Brazilian football: the next frontier in global sport?

The country is unrivalled as a talent factory, but its clubs are barely known overseas. International investors hope a new league could change that

Michael Pooler in São Paulo

For the long-suffering fans of Botafogo, it seemed that glory was finally in sight.

Less than two years after being rescued from financial ruin by an American businessman, the Rio de Janeiro football club found itself the unexpected favourite to be crowned champions for the first time in almost three decades.

The football fairytale was to end in heartache.

Having led Brazil’s top division for most of last season, with a 14-point margin at one point, the team failed to win any of its last 11 matches and finished in fifth place.

The dramatic finale to the Brazilian Série A has drawn attention to a broader effort to modernise the business side of the game in the world’s most famous footballing nation.

The reforms, which include discussions about a new league modelled on English football, are attracting high-profile backers, including Emirati royalty and multiclub conglomerates, who view Brazil as a next frontier in the global sports industry.

“The collapse of our championship campaign was painful,” says John Textor, the US tech entrepreneur and football investor who owns Botafogo.

“But people forget it was a bankrupt club only two years earlier.”

Textor’s acquisition of a 90 per cent stake of Botafogo in early 2022 through his company Eagle Football Holdings, along with promises to inject R$400mn ($80mn) of funding, was among the first in a wave of deals.

“I said we’re going to be fighting for titles within three to five years. Well, we’re already there.

I’m very proud of what we built . . .

[We are] increasing our revenues and becoming more sustainable.”

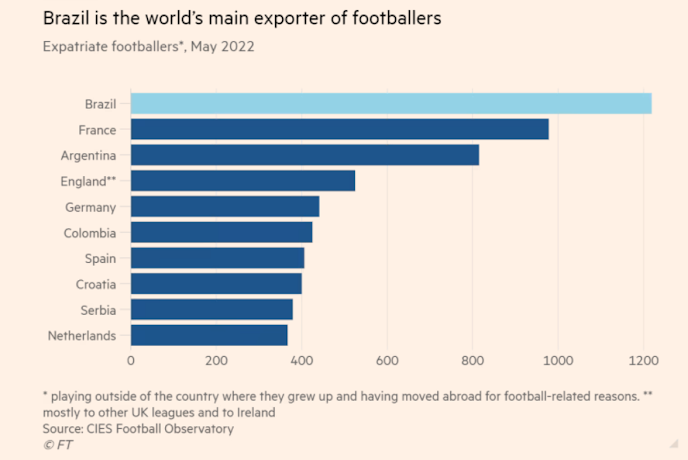

Brazilian football is one of the enigmas of global sport.

The country enjoys a near-unrivalled status as a talent factory — most of the biggest clubs in the world, from Real Madrid to Manchester City, boast Brazilian stars on their rosters.

Yet many of its own major clubs have long underperformed off the pitch — and are barely known outside of Brazil.

A lack of professional management has been blamed for the weak financial position of many clubs and a failure to realise the sport’s commercial potential.

This is exacerbated by the early departure of many of the country’s best players to European leagues, with the allure of much bigger salaries.

Nic Hamer at Oakwell Sports Advisory says he is witnessing “huge interest” from prospective investors.

“There are very few markets in football where there’s this sort of opportunity across all revenue lines,” he adds.

“[Brazilian] clubs generally are undercommercialised.

In the long term, I don’t see why Brazil can’t break into the top five leagues by turnover.”

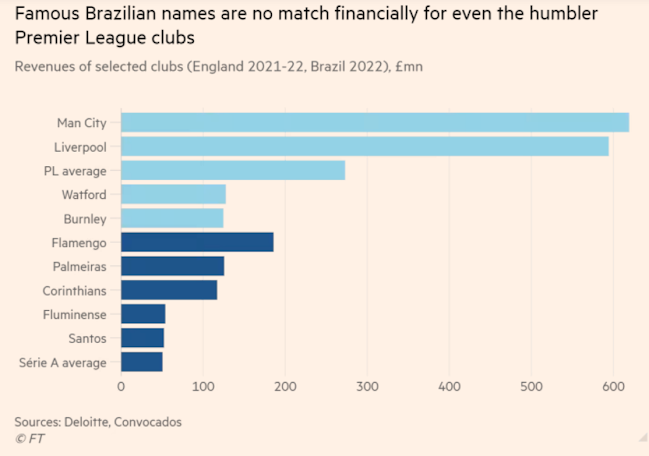

For now, that remains a way off.

