last reviewed before the beginning of the financial crisis and, oddly enough, have not suffered at all since then.

A small team of Fitch employees in London completed the mass rating. The move ensured that securities worth a total of €50 billion were prevented from being removed from the ECB list.

"We have observed the selection criteria for collateral in the euro system at all times," writes the Dutch central bank. It also notes that the ratings for the asset-backed securities were confirmed by "monitoring reports" prior to March 1.

The handling of these securities is surprising, particularly as they pose an ongoing risk until well into the future, with maturities ranging from 30 to 90 years. Many asset-backed securities are now in constant decline. In the fall of 2008, the Frankfurt-based central bankers already had to concede that the ECB could face losses as a result of its acceptance of asset-backed securities as collateral. Following the bankruptcies of the German branch of Lehman Brothers, the Dutch bank Indover and three subsidiaries of Icelandic banks, the ECB was stuck with the failed banks' collateral. They had a total face value of €10.3 billion and consisted "primarily" of asset-backed securities, according to an ECB announcement.

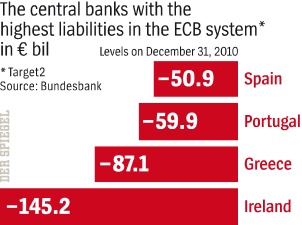

No one really knows how high the central bank's risk is in the crisis-ridden countries of Ireland, Portugal, Greece and Spain. But Bundesbank statistics provide an indication of how drastically the situation has changed in Europe. They show that these countries' liabilities to the euro system have risen to €340 billion within about three years. Since the countries are disconnected from the international capital market and domestic savers have only limited confidence in their banks, other European central banks -- most notably the Bundesbank -- are forced to inject more and more money.

Call for a Reform of European Central Banks

Hans-Werner Sinn questions whether this can succeed in the long term. The president of the Munich-based Ifo Institute for Economic Research believes that a reform of the system of European central banks is urgently needed. He wants limits imposed on the autonomy of national central banks when it comes to recognizing securities as collateral. He has also called for "higher country-specific price discounts for securities submitted as collateral." The banks in these countries would slowly have to return to refinancing themselves in the normal capital market.

The ECB stresses that the securities will only have to be realized if the banks actually declare bankruptcy. But as the drama in Ireland shows, the central banks are walking a very fine line.

By applying a great deal of pressure, ECB President Trichet made sure that the Europeans came to the Irish government's aid so that Ireland was able to protect its banks from collapse. This spared the central bank the embarrassment of having to realize the precarious instruments among its asset-backed securities, which are based on real estate loans in County Longford and elsewhere.

But if the euro crisis rumbles on, the worst-case scenario isn't all that far away. To ensure its national survival, Ireland should reject the European rescue effort and, instead, accept the failure of its banks as a necessary evil, Morgan Kelly recently said. The renowned professor of economics at University College Dublin knows who would be especially hard-hit by such a step: the ECB.

"The ECB can then learn the basic economic truth that if you lend €160 billion to insolvent banks backed by an insolvent state, you are no longer a creditor: you are the owner" Kelly wrote in the Irish Times earlier this month.

.

Translated from the German by Christopher Sultan

0 comments:

Publicar un comentario