How Elon Musk Could Solve His Tesla-Twitter Puzzle

A Starlink IPO could raise billions of dollars and mean less selling of Tesla in the years ahead.

By Al Root

SpaceX has revived the U.S.’s moribund space program and restored it to global launch dominance. ILLUSTRATION BY IBRAHIM RAYINTAKATH

SpaceX is the most valuable space company in the world—and it might offer Elon Musk the key to unlocking his empire.

It’s hard to feel pity for the world’s second-richest person.

Musk is estimated to be worth about $180 billion, the combined value of his stakes in Tesla TSLA -2.38% (ticker: TSLA), SpaceX, Neuralink, the Boring Co., and Twitter, among other investments.

The problem, though, is that all but Tesla are privately held, and therefore illiquid.

When Musk needs money, his only option is to sell Tesla stock.

That was the case from April to December 2022, when Musk was forced to sell some $23 billion in Tesla shares to keep Twitter afloat, one of the reasons the stock tumbled more than 50% during that period.

What Musk really needs is another publicly traded company that would allow him to unlock some of his wealth—and take the pressure off Tesla.

And that’s where SpaceX comes in.

To call the company wildly successful would be an understatement.

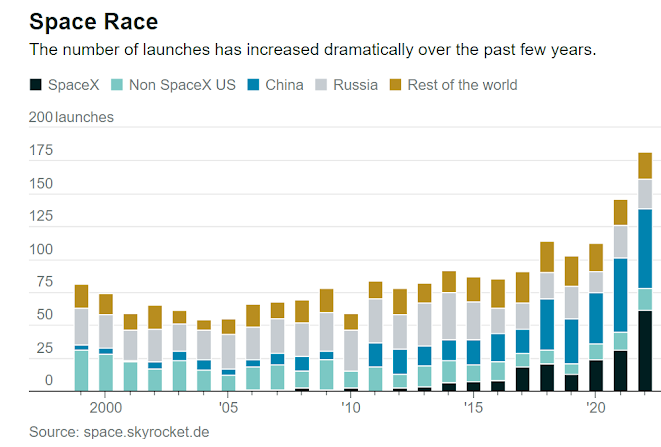

SpaceX has been sending astronauts to the International Space Station and surrounding the Earth with its Starlink satellites, and has even revived the U.S.’s moribund space program and restored it to global launch dominance.

Its businesses are starting to make money, too.

Each launch could bring in from $150 million to $300 million in sales, and Starlink was sporting one million subscribers at the end of 2022.

An initial public offering isn’t out of the question, and it might be just what Musk and Tesla shareholders need.

“I am confused [as] to why the board of directors allowed Elon to crash Tesla’s stock price,” says Leo Koguan, Tesla’s third-largest individual investor behind Musk and Larry Ellison.

“Why not sell shares of SpaceX?”

Why not, indeed.

Don’t let the recent explosion of SpaceX’s Starship fool you—SpaceX is light-years ahead of the competition.

Right now, the focus is on its Starship launch system, the largest ever built, with more than double the payload capacity of the National Aeronautics and Space Administration’s Space Launch System, or SLS, which is part of the Artemis program to return U.S. astronauts to the moon.

Starship is the first system designed to be fully reusable, moving beyond the current SpaceX system, where only the lower stage gets reused.

Success would mean larger payloads and lower costs, making Starlink and other space-based businesses more competitive.

SpaceX is planning to build a constellation of roughly 30,000 satellites to offer its Wi-Fi service. ILLUSTRATION BY IBRAHIM RAYINTAKATH

SpaceX is planning to build a constellation of roughly 30,000 satellites to offer its Wi-Fi service. ILLUSTRATION BY IBRAHIM RAYINTAKATH“We believe that a successful orbital launch of SpaceX’s Starship vehicle could be the most important event in the formation of the space economy since Sputnik launched in 1957,” notes Credit Suisse analyst Scott Deuschle, adding that a combination of size, reusability, and ease of manufacturing could drop the cost of reaching a low Earth orbit by a factor of 30.

The first integrated test with both halves of the unmanned Starship ended with a “rapid, unscheduled disassembly” event, SpaceX lingo for when something blows up.

But failure isn’t a bad thing.

SpaceX has launched more than 220 rockets in its 21-year history, and blown up several of them before the technology to reuse rockets was mastered.

The reusability and development strategy is far different from the strategy used by United Launch Alliance, jointly owned by Boeing BA -0.56% (BA) and Lockheed Martin (LMT), which aims for perfection, adding costs and slowing development.

The traditional space industry still doesn’t reuse rockets, and the United Launch Alliance still primarily serves the U.S. government.

The strategy of actively courting failure has worked for SpaceX.

Over its life, SpaceX has spent something in the range of $10 billion, and it has a constellation of roughly 4,000 satellites, reusable spacecraft, reusable rockets, and its own launch complex in Boca Chica, Texas, to show for it.

NASA, on the other hand, has spent more than $20 billion and 11 years developing SLS, which started around the time that the famously expensive Space Shuttle was mothballed.

SLS is more powerful than the rocket that took the first astronauts to the moon, but it has had just one launch since starting development in 2011.

