Can Singapore hold on to its reputation as Asia’s ‘safe haven’?

The city-state has long prospered as a global hub but some question whether the model is still working

Mercedes Ruehl in Singapore

Singapore needs to navigate the US-China split if it is to keep its citizens supportive of welcoming foreign capital © FT montage/AFP/Getty Images

Singapore needs to navigate the US-China split if it is to keep its citizens supportive of welcoming foreign capital © FT montage/AFP/Getty ImagesOn a hot day in August, Singaporean police arrived at one of the city’s swankiest addresses, made their way past a miniature golf course in the courtyard, and charged inside.

At homes across the city — always in the wealthiest neighbourhoods — similar scenes were repeating as police rounded up people suspected of belonging to a billion-dollar money-laundering ring.

Once upstairs, the officers banged on the bedroom door.

When they entered, Su Haijin, a 40-year-old man of Chinese, Cambodian and Cypriot nationality, was gone.

But not very far.

On hearing the police, Su had hurled himself off the second-floor balcony, fracturing his hands and legs.

Police found him hiding in a nearby drain.

The case, in which Su and nine others have been charged so far, has captivated a public wholly unused to seeing the insalubrious side of their country laid bare.

It is not just the trappings of the S$1.8bn ($1.3bn) bust — gold bars, designer handbags, luxury cars, lavish property and digital fortunes — that have fascinated.

Global banks, precious metal dealers, property agents and one of the country’s most famous golf clubs have also been sucked into the scandal.

Singapore has for decades prospered in no small measure due to its reputation as the “Switzerland of the east” — a safe and neutral haven for business in an at-times intractable part of the world.

The investigation has captured global attention, “not just due to its size and links to Chinese money”, says Chong Ja Ian, associate professor of political science at the National University of Singapore, “but also because it underscores the risks as Singapore tries to reshape itself in a more competitive and fragmented world”.

Singapore, he adds, wants to be “a premium place for premium business, not just a Cayman Islands or a Mauritius, a place where global capital can come in and be reinvested elsewhere.

But a raid of this scale shows the model has serious drawbacks.”

While Singapore’s open, trade-reliant economy has proved resilient to external shocks such as rising global protectionism and supply chain fragmentation, the raid comes at a sensitive and destabilising time.

The city-state is wrestling with rising inequality — linked to unrestrained capital inflows from the US, Europe and especially China — as it prepares for its first change of leader in almost 20 years. Some are questioning whether an economic model so reliant on foreign capital is benefiting citizens in the way it once did.

There is also the delicate matter of deteriorating Sino-US relations.

As more mainland Chinese cash and influence seeps out of China and into Singapore, the country’s high-wire balancing act between Beijing and Washington becomes even more precarious.

All 10 accused in the money-laundering sting share one thing in common: possession of a Chinese passport.

A court illustration of 10 of the people alleged to have involvement with the money-laundering operation that has attracted global attention to the city-state © The Straits Times Illustrations/Cel Gulapa/Reuters

The test for Singapore’s ruling People’s Action party, analysts say, will be its ability to keep citizens convinced of the merits of remaining pro-globalisation and welcoming of foreign capital.

Navigating the US-China split will depend on it.

“All foreign policy is domestic policy,” says Donald Low, a professor at the Hong Kong University of Science and Technology and a former civil servant in Singapore.

“What will shape how Singapore manages its international agenda is how they can manage these domestic tensions.”

‘The money is pouring in’

Under the iron leadership of Lee Kuan Yew, the founder of modern Singapore who died in 2015, the city-state was propelled after independence from Malaysia in 1965 from a south-east Asian backwater into one of the world’s most successful economies.

Lee understood that encouraging foreign investment, the immigration of skilled workers and swift adoption of new technology was part of nation-building.

At a time many countries were suspicious of global multinational corporations, Lee welcomed them with low taxes and subsidies, marrying capitalism with a welfare state that protected citizens and provided housing, medical care and education.

Singapore benefited from a period of rapid industrialisation and globalisation worldwide, its strategic location making it an ideal hub for trade and commerce.

