Currency and bond chaos ahead

The Fed’s signal that further interest rates cuts are not a given is roiling currencies and foreign bond markets. This mega-credit bubble is popping…

ALASDAIR MACLEOD

First, let’s look at the euro and yen (inverted).

Clearly, these currencies are under pressure from US interest rate policy, which is also reflected in bond yields.

Quite why France’s 10-year OAT only yields 3.1% when France is in political turmoil and heading for a 7% budget deficit illustrates how far it is from reality.

And as for Japan, with the 10-year JGB yielding only 1.09%, it’s hardly surprising that the yen is plunging.

Both these currencies and their debt markets are getting a nasty wake-up call, not just from the US Fed, but also global bond markets.

The yield on the leading supposedly risk-free 10-year US Treasury Note is rising as I have recently forecast:

It recently ticked back to find support on a golden cross and has subsequently risen, with price and the moving averages pointing higher.

You can hardly have a clearer signal of its future direction, which is to challenge the 5% level.

When or before that happens, the disparity between equity and bond values will lead to an equity bear market, which may have already started.

Given the US debt trap and its faltering economy, it won’t stop there.

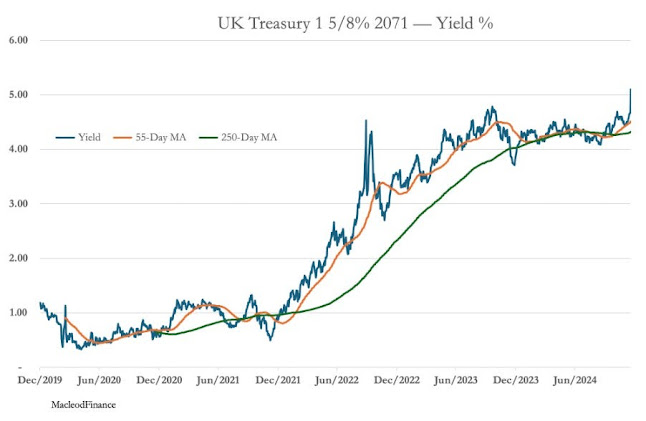

Yesterday, I posted an alarming chart of the 2017 long sterling gilt, which I repeat here updated for today’s price action:

UK pension funds will have bought this gilt in 2020/2021, when they could have paid £160.

Now it is only £41 per £100 of stock.

This is signalling a disaster for the UK economy, which is also reflected in sterling’s exchange rate:

This sterling chart is immensely bearish, with a death cross forming above the exchange rate.

That it has recently rallied to the 55-day MA before being sent sharply south suggests that foreign exchange traders will short it heavily.

More so, given the collapsing gilt market.

Does the average Brit expect this?

Despite their grumbling at the damage the Labour government is inflicting on the economy, their disinterest in gold suggests not.

But with gold looking ready to rise in dollar terms, it will rise even faster in sterling.

A final word for gold’s naysayers, who think that higher bond yields will be bad for gold.

They fail to appreciate that it is not gold rising, but their currency falling.

And unless their central bank aggressively raises rates high enough to stabilise their currency, it will continue to decline relative to real legal money, which is gold.

But if the Fed, the ECB, the BoE, or the BoJ attempt to raise rates enough to stabilise their fiat currencies, they will bankrupt their governments, businesses, and banking systems.

As a deliberate policy, it can be ruled out.

Get out of credit!

0 comments:

Publicar un comentario