Cross-border investment

The movement of capital globally is in decline

Geopolitics is altering its trajectory

Listen to american officials describe the trade and investment barriers they are erecting against China, and you might think they are doing their utmost to limit the economic knock-on effects.

“These steps are not about protectionism, and they’re not about holding anyone back,” Jake Sullivan, the national security adviser, recently told the Council on Foreign Relations, a think-tank in New York.

Officials talk of a “small yard and high fence” when describing restrictions on doing business with China—that is, measures that are narrowly targeted to protect national security, if tough to circumvent.

When Gina Raimondo, the commerce secretary, warns of some Chinese firms becoming “uninvestable” for American counterparts, she strikes an almost mournful tone, urging China to allow such partnerships to flourish again.

But the talk of limiting disruption is a fantasy.

The prioritisation of national security above unfettered investment is reshaping the movement of capital across borders.

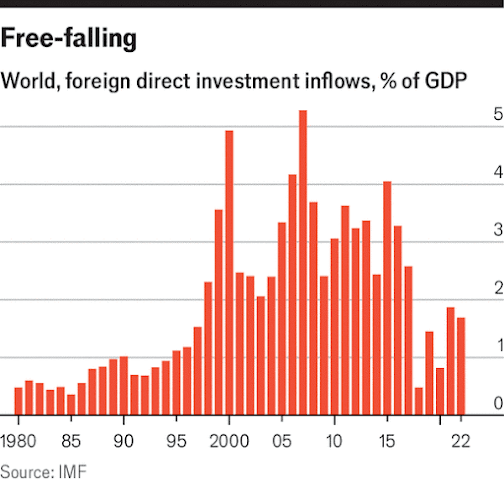

Global capital flows—especially foreign direct investment (FDI)—have plunged, and are now directed along geopolitical lines.

This has benefits for non-aligned countries that can play both sides, and, if it limits the volatility of capital flows, may do some good for the financial stability of emerging markets.

But as geopolitical blocs pull further apart, it is likely to make the world poorer than it otherwise would be.

Cross-border capital flows come from investors’ portfolio positions, banks’ lending books and companies’ FDI.

All types fell after the financial crisis of 2007-09, and have not recovered since.

But the drop in FDI became more pronounced after the onset of America’s trade war with China during Donald Trump’s presidency (see chart).

A study by economists at the IMF published in April 2023 found that, as a share of global GDP, gross global FDI had fallen from an average of 3.3% in the 2000s to just 1.3% between 2018 and 2022.

Following Russia’s invasion of Ukraine in 2022, cross-border bank lending and portfolio debt flows to countries that have supported Russia in un votes fell by 20% and 60% respectively.

To assess whether FDI has also been redirected over time, the IMF researchers analysed data on 300,000 new (or “greenfield”) cross-border investments carried out between 2003 and 2022.

They found a rapid drop in flows to China after trade tensions ratcheted up in 2018.

Between then and the end of 2022, China-bound FDI in sectors which policymakers deemed “strategic” fell by more than 50%.

Strategic FDI flows to Europe and the rest of Asia fell, too, but by much less; those to America stayed relatively stable.

FDI for China’s chip sector plunged by a factor of four, even as FDI for chip firms rose sharply in the rest of Asia and America.

The IMF researchers then compared investments in different regions completed between 2015 and 2020 with those completed between 2020 and 2022.

From one time period to the next, average FDI flows declined by 20%.

But the decline was extremely uneven across different regions.

America and countries in Europe, especially its emerging economies, came out as relative winners.

FDI to China and the rest of Asia fell by much more than the aggregate decline.

The roster of relative winners—rich America and its closest allies—suggests that geopolitical alignment has played a part in diverting capital flows.

Sure enough, it has become more important than ever.

Measuring such alignment through un voting patterns, the IMF researchers calculated the share of FDI flowing between pairs of countries that are geopolitically close.

They found that this share has risen significantly over the past decade, and that geopolitical proximity is more important than the geographical sort (see chart).

The same correlation with geopolitical alignment is present for cross-border bank lending and portfolio flows, though to a lesser extent.

That none of this seems to provoke much angst or even interest from policymakers might seem surprising.

Like free trade, free capital flows ought in theory to provide more opportunities for businesses and investors, giving all a greater chance of getting rich.

Long-term investment from big firms also supplies innovation, management expertise and commercial networks.

For poor countries it matters especially.

Foreign capital fosters growth where domestic savings may be lacking.

And if global capital is free to move, you would expect its cost should be lower.

Slow down, you move too fast

Yet in spite of the vast scale of financial globalisation over the past three decades, with gross cross-border positions rising from 115% of world GDP in 1990 to 374% in 2022, gains have proved elusive to measure.

That does not mean there have been no gains.

But at the same time there is clear evidence that sudden inflows of foreign capital can cause financial crises.

A paper published in 2016 by Atish Ghosh, Jonathan Ostry and Mahvash Qureshi, then all of the IMF, identified 152 “surge” episodes of unusually large capital inflows across 53 emerging-market countries between 1980 and 2014.

Around 20% ended in banking crises within two years of the surge ending, including 6% that resulted in twin banking-currency crises (far higher than baseline).

Crashes tended to be synchronised, clustered around global financial convulsions.

But the link between sudden floods of foreign capital and subsequent credit growth, currency overvaluation and economic overheating is hard to dismiss.

This provides ballast for the Asian policymakers who methodically reduced their reliance on foreign capital after the disaster of 1998.

And indeed, the resilience of emerging-market countries over the past few years, as the Federal Reserve has tightened monetary policy at its quickest pace since the 1980s, has been remarkable.

Then, the Fed’s tightening sparked a Latin American debt crisis; this time most big, middle-income countries managed to insulate themselves and weather the storm.

The trouble is countries with less risky capital flows are also losing FDI.

Mr Ghosh and co-authors found that surge episodes dominated by FDI were less likely to end in crisis; it is sudden floods of bank lending that are destabilising.

What evidence there is on the benefits of unimpeded capital also suggests that FDI flows are best placed to spur growth and spread risk among businesses and investors.

The IMF study from 2023 modelled the impact of the world splintering into separate FDI blocs centred on America and China, with India, Indonesia and Latin America remaining non-aligned (and so open to flows from both sides).

It estimated the hit to global gdp to be about 1% after five years, and 2% in the long run.

The lost growth was concentrated in the two blocs; non-aligned regions stood a chance to benefit.

But lower global growth—and the chance they could be forced to join a bloc—could turn this into a loss.

The real losers are the low-income economies that must contend with the worst of both the old world and the new.

Lacking middle-income countries’ domestic savings rates, capital markets and foreign-exchange reserves, they are simultaneously reliant on foreign capital flows for investment and less insulated from their sudden reversals.

Lacking economic heft, they are more vulnerable to being forced to choose a geopolitical side, restricting their access to funding.

The dilemma has become familiar to such countries, and nowhere more than in the next arena of change for the global financial system: payments.

0 comments:

Publicar un comentario