Zillow Signals More Pain Ahead in Online Real Estate

Investors don’t seem to appreciate the difficulties faced by online home buying platforms

By Laura Forman

Zillow is telling investors that housing affordability challenges remain ‘front and center’ this year. / PHOTO: TIFFANY HAGLER-GEARD/BLOOMBERG NEWS

Zillow is telling investors that housing affordability challenges remain ‘front and center’ this year. / PHOTO: TIFFANY HAGLER-GEARD/BLOOMBERG NEWSInvestors in online real estate platforms probably could waste a lot of energy figuring out how low home prices will go or whether mortgage rates have topped out, but common sense beats all that number crunching.

What good is investing in a housing “super app” if far fewer people are buying houses?

U.S. home purchases fell more than 40% in the fourth quarter from a year earlier, Redfin RDFN 9.93%increase; green up pointing triangle reported this week.

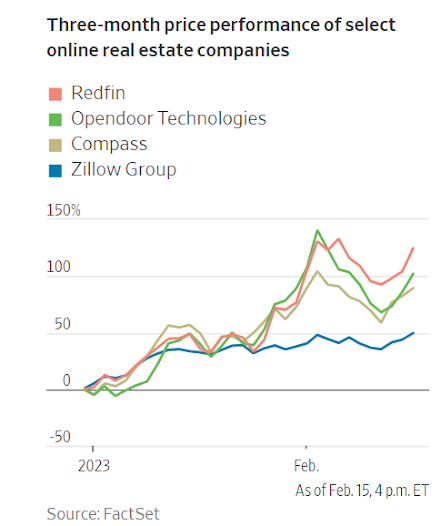

Meanwhile, online real-estate stocks including Zillow Group Z 4.28%increase; green up pointing triangle, Redfin, Opendoor Technologies OPEN 8.33%increase; green up pointing triangle and Compass COMP 3.76%increase; green up pointing triangle are up an average of more than 90% this year so far.

That is probably wishful thinking.

Zillow’s shares rose another 2% after hours Wednesday, after the company said fourth-quarter revenue and adjusted earnings beat its own outlook and Wall Street’s estimates.

Chief Executive Rich Barton was clear the industry isn’t out of the woods, though.

Industrywide forecasts for the housing market this year range from a serious crash to a mere slump.

Indeed, in Wednesday’s shareholder letter, Mr. Barton wrote that housing affordability challenges remain “front and center” in the new year, affecting supply and demand.

Zillow’s outlook called for industry transaction dollars to decline by as much as 35% from a year earlier in the first quarter.

Visits to Zillow’s apps and websites were down 5% year-over-year in the fourth quarter—a sign of ebbing consumer interest in home buying in the current economy.

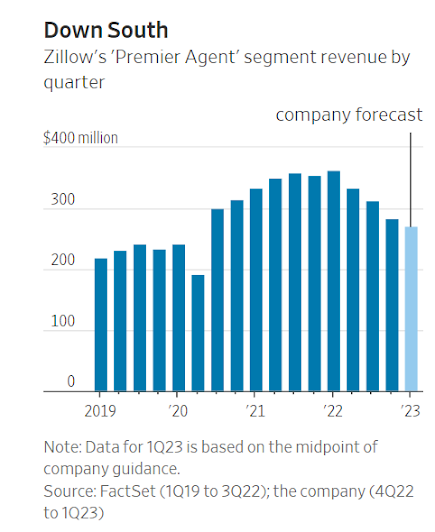

Agents seem to be pulling back on spending too: For the first quarter, Zillow said its agent ads business could see sales fall as much as 28% over the year-earlier period.

Those expected declines, coupled with investments in new products, led to a first-quarter adjusted earnings before interest, taxes, depreciation and amortization forecast that was 40% below what analysts’ had been modeling at the low end of the company’s guidance range.

Redfin will report its earnings Thursday, with Compass and Opendoor following over the next two weeks.

Investors should be prepared for more disappointments.

Automated home flipper Opendoor, for example, has significantly trimmed its buying efforts, according to ATTOM data, likely in reaction to the market’s turn.

An analysis published this week by global real-estate tech strategist Mike DelPrete shows Opendoor bought somewhere around 5,000 homes in a single month last summer, but it was buying fewer than 1,000 homes by December.

Such a sharp decline in physical buying, paired with the iBuyer’s recent emphasis on more asset-light products, seem to call into question the viability of the iBuying model altogether, particularly as competitors Zillow and Redfin have already left the arena.

As Mr. DelPrete put it, “an iBuyer must buy homes to generate revenue and remain relevant.”

Buying fewer homes amid a market decline might mean losing less money, but it certainly doesn’t mean making any.

Citing YipitData, Mr. DelPrete’s analysis shows buy-to-sale premiums—the way an iBuyer would ostensibly profit—turned negative around the middle of last year and haven’t yet meaningfully recovered.

According to Redfin, investors are buying roughly half as many homes as they were a year ago, making it hard for iBuyers to find alternative ways to turn profits in a higher mortgage-rate environment where individual home buyers have less buying power.

Without iBuying, online real-estate companies are now trying to make money in less risky businesses.

Diversification is proving costly, though.

Wall Street is forecasting Zillow, for example, will lose tens of millions of dollars in mortgages this year on the basis of adjusted Ebitda.

Even two years ago, when a Mortgage Bankers’ Association report showed 96% of mortgage lenders making money amid record low mortgage rates, Zillow still logged losses.

Its failure in iBuying and mortgages highlight the value of old school professionals’ understanding of each market’s idiosyncrasies.

The company says it was merely subscale in the mortgage business and that it is investing for growth.

Consumers might crave a one-stop digital shop for all their real-estate needs, as online real-estate companies attest, but profitably disrupting a historically fragmented market won’t be easy.

It is hard enough to compete with experienced individuals in a bull market, and we aren’t in one.

0 comments:

Publicar un comentario