Western leaders are making a sensible bet on India

Its population and economy are both forecast to grow rapidly over coming decades, offering a counterweight to China

Martin Wolf

The enemy of my enemy is my friend.

On this basis, closer western relations with India make good sense.

Joe Biden’s warm embrace of the once-banned Narendra Modi, now its politically dominant prime minister, in Washington and Emmanuel Macron’s equally warm embrace of the Indian leader in Paris are aimed at forging a close relationship with a country expected to be a powerful counterweight to China.

Is this a good bet for western powers?

Yes.

India is indeed likely to be a rising great power.

Interests also align.

But how far values are shared is a more open question.

Where is India now and where might it go, economically and politically?

Today, India has the world’s fifth-largest economy at market prices and third largest at purchasing power.

Its population is 1.43bn, almost exactly the same as China’s.

By 2050, however, India’s population is forecast by the UN to reach 1.67bn, against 1.31bn in China.

India’s GDP per head (at purchasing power) is close to 40 per cent of China’s levels, according to the IMF.

Back in 1990, India and China were both almost equally poor, with GDP per head, measured at purchasing power, estimated at 4.6 per cent and 4.1 per cent of US levels, respectively.

In what is surely the most remarkable economic performance in world history, China’s GDP per head reached 28 per cent of US levels last year, against India’s 11 per cent.

Yet, while China’s relative performance was incomparably the best, India came second among the seven largest emerging economies.

China’s was an extreme example of the most successful development strategy of the modern era — high investment, rapid industrialisation and progressive upgrading of exports of manufactures.

This was also Japan’s path.

India has followed a very different one.

Between 2014 and 2023, its investment rate has averaged just 31 per cent of GDP, against China’s 44 per cent, and its national savings rate averaged 30 per cent, against China’s 45 per cent.

More strikingly, the share of manufacturing in India’s GDP has been falling, not rising, as would have been expected at this stage in its development.

This share was 13 per cent of GDP in 2022, against China’s 28 per cent.

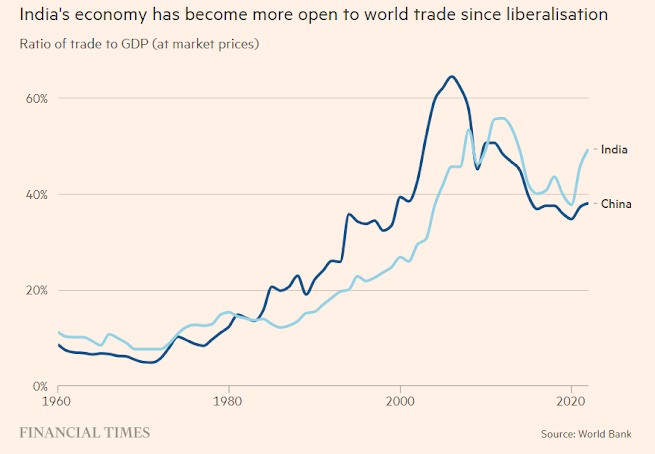

While the ratios of trade to GDP (at market prices) have become roughly equal, China is by now a far bigger exporter to world markets.

What then might lie ahead?

Let us start with the fundamentals.

India’s gross savings rate, though not as high as China’s, is high enough, particularly given the possibility of importing capital, to finance a growth rate of at least 5-6 per cent.

India also has reasonable macroeconomic stability.

Entrepreneurship is abundant and infrastructure is improving.

India will definitely not suffer from labour shortages, but the opposite.

As Ashoka Mody notes in India is Broken, the inability to generate sufficient good jobs is a great failure.

Yet another is the inability to educate the population to a high standard: human capital is likely to prove a far tighter constraint than physical capital.

India is an obvious location for companies following a “China plus one” strategy.

It also has the advantage over obvious competitors of a large home market.

Nevertheless, India has repeatedly failed to exploit opportunities for fast growth of exports of manufactures over the last 75 years.

Suspicion of open trade always gets in the way.

As was true of many other countries, India has suffered from an overhang of bad debt since the global financial crisis.

This “twin balance sheet problem” was a significant constraint on growth.

But, argues this year’s Economic Survey, “in the course of the last decade, Indian non-financial private sector debt and non-financial corporate debt as a share of GDP declined by nearly 30 percentage points”.

Bank balance sheets have also been repaired. In all, the credit engine is once again in quite good shape.

The IMF forecasts annual economic growth at a little over 6 per cent from 2023 to 2028, with GDP per head growing at roughly one percentage point more slowly.

Such growth would be quite close to the averages of the past three decades.

Provided the country is not buffeted by big global or domestic shocks, this sounds perfectly feasible, even rather plausible.

But what about the longer term?

Remember that India still has huge room for catching up.

It is also a young country, with a grossly underemployed labour force, potential for improving the quality of that labour force, a reasonably high savings rate and increasingly widespread hopes of greater prosperity.

A great deal of adaptation will be required to meet the climate change challenge, given the failure to bring global emissions down.

But the energy transition also offers huge opportunities to India.

On balance, I judge that India should be able to sustain growth of GDP per head at 5 per cent a year, or so, up to 2050.

With better policies, growth might even be a bit higher, though it could also be lower.

So, let us assume that India’s GDP per head continues to grow at 5 per cent a year, while that of the US grows at 1.4 per cent, roughly as it has over the last three decades.

Then, by 2050, India’s GDP per head (at purchasing power) would reach about 30 per cent of US levels, roughly where China’s is today.

According to UN median forecasts, India’s population would also be 4.4 times as big as that of the US.

So, its economy would be some 30 per cent larger than the US’s.

It is, in sum, quite reasonable to assume that India will become a great power.

It is not that hard to imagine that its economy will be of a similar size to that of the US by 2050.

Thus, western leaders are making a sensible bet on an alliance of convenience with India.

But will India also be a liberal democracy?

I will discuss that issue next week.

0 comments:

Publicar un comentario