Total turnover in Brazil’s first division was R$6.9bn (€1.3bn) in 2022, found a study by the consultancy Convocados — well below the revenues earned by the top five leagues in Europe.

In a bid to raise broadcast receipts, proposals are also afoot to create a new nationwide competition in Brazil that is capable of reaching a much wider overseas audiences.

Botafogo fans in Rio. The club epitomises the effort to modernise the business side of Brazilian football, which is attracting high-profile international investors © Tuane Fernandes/FT

Botafogo fans in Rio. The club epitomises the effort to modernise the business side of Brazilian football, which is attracting high-profile international investors © Tuane Fernandes/FTAt present, local giants such as Flamengo, Corinthians and reigning title-holders Palmeiras can only dream of the kind of international brand recognition built up over years by European counterparts such as Barcelona, Manchester United and Paris Saint-Germain.

The great hope of fans and executives alike is that more money will convince younger stars to stay at home for longer.

This can unlock a “virtuous cycle”, says Bruno Amaral, head of mergers and acquisitions at investment bank BTG Pactual.

“It’s going to represent a big improvement in the attractiveness of matches, leading to better revenues both locally and internationally and will make the clubs stronger,” he adds.

But to succeed, the grand plans will have to overcome the infighting and questionable practices that have often blighted the domestic game and stunted its off-field development.

“Brazilian football has always been very political,” says Ricardo Fort, founder of sports consultancy Sport by Fort.

“This has proven to be an obstacle, because the clubs have allowed their on-field rivalries to be a barrier to them working together.”

The catalyst for change in Brazilian football was a 2021 law encouraging clubs to operate as businesses, instead of the traditional model of non-profit associations. Previously, only two top-flight clubs were run as companies.

By creating a novel corporate structure that enjoys favourable tax rates, the legislation has opened the door to investors.

Textor was one of the new entrants to Brazil.

His company also owns Olympique Lyonnais, Belgian team RWD Molenbeek and a minority stake in south London side Crystal Palace.

In Botafogo, he found a club with a rich history — Mané Garrincha, one of the stars of the Brazil sides that won the 1958 and 1962 World Cups, played for the team in its heyday — but which had fallen on hard times in recent years.

The club won promotion from the second division in 2021,

Shortly before Textor agreed the deal for Botafogo, former superstar and World Cup winner Ronaldo acquired a controlling stake in his boyhood club Cruzeiro.

Miami-based investment firm 777 Partners, which counts England’s Everton in its portfolio of teams, took a majority stake in Vasco da Gama in Rio.

Esporte Clube Bahia was bought by City Football Group, the Abu Dhabi-controlled owner of a dozen sides including Manchester City.

The new company template, known by its Portuguese acronym SAF, is a radical break from the conventional system of clubs controlled by members, with a president chosen every few years.

Critics say the old set-up frequently led to maladministration and overspending, with some leaders elected due to popularity rather than management abilities.

“In the association model, you can’t design something for the medium and long-term, a real business platform,” says Pedro Daniel, executive director at EY in São Paulo.

“This results in unpredictability and a high risk for all the stakeholders.”

Unpaid bills or wages have not been uncommon at Brazilian clubs and in the past there have even been cases of corruption, embezzlement and match-fixing.

“SAFs bring more planning and a professional perception, which can attract new sponsors [with] greater security and less risk,” adds Daniel.

“There is fiscal responsibility and incentives for good management — but the numbers don’t happen overnight.”

Indeed, the already high levels of indebtedness among Série A clubs increased 9 per cent to a combined R$10bn in 2022, according to Convocados.

Past ventures into Brazilian football by outsiders have rarely succeeded.

A handful of partnerships struck in the late-1990s by names such as Bank of America and private equity firm Hicks & Muse were wound down within a few years.

But some industry veterans believe the new legal framework provides a structure for investments, along with a mechanism for resolving heavy debtloads.

