Wobbly jobs data leaves central bankers on shaky ground

Economists question whether official reports offer accurate guide to the labour market

Claire Jones in Washington, Delphine Strauss in London and Eva Xiao in New York

Since the beginning of 2023, the final US non-farm payrolls number has been downgraded from the first estimate seven times © FT montage/Getty Images

Since the beginning of 2023, the final US non-farm payrolls number has been downgraded from the first estimate seven times © FT montage/Getty ImagesEmployment figures are being closely watched by central bankers around the world as they try to work out when to cut interest rates this year.

There is just one problem: the data might be dodgy.

Swings in immigration, rapid changes to working conditions in the wake of the pandemic and lower participation in polls are combining to create a big problem for labour market statisticians.

Economists are increasingly questioning whether official reports can be relied upon for an accurate read of the labour market, with constant revisions to crucial US jobs data just one of the many headaches facing policymakers.

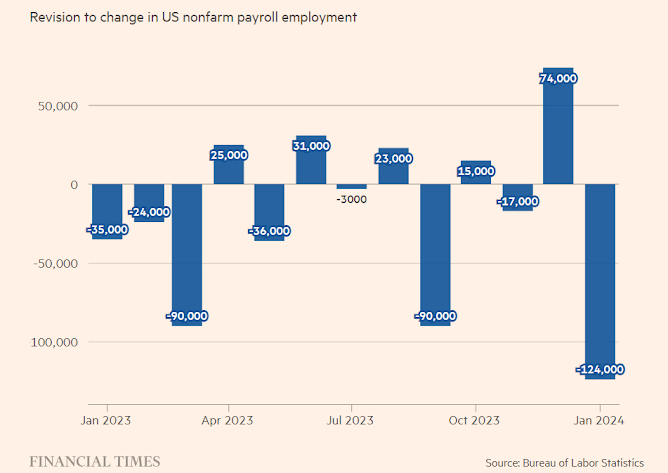

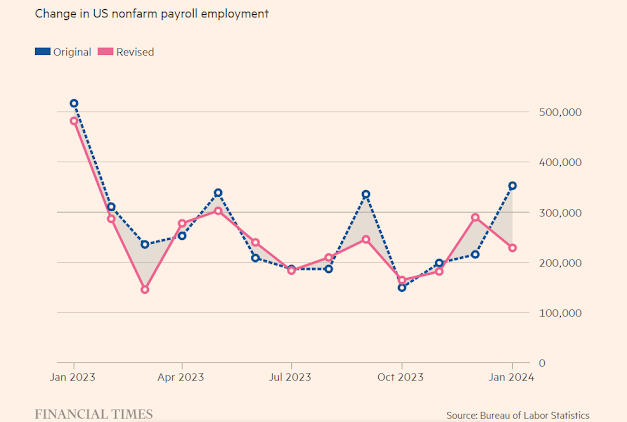

Since the beginning of 2023, the final US non-farm payrolls number has been downgraded from the first estimate seven times.

The January jobs figure, initially described as “stunning”, was cut by 124,000 a month later to a more modest 229,000.

The final January number is due out on Friday, along with the preliminary estimate for March.

The discrepancies have left rate-setters and economists struggling to gauge whether the country’s hot labour market has cooled enough to begin considering cutting rates.

A slowdown would alleviate concerns that sharp wage growth could spark a fresh rise in inflation.

“At this point, everyone sees the first NFP number and thinks, ‘Oh, yeah, that’ll be revised down’,” said Jason Furman, a professor at Harvard University.

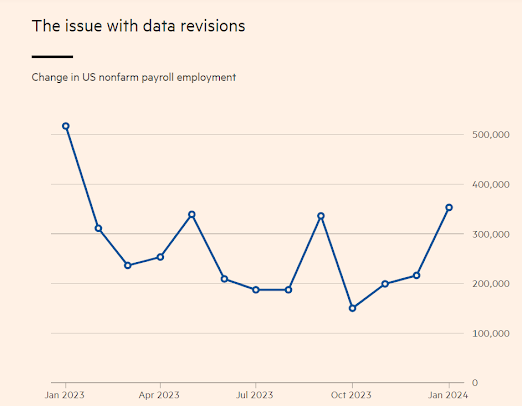

Monthly nonfarm payroll data has recorded a steady increase in the number of jobs across the US...

The most recent revision reduced the figure by nearly 125,000, a downward movement in excess of a third of initial number

The most recent revision reduced the figure by nearly 125,000, a downward movement in excess of a third of initial numberDivergence between the US Bureau of Labor Statistics’ current employment statistics poll, upon which the NFP number is based, and the body’s household survey has led some to suspect that the jobs figures may be underestimating a swelling of the US labour force too.

