Fixing Burger King’s Royal Mess

Struggling fast-food chain’s turnaround will take time to pay off

By Spencer Jakab

An infusion of cash and discipline at what had been a neglected franchise is showing results in its early stages. PHOTO: JORGE SILVA/REUTERS

An infusion of cash and discipline at what had been a neglected franchise is showing results in its early stages. PHOTO: JORGE SILVA/REUTERSBurger King, the longtime No. 2 U.S. burger chain, looked even more like a pretender to the throne after slipping to third place in 2020 behind Wendy’s by revenue.

But market share was the least of its concerns after the pandemic roiled the restaurant industry.

Its franchisees have seen revenue and profitability sag, and two of its largest owners have been forced into bankruptcy recently with another failing to pay royalties.

Now the chain is nine months into a mission to “reclaim the flame”—a tough-love approach to beef up its best operators and encourage weaker ones to cut back.

There is good news and bad news for investors in parent Restaurant Brands International, which also owns Tim Hortons, Popeyes and Firehouse Subs.

On the positive side, an infusion of cash and discipline at what had been a neglected franchise that has changed owners several times over the decades, including two private-equity overseers, is showing results in its early stages.

The 2021 appointment of 35-year Domino’s Pizza veteran Tom Curtis as Burger King’s president for the U.S. and Canada has been well-received.

Between its initial public offering in 2004 and the end of 2021, Domino’s shareholders had a total return more than five times as high as McDonald’s.

While history is unlikely to repeat, RBI stock has outpaced its rival by nearly 40 percentage points over the past year.

The bad news: The Golden Arches continues to tower over Burger King on virtually every operating measure that matters.

Unlike the Burger Wars of the 1980s, when Burger King gave as good as it got, clever marketing and new sandwiches can’t move the needle much on their own.

And, as its recent Ch’King flop shows, new products involve execution risk.

According to a ranking last year of top U.S. quick-serve restaurants by QSR Magazine, Burger King placed 12th out of 15 burger concepts by average unit volume at $1.47 million a year.

McDonald’s and five other chains had $3 million or more.

And in the increasingly vital digital realm, McDonald’s stands alone among restaurants in terms of presence on customers’ smartphones.

Its app was downloaded 40 million times in the U.S. last year, according to Apptopia, compared with 7.1 million times for Burger King, good for ninth place.

Curtis told an Evercore ISI audience last week that “operations and the marketing have improved dramatically” as franchisees are being given letter grades.

Its “Royal Reset” plan for its approximately 7,000 U.S. restaurants involves carrots as well as sticks, showering high performers with $250 million for equipment and remodeling and $150 million in marketing and digital spending.

If its initiatives begin to bear fruit, with average restaurant earnings before interest, tax, depreciation and amortization reaching $175,000 annually by 2024, the parent company has promised to kick in more cash for advertising. Last year average restaurant Ebitda was about $140,000, according to the chain.

Even with a minority of the promised sums invested, there has been some improvement with comparable sales growing by 10.8% in the first quarter from a year earlier.

Investing in only the strongest franchisees makes sense—there is no reason to water your weeds.

Fast-food chains with financially weak partners have a harder time pushing through promotional discounts or launching products that might require a new piece of equipment.

Dirty, understaffed or poorly located restaurants detract from a chain’s overall corporate image.

But continuing cost pressures and now signs of fatigue by core fast-food customers, who skew younger and lower income, are weighing on quick-serve restaurants.

Along with Wendy’s, Jack in the Box, Shake Shack and even Taco Bell owner Yum Brands, 2023 earnings-per-share forecasts for RBI have slipped over the past 12 months, according to FactSet.

The sole exception?

McDonald’s, which seems to be moving from strength to strength.

One seeming positive for the whole sector is a recent, rapid reversal in food and freight costs and an easier time hiring burger flippers.

But if that is a precursor to what many economists predict is an oncoming U.S. recession, then it will be a Pyrrhic victory.

People don’t stop eating fast food altogether in an economic downturn, but they do become more discerning.

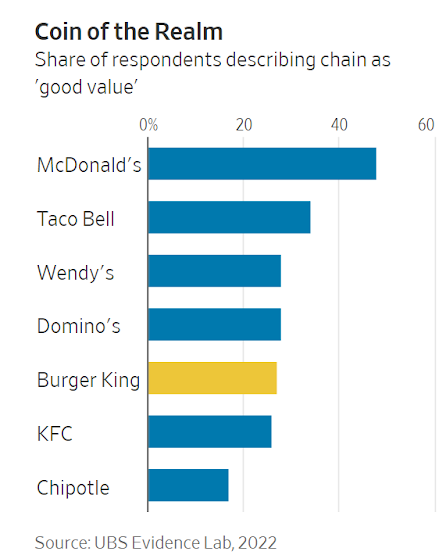

In an ominous sign, a 2022 UBS Evidence Lab survey of consumers found that only 27% considered Burger King to offer “good value.”

No prizes for guessing which chain was No. 1 in the category with 48% of respondents saying so, likely because of its ability to push out digital promotions: McDonald’s.

You come at the king, you best not miss.

0 comments:

Publicar un comentario