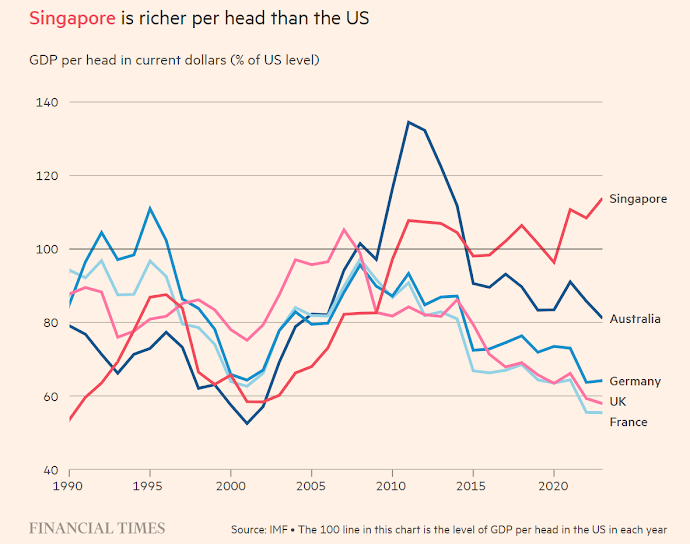

In 1965, per capita gross domestic product was a mere $516 compared with $91,000 today — higher than the US, Australia, France, the UK and not far behind Switzerland.

The economic boom continued under Lee’s successors, first Goh Chok Tong and then his son, Lee Hsien Loong, who came to power in 2004.

Even the US-China decoupling and other global shocks, such as Russia’s invasion of Ukraine, have not derailed its progress.

Stable Singapore has even benefited from the external disorder.

“There is a paradox that smaller open economies benefit from worsening bilateral relations,” says David Bach, a professor at the International Institute for Management Development in Switzerland.

“As a result of recent dynamics Singapore has become a lot safer for investors and multinationals to conduct business.”

Singapore’s “safe hub” reputation — coupled with its low taxes — has helped the city-state to compete with the massive industry subsidies on offer across large developed economies in the US and Europe, such as the US’s Inflation Reduction Act or the EU’s Green Deal.

Singapore receives a bigger percentage of US foreign direct investment into Asia-Pacific than China and Hong Kong combined. Overall foreign direct investment inflows surged to S$195bn last year, its highest level ever and a 10 per cent increase from S$176bn in 2021.

Singapore attracted a record S$22.5bn in fixed asset investments in 2022 despite the global headwinds.

Many think the money-laundering scandal will have little long-lasting impact on Singapore’s reputation overseas.

“The money is pouring in,” says Parag Khanna, founder and managing partner of FutureMap, a global strategic advisory firm.

Investors want somewhere “genuinely open, home to everyone and that isn’t dominated by one power.

Hong Kong has long since ceased to be that pan-Asian hub.”

Singapore’s finance minister, Lawrence Wong, is seen as likely to become prime minister, but he would be taking over at a time when his ruling party’s vote share is at historic lows © Edgar Su/Reuters

Singapore’s finance minister, Lawrence Wong, is seen as likely to become prime minister, but he would be taking over at a time when his ruling party’s vote share is at historic lows © Edgar Su/ReutersAmong the expatriates that call Singapore home is German conglomerate Siemens.

Roland Busch, chief executive, said in June that the company chose Singapore over places with cheaper labour and property costs such as India and Indonesia to build a new high-tech factory.

Globally connected Singapore, Busch said, was a “lighthouse of stability”.

Even with slowing global growth and weak local demand, Singapore has avoided a recession.

Core inflation slowed for a third straight month in July to a year-on-year rate of 3.8 per cent.

Unemployment was 1.9 per cent in the second quarter of this year.

By comparison, in the same quarter Hong Kong recorded a rate of 2.9 per cent, London was at 5.1 per cent and, in June, New York’s rate was 5.4 per cent.

Singapore-washing

Yet while it thrives as a global power, Singapore has domestic concerns.

The long-ruling People’s Action party is grappling with only its third change in leadership since independence, with finance minister and deputy prime minister Lawrence Wong — the so-called 4G or fourth generation leader — likely to take the reins.

Wong will take over at a time when the PAP’s share of the popular vote is at historic lows.

The timing of the handover remains unknown and whether Lee or Wong will lead the PAP through the next general election — due to be held by November 23, 2025 — is unclear.