John Textor, the US tech entrepreneur, acquired a 90% stake in Botafogo after Brazil enacted a law in 2021 encouraging clubs to operate as businesses, instead of non-profits © Thiago Ribeiro/AGIF/Reuters

John Textor, the US tech entrepreneur, acquired a 90% stake in Botafogo after Brazil enacted a law in 2021 encouraging clubs to operate as businesses, instead of non-profits © Thiago Ribeiro/AGIF/ReutersUnder the new model, the legacy association transfers football activities to the SAF, but retains other sports and social functions — as well as prior obligations and liabilities.

One-fifth of the new entity’s revenues must go to paying down these historic debts.

The initial takeover deals were clubs in financial distress with scant other options, says sports lawyer Eduardo Carlezzo.

He reckons the law is working.

“Botafogo, which was always broken, almost became champions,” he says.

“The SAF [model] is rehabilitating clubs that were destroyed.”

As evidence of its turnaround, Botafogo says debts have decreased from an initial R$1bn to an estimated R$740mn at the end of 2023; it hopes to agree a further restructuring with creditors in the months ahead.

Revenues meanwhile increased from R$140mn in 2022 to R$402mn last year.

Textor says the target is to break even next year.

The Rio club’s chief executive Thairo Arruda puts the early success down to administrative restructuring coupled with a more entrepreneurial mindset.

Membership promotions and ticket discounts have led to sellout games, while the stadium has begun to host music shows.

When Taylor Swift brought her Eras tour to Rio de Janeiro last year, she played at the Botafogo stadium.

Botafogo has also invested heavily in scouting talent but its ambitions go deeper, says Arruda: “It’s in our plan to develop the infrastructure to be one of the greatest academies in the country.”

To reformers of the game in Brazil, the ultimate goal is the establishment of a new tournament controlled by the clubs, rather than the national confederation.

Inspired by the English Premier League, the idea is to turbocharge the marketing of TV and other media rights by selling them collectively.

Until now, Brazilian clubs have signed contracts on an individual basis with the country’s largest media group, Globo.

In theory, centralising rights will not only give greater bargaining power, but open up a slew of other fronts for new income streams and improvements.

This ranges from how the product is packaged and fixture schedules through to the sale of data to gambling companies.

The global football media rights market was worth $19bn in 2023, according to data provider SportsBusiness.

Although competition for viewers is tough, Brazilian football’s reputation for flair is an inherent advantage, says Adam Kelly, president of media at IMG.

“It is a chance to spot the talent of tomorrow and see some incredible skills,” he says, adding that streaming platforms and international broadcasters could be possible buyers.

“You could launch a brand new service [showing games] and be successful in season one.”

Another attraction is the highly competitive nature of the spectacle: five clubs were still contenders for the title with a handful of games left in the 2023 season.

There is also potential to expand domestic audiences in a country of 200mn people, given relatively low attendances at some grounds, say experts.

However, for a new league to take shape there must first be the unification of two rival camps with differing views on how revenues should be shared out.

The first group, known as the Libra project, counts 19 clubs across the top three divisions, including the four largest by revenues and supporter bases.

It is in talks with Mubadala Capital over an investment and is being advised by BTG Pactual.

An arm of the Abu Dhabi sovereign wealth fund, Mubadala has proposed an agency owned 50/50 with the clubs that would have exclusivity to sell their transmission rights, according to people aware of the details.

An agreement could include a minimum guaranteed income for the clubs, in exchange for the investor receiving an interest in the rights at a later stage, says one person involved in the talks.

The other grouping is Liga Forte União, comprising 26 teams from the top three divisions, and advised by XP, a Brazilian financial services group.

It signed a definitive agreement in November with a consortium of investors led by local private equity firm Life Capital Partners (LCP), who paid R$2.6bn for a 20 per cent stake in a media company that will market the rights over a 50-year period.

Some R$1.2bn has already been released to the clubs.

São Paulo’s Wellington Rato, left, competes for the ball against Richard Rios of Palmeiras in the Super Cup on Feb. 4. Palmeiras’ president has ruled out running the club as a business, saying it belongs to the fans © Castelo Branco/Eurasia Sport/Getty Images

São Paulo’s Wellington Rato, left, competes for the ball against Richard Rios of Palmeiras in the Super Cup on Feb. 4. Palmeiras’ president has ruled out running the club as a business, saying it belongs to the fans © Castelo Branco/Eurasia Sport/Getty Images“We believe in the potential for overseas expansion, as roughly 2 per cent of the Brazilian league’s revenues are international,” says LCP founding partner João Gabriel Leitão.