Jared Bernstein, chief economist to US President Joe Biden, said that while the quality of US labour market data remained “very high” and the BLS did “great work”, the issue of whether the data was properly capturing a surge in immigration “was a really important thing to think about”.

Other countries are also facing problems with their data.

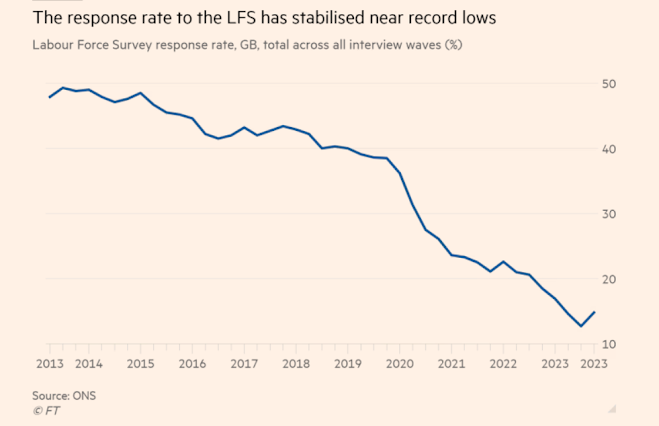

In the UK, the Office for National Statistics was for months unable to publish even its headline estimate of unemployment because the response rate to its labour force survey had dropped so low that it was unreliable.

The ONS is still warning users to treat the patchy data it is now releasing with extreme caution — complicating decisions on policies such as the minimum wage as well as on interest rates, and making it harder for local and national policymakers to plan services.

The European Commission drew attention to a drop in response rates to its labour force survey at the start of the pandemic, saying it might introduce “random and systematic errors” in its data at a time when “the working reality of many people has changed extensively”.

In Canada, the statistical office has struggled to sustain the response rate to its labour force survey after a Covid-induced slump — although Statcan says it is confident the survey is still giving a reliable picture.

Sally Anderson, at the BLS’s division of current employment statistics, which compiles the survey used for non-farm payrolls, thinks the longer-term decline in response rates is down to “survey fatigue”.

“These days, when you go shopping, they have your email address, and you’re getting surveyed even before you walk out of the store,” Anderson said.

“So we’re competing with all of that.”

She added that the decline accelerated during the pandemic as household and business patterns changed, and that it had been exacerbated by an increasing use of caller ID with a distrust of unknown callers.

In the UK, Sam Beckett, chief economic adviser to the Treasury, told the House of Lords economic affairs committee last month: “People are less and less willing to participate in these long door-to-door surveys, so it has created a problem with the quality of the statistics.”

Beckett added: “It is obviously challenging at a time when you would want to know very accurately what was going on.”

Some statistical agencies have offered incentives to boost their numbers.

The ONS has tried free gifts, £10 vouchers, intensive chasing up of non-respondents and shorter questionnaires as it moves to replace its frayed labour force survey with a “transformed” online-first survey later this year.

The BLS said such a move would add substantially to costs.

“We’re operating within budget constraints and offering incentives wouldn’t work within the budget,” said Chris Manning, programme manager for the CES programme.

A more radical option would be to follow the model already in place in some countries — including France and Canada — and make it mandatory in law to fill in the questionnaire.

In the US, just four out of 50 states make responding to government polls compulsory.

An independent report recently suggested that the UK Statistics Authority could make completing its labour force survey mandatory.

France, which overhauled its labour force survey in 2021, has found this legal requirement to be impossible to enforce — and the penalty of €38 for non-compliance is unlikely to deter those who would rather not reply.

The ultimate aim of many agencies is to shift to figures based on big government data sets, and other digital data, with surveys playing a much smaller role than in the past.

Denise Lievesley, who led the review of UKSA, said all OECD statistics agencies saw this as essential due to “falling response rates to conventional surveys, growing demands for more timely statistics, and pressures on public sector budgets”.

However, Lievesley acknowledged that outdated IT systems and privacy concerns complicated the task — and agencies admitted that polls may still be the only way of answering some really important questions.

The BLS said timeliness was also an issue for NFPs, which are usually published on the first Friday of every month, just a few days after the period they measure.

Anderson noted that most other data sources appeared with a much longer lag time than the NFPs, though she added that the BLS accepted some large electronic files and extracted the necessary data from these to shorten the time it took companies to respond.

In the meantime, economists and policymakers in the UK and US are doing their best to patch together a coherent view of their labour markets by looking at a broader range of surveys and alternative data.

“There are a lot more indicators than just the payroll numbers,” said Jan Hatzius, chief economist at Goldman Sachs, adding that, while immigration made it tough to get an exact read on the situation, all the indicators were “pointing in the direction of greater labour market balance”.

0 comments:

Publicar un comentario