Prices Fell in November for the First Time Since 2020. Inflation Is Approaching Fed Target.

Spending and personal income rose, a sign of Americans’ confidence in the economy

By David Harrison and Amara Omeokwe

Inflation retreated further in November, and consumer spending rose, another indication the U.S. economy can avoid a recession while bringing prices under control.

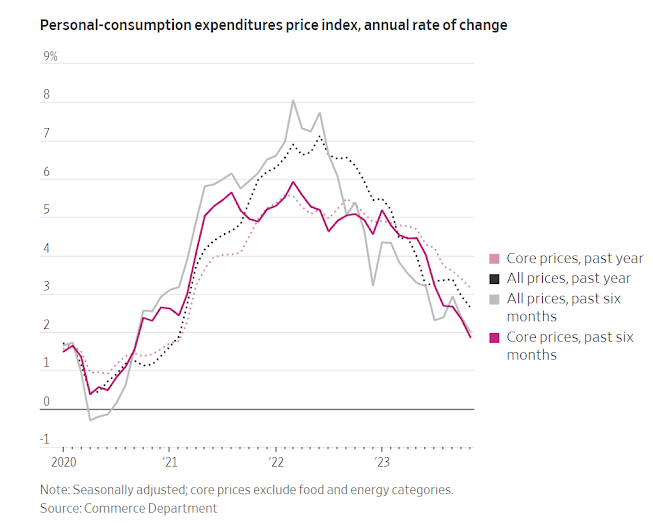

The personal consumption expenditures price index fell 0.1% in November from the previous month, the first decline since April 2020.

It was up 2.6% on the year.

Excluding food and energy prices, the index was up 0.1% on the month, same as in October.

On the year, core inflation was up 3.2% in November, down from 3.4%.

The Federal Reserve targets 2% annual inflation using the PCE price index.

On a six-month annualized basis, core inflation eased to 1.9%, suggesting the Fed is well on its way to reaching the target.

Consumer spending, meanwhile, was up 0.2% on the month in November, down from 0.1% in October.

Overall personal income was up 0.4%, down from 0.3% in October, a sign of confidence in the economy on the part of American households.

Separate data set for release Friday morning by the University of Michigan will show the final reading of December consumer sentiment.

A preliminary reading showed a 13% increase from the prior month.

Americans’ incomes are rising when adjusting for price changes “because of lower inflation, steady job growth and steady wage gains,” said Bernard Yaros, lead U.S. economist at Oxford Economics.

“And that bodes favorably for real consumer spending,” which will support the overall economy next year.

Coming in for a soft landing

The U.S. economy defied predictions that it would tip into recession in 2023, largely because consumers kept up their spending despite higher prices and the Fed’s interest-rate increases.

Many economists now say the economy will likely cruise to a so-called soft landing in which inflation returns to the Fed’s 2% annual target, measured under the personal-consumption expenditures price index, without triggering a recession.

Fed officials, who spent much of 2022 and 2023 pushing interest rates up to the highest level in 22 years, have penciled in three rate cuts next year, according to projections released last week, in response to inflation’s faster-than-expected deceleration.

“Inflation keeps coming down, the labor market keeps getting back into balance, and it’s so far so good,” Federal Reserve Chair Jerome Powell said at a press conference following the central bank’s December meeting.

“We kind of assume that it will get harder from here, but so far it hasn’t.”

Strong job growth is to thank for that.

Employers have kept hiring, although the pace of growth has slowed.

Wage gains have eased, but inflation has cooled faster, leaving many workers better off.

Higher pay and strong hiring encouraged more people to get off the sidelines.

The labor-force participation rate for workers between the ages of 25 and 54—83.3% in November—is trending near the highest rate in more than two decades.

That makes it easier for employers to find workers, which should prevent wages from rising so fast that they put upward pressure on inflation.

“The big surprise is on the domestic labor market side: how strong the labor force has grown,” said Michael Gapen, head of U.S. economics at Bank of America.

“If you’re adding more people to the ranks of the employed, total income in the economy is rising and total spending is rising.”

Improving view

Signs of strength in the economy have made Americans more optimistic about the future.

Consumer confidence rose in December to its highest level since July, the Conference Board said Wednesday.

That survey showed Americans’ expectations for a recession over the next 12 months fell to the lowest level of 2023.

The Fed’s signal that it was likely done with interest-rate hikes, a pullback in mortgage rates and easing inflation are combining to fuel improved economic sentiment, said Dana Peterson, the Conference Board’s chief economist.

She said that while the December survey showed Americans are still broadly upset about inflation, they increased their plans to purchase big-ticket items, such as cars and large appliances.

Financial markets have rallied this month, making those with 401(k)s and stock portfolios feel wealthier.

Changing feelings about the economy could have ramifications for the 2024 presidential election.

Americans’ concerns about the economy have weighed on President Biden’s approval numbers, with polls suggesting voters feel his policies have hurt them rather than helped.

The administration has sought to push back, often by touting the economy’s resilience during Biden’s tenure and his legislative accomplishments.

Gradual slowing

Peterson said it is too early to say whether the pessimistic economic mood consumers had for much of 2023 had turned a corner.

She estimates that the lagged effects of the Fed’s rate increases will contribute to a mild recession in early 2024.

After solid growth this year, economists expect the economy to lose steam slightly in 2024. That should allow inflation to soften further.

Economists at BMO Capital Markets see growth cooling to 1% in the fourth quarter of 2024 versus the same period of 2023, down from 2.6% this year.

Scott Anderson, chief U.S. economist at BMO, said he sees a slight slowdown in the first half of the year and a pickup in the second half.

A cooler economy and softening inflation should allow the Fed to cut rates four times, he said.

“That’s a win for the Fed if they can achieve this,” Anderson said.

“It’s the immaculate disinflation story.

That’s the best we could have hoped for when the Fed started hiking rates in 2022.”

0 comments:

Publicar un comentario