“It could reach 10 per cent in the next 10 years.

We have a huge opportunity to sell the rights outside Brazil.”

For now, the initiatives are progressing as blocs selling sets of pooled rights.

But there is consensus that to reap the full benefits, a single body involving all 40 clubs across the Série A and B must prevail in order to design a brand-new competition.

“If you just have the sale of the rights, it’s too superficial.

The reality is unless you control the tournament, you will never be able to make the structural changes you need in order to grow the league,” says Fort.

On-off talks have taken place with a view to a merger and common ground has been found, say people involved in the talks.

But with the current Globo contracts to expire at the end of 2024, the clock is ticking.

Libra last week confirmed it would pursue talks with the network for the next four-year broadcast cycle.

“If they can’t get an agreement and the two blocs negotiate separately [with broadcasters], it will be better than the previous situation, which was one-on-one with clubs.

But it won’t maximise the value for Brazilian football,” says one person involved in the talks.

Until the league situation is clarified, some potential investors in Brazilian clubs will continue to sit on the fence, according to industry figures.

Seven of the 20 Série A clubs now have private owners; the question is, which will be next?

“The second wave will be about growth, at intermediate or small clubs that are in a better situation but need money to expand,” says Carlezzo the lawyer.

Fans have displayed little opposition to takeovers in principle, even if poor results have on occasion sparked criticism of owners from influential supporters’ organisations.

Yet among some larger teams there is resistance to the notion of inviting outside shareholders.

The presidents of Corinthians and Palmeiras have explicitly ruled out the idea of a SAF, saying that the clubs belong to the fans or that they are already professionally managed.

Observers also warn that the model is not a silver bullet, noting that clubs still need professional management and good governance structures.

Brazil’s most-followed team, Flamengo, won praise for a financial and business turnaround as an association.

Its president has spoken of the possibility of a SAF in order to raise finance to build a stadium.

Teams seeking inspiration to challenge the status quo only need look at Red Bull Bragantino, a smaller club in São Paulo state that was acquired by the energy drink brand in 2020 and turned into a limited company before the new law.

Having gained promotion under Red Bull it is now considered a contender after finishing in sixth place last year.

Bahia fans gather outside their home stadium. Esporte Clube Bahia has been acquired by City Football Group, the Abu Dhabi-controlled owner of a dozen sides including Manchester City © Rafaela Araujo/AFP/Getty Images

Bahia fans gather outside their home stadium. Esporte Clube Bahia has been acquired by City Football Group, the Abu Dhabi-controlled owner of a dozen sides including Manchester City © Rafaela Araujo/AFP/Getty Images“The Brazilian league is probably one of the most competitive in the world.

To be in the top half of the table is an achievement for us, fighting against very big clubs,” says managing director André Rocha.

But with the flow of new money, in some quarters there are calls for “financial fair play” rules to ensure the competition is not distorted by overspending.

And if the Textor era at Botafogo is a test case for the new phase of investments in Brazilian football, it has also shown the game’s habitual controversies are not going away any time soon.

To many supporters, the side’s on-field capitulation was just further proof of a saying that reflects its perceived bad luck: “Some things only happen to Botafogo”.

But in the American’s view there were darker forces at play.

After Botafogo blew a three-goal lead to lose 4-3 at home to Palmeiras — a defining moment of the campaign — Textor alleged corruption in a post-match TV interview on the sidelines.

He was fined and temporarily banned from football activities.

Although the country’s top sports court agreed the expulsion of a Botafogo player was unfair, it rejected Textor’s calls for an investigation into match-fixing and for six games to be replayed.

The club said it intends to pursue further legal action.

“Of everything Textor has done, there are far more positive things than negative,” says Andre Callipo, a Botafogo fan and online football influencer.

“If we manage to win a competition it would be a great act to close the wound.”

Additional reporting by Beatriz Langella

0 comments:

Publicar un comentario