SpaceX launched 61 rockets in 2022.

“SpaceX showed that failing and trying again was far cheaper and more effective than traditional space development,” says Hélène Huby, co-founder of the Exploration Co., which is working on reusable spacecraft.

The upstarts are having trouble keeping up.

Richard Branson’s Virgin Orbit Holdings (VORBQ), a satellite launch company, filed for bankruptcy in April, and shares of Virgin Galactic Holdings SPCE -1.23% (SPCE), his space travel company, have tumbled 92% since peaking in February 2021.

Companies such as Momentus (MNTS), Astra Space (ASTR), and Spire Global (SPIR), which came public via special purpose acquisition companies in 2021, all trade for less than $1 a share.

Even Amazon.com AMZN -1.71%(AMZN) founder Jeff Bezos’ Blue Origin, founded in 2000 with the motto gradatim ferociter—Latin for “step by step, ferociously”—hasn’t conducted an orbital flight.

Blue Origin was also late delivering engines to United Launch Alliance, and the Vulcan rocket they will be used on has yet to make an orbital flight.

The company doesn’t act with the same sense of urgency as SpaceX, multiple industry professionals tell Barron’s.

Blue Origin points out that it has conducted 23 launches of its New Shepard fully reusable vehicle that has carried more than 100 payloads and 31 people to space.

And while it may be lagging behind SpaceX, there is room for more than one player, says Micah Walter-Range, co-founder of space consulting firm Caelus Partners.

“Governments like to avoid monopolies,” he says.

It isn’t all about launches.

Starlink, SpaceX’s space-based Wi-Fi business, has thousands of satellites orbiting the Earth, providing high-speed internet service for about $110 a month.

The scale and growth of Starlink have the business on pace to generate sales of about $1.8 billion in 2023, double that of 2022.

And of all Musk’s privately held businesses, Starlink is the one that looks most ready to stand on its own.

Even Musk acknowledged as much in 2021, when he said that he might take Starlink public when cash flows are predictable—and cash flow now appears to be getting predictable.

Whether Musk should IPO Starlink comes down to how much it would fetch from investors.

The private markets aren’t much help. Though SpaceX was valued at $137 billion in its last funding round, its shares haven’t been changing hands on platforms that specialize in facilitating private transactions as frequently.

Rainmaker Securities, for instance, has traded more than $4 billion in SpaceX stock in transactions stretching back more than five years.

Rainmaker CEO Glen Anderson has seen a troubling trend in shares recently—they aren’t trading.

“Six months ago, if we got a SpaceX block, it sold in two, three days,” he says.

“Now, we’ve had SpaceX blocks on the books for two months.”

It’s tough to know exactly why that’s the case.

The easiest thing to point to is the market.

The Nasdaq Composite COMP -0.35% is off more than 20% from its peak, as the Federal Reserve has raised interest rates in an attempt to lower inflation.

Rising rates tend to hit richly valued stocks harder than most.

SpaceX might not be publicly traded, but it is a growth company, and even private-market valuations aren’t immune to the Fed.

That makes figuring out how much Starlink would be worth in an IPO even more difficult.

At about $140 billion, SpaceX is worth less than Boeing’s value of roughly $170 billion, including debt and equity.

It’s a lofty valuation, even for a company that has perfected reusable rockets, driven down the cost of reaching space, restored America’s space-launch leadership lost to China, ferried NASA astronauts to the International Space Station, and started a space-based Wi-Fi business that now has an estimated 1.2 million subscribers.

Comparables to Starlink are hard to find.

There’s HughesNet, which is owned by EchoStar (SATS) and has 1.2 million Wi-Fi subscribers.

The entire EchoStar business, which also includes satellite services sold to news organizations and the government, is valued at $1.3 billion, and the stock trades for about 23 times estimated 2023 earnings.

HughesNet isn’t growing, though—a big difference from SpaceX, which wouldn’t be worth $140 billion if Starlink subscribers were hitting a peak.

Verizon Communications (VZ) might be a better comparison.

The company, which has 143 million subscribers, is valued at $335 billion including debt and equity, or roughly $2,300 a subscriber.

By that math, Starlink needs to get to 50 million or 60 million subscribers to justify the total SpaceX valuation.

Even that is an imperfect comparison, however, because it doesn’t consider the cost of building out the Starlink network, how profitable Starlink could become, or if the company will be able to substantially lower the cost of providing high-speed internet.

Despite the uncertainty, Starlink is the business that investors are most likely to be able to purchase sooner rather than later.

SpaceX is planning to build a constellation of roughly 30,000 satellites to offer its Wi-Fi service, which could take up to $10 billion just to build based on estimates of current pricing, and a capital raise seems likely.

SpaceX hasn’t responded to multiple requests for comment.

An IPO, even at a valuation of $70 billion—assuming Starlink is worth half of SpaceX’s total value—would help Starlink raise that money without having to go to another round of private funding.

It would also allow Musk, who owns an estimated 42% of SpaceX, to free up some $30 billion and give him another company’s shares to sell when it’s time to pay taxes or buy a social-media platform.

For Tesla shareholders, that would be a successful IPO, no matter the valuation.

0 comments:

Publicar un comentario