While the PAP’s grasp on power in the quasi-authoritarian democracy remains firm, the opposition Workers’ party won a record 10 out of 93 contested seats in the 2020 general election for Singapore’s parliament.

For Singaporeans preparing for this next era, the opacity of the succession plan adds to an underlying sense of unease about the city-state’s identity.

“Philosophically and emotionally, it’s the sense that the ‘Switzerland of the east’ is actually designed more for global plutocrats than ordinary Singaporeans,” says Sudhir Vadaketh, editor of Jom, a Singaporean weekly magazine.

Some see Singapore as a way station, others a nation home, others a bit of both, Vadaketh adds.

“There’s an inherent existential tension between the two that expresses itself in different ways, and requires perpetual management from politicians and bureaucrats.

[August’s] money-laundering case, for many people, reminds us that we may be leaning too much towards ‘global city’.”

Singapore, whose own population is ageing, has become a favoured home for Asia’s millionaires, prompting local pushback to foreign workers and immigration.

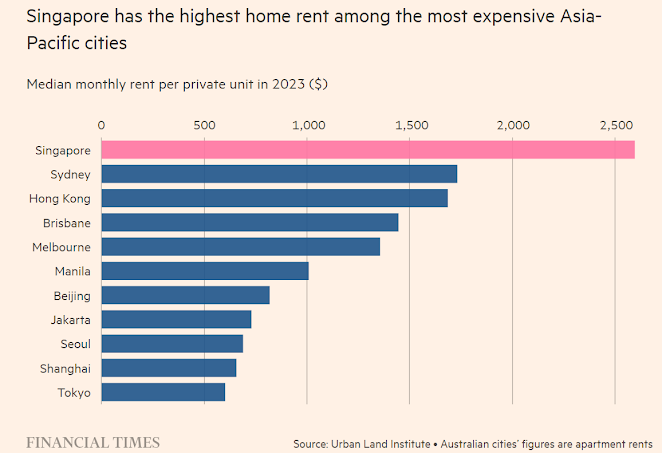

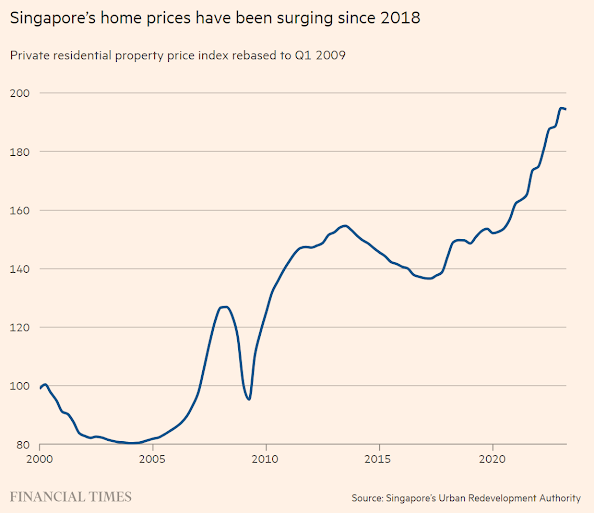

House prices and rents have skyrocketed, with the median price of a private home hitting $1.2mn in 2022, the highest among cities in the Asia-Pacific, according to data from the Urban Land Institute Asia Pacific Centre for Housing.

Rents for private homes outpaced even New York City at the end of last year.

Many Singaporeans are somewhat shielded thanks to a government housing scheme.

Close to 80 per cent live in state flats and the majority own their home via long-term leases from the government.

But even here higher costs are trickling through.

“I am moving back in with my parents because the landlord at the Housing Development Board flat I was renting with a friend lifted the rent from $3,000 per month to $5,000.

That is crazy for a two-bedroom apartment,” says Nicole, a Singaporean living in Tiong Bahru who did not want to give her full name.

Fuelling a large part of this spike in housing costs, especially since the Covid-19 pandemic, has been the movement of rich Chinese, not just tycoons but also talented citizens with specific skills.

Many are fleeing a “common prosperity” campaign — aimed at redistributing more of China’s wealth — and a crackdown on multiple industries including property, healthcare, technology and education.

“Singapore-washing”, where mainland Chinese companies redomicile and rebrand as Singapore-based international businesses as a hedge against geopolitical risk, has increased.

