Made in the U.S.A.: Natural-Gas Prices

Warm weather, ample storage bring prices down to reflect local realities

By Jinjoo Lee

Barring a dramatic swing to frigid weather, 2023 is likely to feature more muted natural-gas prices that reflect local dynamics./ PHOTO: BING GUAN/BLOOMBERG NEWS

Barring a dramatic swing to frigid weather, 2023 is likely to feature more muted natural-gas prices that reflect local dynamics./ PHOTO: BING GUAN/BLOOMBERG NEWSWhy was American natural gas so expensive last year?

With U.S. and European prices moving in tandem, it was easy to forget that the commodity is largely homebound—produced and consumed domestically.

Warm weather and replenished inventories are now shifting the focus back to home dynamics.

The U.S. is still only halfway through the heating season, but benchmark Henry Hub futures prices have plunged by 23% since Christmas, landing at $3.91 per million British thermal units.

For context, that is 40% below the 2022 average and a whopping 60% below the peak seen last summer.

Warm weather—both in North America and in Europe—played a big role.

The extreme Arctic chill in late December was brutal but short-lived, and the U.S. is starting off with the warmest January in 15 or more years, according to Eli Rubin, senior energy analyst at EBW Analytics.

Last year’s natural-gas prices baked in a lot of fear as Russia sharply curtailed supplies of the fuel to Europe, where storage badly needed a refill ahead of last winter.

Christopher Louney, commodity analyst at RBC Capital Markets, estimates that the so-called geopolitical premium in U.S. prices was $2 to $3 per MMBtu at various points last year.

At their peak in August, European benchmark prices exceeded $100/MMBtu.

Around the same time, U.S. natural-gas prices peaked at nearly $10/MMBtu as markets put a sharp focus on the price it would take for the U.S. to compete with desperate European buyers.

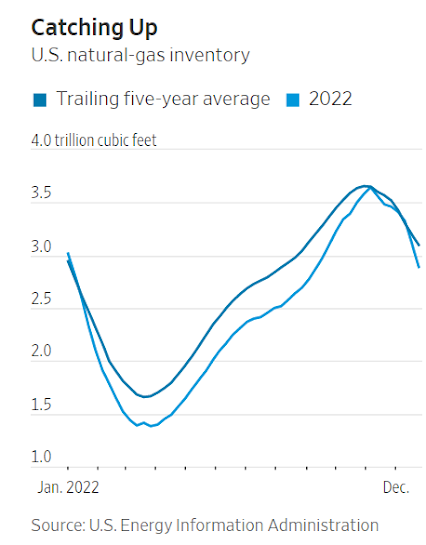

Domestic natural-gas storage around that time was 12%-13% below the trailing five-year average.

Storage is looking a lot better today on both sides of the Atlantic.

In the U.S., there was nearly 2.9 trillion cubic feet of natural gas in storage as of Dec. 30, falling safely within the trailing five-year range and just 6.7% below the five-year average.

In the European Union, natural-gas storage is at roughly 83% of capacity, a healthy cushion compared with the 51% level a year earlier, according to industry body Gas Infrastructure Europe.

Even though the U.S. is one of the largest exporters of liquefied natural gas or LNG, most of what it produces is consumed domestically.

Monthly U.S. natural-gas exports were around 553.7 billion cubic feet as of October 2022, or about 16% of total U.S. production that month.

Of that, LNG exports—which are shipped rather than piped—comprised 9% of total production.

Barring a dramatic swing to frigid weather, 2023 is likely to feature more muted natural-gas prices that reflect local dynamics.

European natural-gas prices could still rebound later in the year as the continent tries to rebuild inventory with minimal Russian gas.

Ample local storage should shield against some of that volatility, as should the fixed amount of LNG export capacity.

No new U.S. export LNG terminals are scheduled to start operating until 2024.

Freeport LNG, a large, existing facility that shut down in June due to a fire, is now expected to resume operating in the second half of January, but that only adds about 60 billion cubic feet per month of total export capacity.

The longer-term outlook for natural gas looks more bullish.

The U.S. is slated to add roughly 40% more LNG export capacity to today’s levels between 2024 and 2026.

Meanwhile, around 27% of operating coal-fired power plants in the U.S. were expected to retire between 2022 and 2029, according to the EIA.

That might leave limited room for the U.S. to switch to coal for power when natural-gas prices spike.

For the time being, the weather forecast is going to be a better gauge of where U.S. natural-gas prices are headed than geopolitics.

0 comments:

Publicar un comentario