Why Manufacturing Is in a Slump, Despite Signs of a Renaissance

Biden’s incentives drive factory construction as rates and inventories weigh on sales and employment

By David Harrison

Deere expects high interest rates to reduce sales of large agricultural equipment as much as 15% in 2024. PHOTO: JOE BUGLEWICZ/BLOOMBERG NEWS

Deere expects high interest rates to reduce sales of large agricultural equipment as much as 15% in 2024. PHOTO: JOE BUGLEWICZ/BLOOMBERG NEWSU.S. manufacturing is entering a golden age, with government subsidies sparking a boom in factory construction.

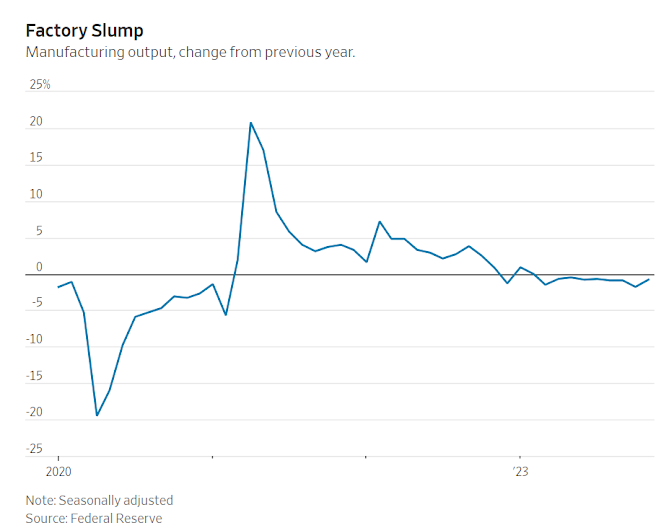

Yet the industry is also mired in the longest slump in more than two decades.

Activity has weakened for 13 straight months, the longest stretch since 2002, according to surveys of purchasing managers by the Institute for Supply Management.

Behind that split-screen image: U.S. manufacturing is large and varied.

Investment in factories has occurred in the most high-tech sliver of the sector while other industries struggle with a pandemic-induced inventory overhang and higher interest rates.

“Normally you would see capacity get added when things are booming,” said Chris Snyder, director of industrials equity research for UBS.

“This is not necessarily that.”

This divergence won’t last forever, economists say.

They expect factory output to pick up as the Federal Reserve cuts rates and the lagged effects from the inventory buildup of 2022 and early 2023 fade.

Bringing the new factories online would further support the sector’s growth.

As President Biden gears up for his re-election campaign, he points to manufacturing’s future as a vindication of his economic plan.

The Inflation Reduction Act offered tax incentives for renewable-energy equipment manufacturers and buyers of electric vehicles.

The Chips and Science Act included $39 billion in subsidies for semiconductor makers.

By boosting domestic production of such high-value goods, the administration seeks to make the U.S. less dependent on Chinese imports.

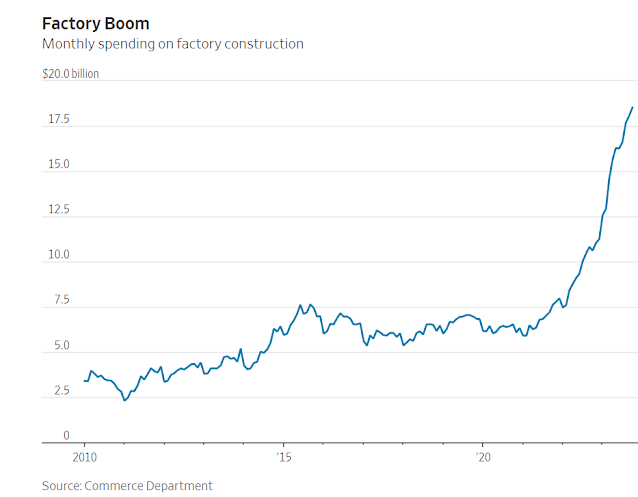

Spending on manufacturing construction rose almost 40% in 2022 and is up a further 72% through the first 10 months of 2023 versus the same period the previous year.

U.S. quest to lead manufacturing

“For the longest time, we’ve been told to give up on American manufacturing,” Biden said to union members during the summer.

“Well, I never believed it.

This nation used to lead the world in manufacturing and we’re going to do it again.”

But the administration’s subsidies target only a subset of manufacturers. Semiconductors and other high-technology industries, for instance, comprise 1.9% of industrial production.

And electric vehicle output could be offset by declining gasoline-powered vehicle output.

“You’ve got these acyclical drivers that are really pushing up investment in manufacturing structures just in this one sector, but the broader sector is still struggling,” said Bernard Yaros, lead U.S. economist at Oxford Economics.

This has been an unusual cycle for manufacturing.

After the recessions of 1990, 2001 and 2007, factory employment never fully recovered even as overall employment rose.

Output has never returned to 2007 levels.

The Covid-induced recession was different.

Output returned to 2019 levels by late 2021 and employment by early 2022.

The improvement occurred as fiscal stimulus across developed economies propped up domestic demand and exports, and as homebound consumers shifted spending to goods from services.

Those tailwinds have now faded.

Factory employment has been flat for the past year, even as overall employment is up almost 2%.

Output has declined year-over-year every month since March, according to Fed data.

U.S. auto factories are pumping out fewer vehicles than they did in the years before the pandemic, Fed data show, although part of the weakness could be because of shutdowns from the recent United Auto Workers strike.

High interest rates bite into business investment

Several factors are holding back manufacturing now.

The Fed raised rates from around zero in early 2022 to more than 5% in 2023.

That made it more expensive to finance big purchases such as cars, trucks and industrial machinery.

Business orders of capital goods, excluding aircraft and military goods, have been falling for about two years after adjusting for inflation, according to the Commerce Department.

Joshua Rohleder, manager of investor communications at farm-equipment maker Deere, told analysts on a November conference call that he expected sales of large agricultural equipment to decline 10% to 15% in 2024 partly because of “high interest rates weighing on discretionary equipment purchases.”

Second, consumption is slowly pivoting back toward services.

Goods’ share of consumer spending eased to 33% in November, though it is still more than before the pandemic.

Third, supply-chain meltdowns in 2021 and 2022 that froze global shipping prompted manufacturers’ business customers to stock up as a precaution; their inventories grew by double-digit percentages in 2022.

With inventories stuffed, they are trimming orders.

“A lot of these headwinds that we’re seeing, it’s really around the normalization of inventory levels,” Snyder said.

Analysts and manufacturers expect output to grow alongside the broader economy in coming years as the Fed cuts rates and inventories come back into balance.

“Long term for the crane business, I’m very optimistic about it and it’s really driven by those macro trends,” said Brian Regan, chief financial officer of Manitowoc, a maker of construction cranes and lifts.

“We’ll have bumps in the road to get there.”

Manufacturers surveyed by the Institute for Supply Management expect revenues to grow 5.6% in 2024, up from 0.9% in 2023.

The factory-construction boom could also provide a long-term boost.

Jared Bernstein, chairman of the White House Council of Economic Advisers, estimates that it will take about two years from new investment in factories for manufacturing employment to start growing.

That points to a pickup around next summer as the first of the factories now under construction begin to increase production.

“We know that we’re seeing increased investment in the sector and we’re optimistic about where that’s going to take us,” he said.

0 comments:

Publicar un comentario