Of 63,801 new corporate entities formed in Singapore last year, 29 per cent had majority foreign ownership, according to analytics group Handshakes.

Of those 7,312 were from China, up from 4,951 in 2021.

Even HongShan, formerly known as Sequoia China, a mainland investment juggernaut which has long focused its financial firepower on Chinese technology start-ups, opened a Singapore office this year.

“It used to be they all fled to Hong Kong but now Singapore has unintentionally become a favoured destination for rich Chinese but also Chinese professionals,” says Low, the former civil servant.

“Of course there is a reaction to that [in Singapore].

They raise prices all around and fuel the politics of envy.”

The city-state drew in more money than ever before in 2021, with S$448bn in new funds, according to the most recent data available from its central bank, a number expected to be even higher for 2022.

But the S$1.8bn money-laundering scandal will reinforce some critics’ view that Singapore acts as a bolt-hole for less-than-respectable money or flight capital.

Since the pandemic, Singapore has seen an explosion of activity in its decentralised financial market: family offices, private banking and new discreet, lightly taxed funds.

These are harder to regulate and to justify as benefiting the mainstream Singaporean economy, for instance there has not been a parallel jump in stock market listings.

“I think the money-laundering probe barely scratches the surface of the illicit activity that has gone on here for years,” says the Singaporean head of a large international investment bank in the city, referring to wealthy Indonesians and other rich south-east Asian individuals who have used the city-state to keep their wealth.

“It is something the government must manage better or risk the rise of populism and xenophobia that has swept through so many other countries.”

Balancing act

The flow of money into Singapore is not only from China, nor is it the only country affected by the way elite Chinese people are shifting money overseas.

But it does provide a colourful, timely example of how Singapore’s neutrality could eventually be affected.

Kenneth Jeyaretnam, the secretary-general of the opposition Reform party, on his Facebook page noted the money-laundering raids took place days after a visit by China’s foreign minister, Wang Yi, and suggested there was “foreign pressure”.

Luxury shops on Orchard Road in Singapore. Some of the wealthy people moving to the city-state are fleeing a ‘common prosperity’ campaign in China, aimed at redistribution © Edwin Koo/Bloomberg

Luxury shops on Orchard Road in Singapore. Some of the wealthy people moving to the city-state are fleeing a ‘common prosperity’ campaign in China, aimed at redistribution © Edwin Koo/BloombergThe PAP has rejected this assertion and issued Jeyaretnam with a correction order under its online falsehoods or so-called fake news law.

The financial regulator said that suspicious fund flows and other inconsistencies with documentation prompted banks in the city state to file reports to the authorities.

One Washington-based policymaker tells the Financial Times that the Biden administration is “watching more closely than ever before” the Chinese companies and people moving to Singapore.

“The more the volumes of money and people that come in, the more Beijing might start to feel it can intervene in Singaporean affairs,” they say.

The Chinese Communist party is often accused of using its soft power machine to influence Singaporeans — the majority of whom are ethnic Chinese — and the mainland Chinese who have emigrated there.

A recent Washington Post report suggested Beijing was using the Singaporean Chinese Lianhe Zaobao newspaper to sway opinions in the city-state.

When asked about the report, Singapore’s ambassador-at-large Chan Heng Chee in August said the government was “well aware of these activities” and was “vigilant against agents of influence of all countries”.

The more the volumes of money and people that come in, the more Beijing might start to feel it can intervene in Singaporean affairs

The Singapore newspaper said in a statement that the Washington Post’s article “made biased comments and unfair statements about Lianhe Zaobao”.

The media organisation added it “takes its mission of delivering information seriously and remains committed to neutrality”.

The PAP formally upgraded its relationship with Beijing this year in areas including technology as well as supply chains.

The two launched a new bilateral defence hotline in June and restarted military drills after a pandemic-related pause.

Singapore has at the same time maintained its close relations with the US military.

But the party admits Singapore’s position is tricky. Wong, the prime minister-in-waiting, this year said the rift between Beijing and Washington “appears insurmountable”.

Singapore has “one foot firmly in each canoe, gaining benefits from both [the US and China],” says Drew Thomson, a visiting senior research fellow at National University of Singapore’s Lee Kuan Yew School of Public Policy.

“But those canoes are drifting apart, can you really play both sides forever?”

0 comments:

Publicar un comentario