$100 Oil Needs Western Drills to Stay Quiet

Saudi Arabia and Russia rely on high oil prices to fund infrastructure projects and the Ukraine war. U.S. and European oil companies are helping them with low investments.

By Carol Ryan

Western oil companies hope that fat dividends and share buybacks can boost their stock valuations. PHOTO: MARIO TAMA/GETTY IMAGES

Western oil companies hope that fat dividends and share buybacks can boost their stock valuations. PHOTO: MARIO TAMA/GETTY IMAGESFrugal U.S. and European oil-and-gas companies are making it easier for Saudi Arabia and Russia to fund their political maneuvers.

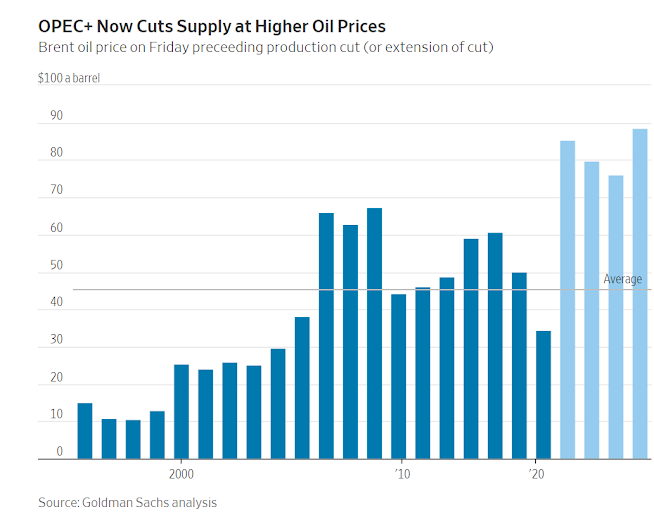

With recently extended voluntary production cuts, the Saudi-led Organization of the Petroleum Exporting Countries and its Russia-led allies are betting that Western producers won’t respond to higher energy prices as much as they used to.

So far, so good for OPEC+.

Even with oil trading above $90 a barrel, 11 fewer rigs were operating in the U.S. on Sept. 22 than one week earlier, and 134 fewer were operating than a year ago, according to oil-field services company Baker Hughes.

The likes of Exxon Mobil and Chevron are under pressure to hand cash to shareholders after years of poor returns.

Listed U.S. oil producers are only reinvesting half of their operating cash flows today, compared with 90% or more in the years leading up to the pandemic, according to Goldman Sachs analyst Daan Struyven.

This may have reassured OPEC+ that it can curb supply, even at unusually high oil prices, without losing as much market share as it did at the peak of the shale boom.

European giants Shell and BP are even less likely to respond quickly to today’s high prices as their projects, especially offshore, can take years to begin production.

Record-high oil demand and lower-than-expected OPEC+ supply point to a shortfall of more than one million barrels a day in the last quarter of 2023.

Many analysts expect the oil price to rise above $100 in the near term.

Looking ahead to 2024, an additional one million barrels a day will be needed to meet demand, according to Bernstein estimates.

Supply from non-OPEC sources may only meet roughly half of this, so the world will rely on the cartel to open the spigots.

Such a tight market is good news for Saudi Arabia and Russia.

The Saudi government needs the oil price to stay above $80 to balance its budget, especially as ritzy infrastructure projects, such as the futuristic desert city Neom, haven’t attracted as much overseas investment as hoped.

Russia is under pressure too.

Since the start of the war in Ukraine, the Kremlin’s fiscal break-even oil price has risen to $114 a barrel, from $64 before the invasion, according to S&P Global Commodity Insights.

Russia would have a lot to lose from a low oil price, which may explain why it has become more compliant with OPEC+ quotas in recent months.

Provided there isn’t a big drop in global demand for oil any time soon, lower spending on new production by Western energy companies should boost OPEC+’s leverage.

Compared with prepandemic levels, Middle Eastern oil companies such as Saudi Aramco and Abu Dhabi’s ADNOC in particular have been reinvesting at a much faster clip than the U.S. and European supermajors.

The trend is expected to continue at least through 2025, according to Rystad Energy analyst Olga Savenkova.

Russia and Saudi Arabia still need to be careful about how high they push prices to avoid denting demand and making investments in alternative sources of energy such as solar and wind more attractive.

Warren Patterson, head of commodities strategy at ING, also points out that OPEC could face geopolitical pressure to release more supply in 2024.

Both the U.S. and India—a large consumer of Russian oil—are holding elections next year and will be sensitive to how voters feel about gasoline prices.

Western oil companies hope that fat dividends and share buybacks can boost their stock valuations.

But the downside of their lavishing investors is becoming clearer: Oil suppliers that put national interests first are increasingly running the show.

0 comments:

Publicar un comentario