Copper and Aluminum Bulls are Running Too Fast

As China moves from ‘zero Covid,’ metals are rallying in hopes of a quick economic rebound

By Megha Mandavia

Aluminum prices are up about a fifth from their late September lows./ PHOTO: LUKE SHARRETT/BLOOMBERG NEWS

Aluminum prices are up about a fifth from their late September lows./ PHOTO: LUKE SHARRETT/BLOOMBERG NEWSThe cliché is that when China sneezes, commodities catch a cold.

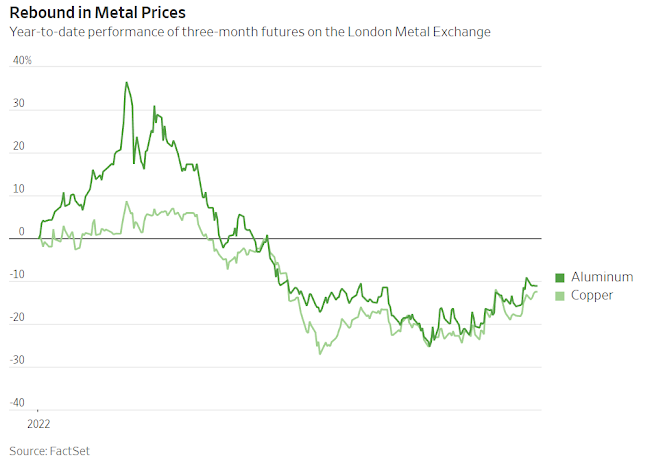

Logically, then, when it’s feeling better the commodity complex should too: Industrial metals like copper, aluminum and iron ore have staged an impressive rally recently as signs that China is preparing to reopen become more obvious.

This time, however, there are a few wrinkles that should give investors pause: especially the still-dire state of the nation’s housing market, which constitutes the single largest source of global demand for metals like iron ore.

Copper is trading at around $8,536 per metric ton on the London Metal Exchange, up about a fifth from the lows of July this year, according to FactSet.

Aluminum prices on the LME are also up about a fifth from their late September lows.

Iron ore was late to join the party, but prices have now rallied 23% over the past month, CEIC data shows.

There are some legitimate reasons for optimism: a weaker dollar and the end of China’s policy paralysis on Covid-19 and its property market.

But investors seem to be ignoring the forest, which remains rather dark and gloomy, for a few budding trees.

While it’s true that China appears to finally be abandoning the suite of “zero-Covid” policies that punished the economy for so long, the reopening process is likely to be bumpy and traumatic.

Covid-19 will now almost certainly spread rapidly, straining hospitals, spooking many consumers and—potentially—forcing new rounds of restrictions in some areas.

Moreover, while Beijing’s recently announced support for languishing Chinese property developers suggests the worst for iron ore prices may be over, the housing market and actual investment remain deeply depressed.

Real-estate investment fell 8.8% in the first 10 months of 2022 compared with a year earlier.

The shift away from zero-Covid and additional support for the property sector will eventually drive a recovery in domestic demand, notes Capital Economics, but probably not until the second half of next year.

Some analysts see ample supply as another potential headwind.

Citi says that copper supply now likely exceeds demand, and that aluminum shifted into surplus during the third quarter.

The bank expects further economic weakness, as well as seasonal softness, to limit the further upside for metals prices—and says that metals such as copper are pricing a major near-term recovery in demand growth, which is unlikely to materialize.

Much of the developed world is perched on the edge of recession—whether or not it will fall over is still unclear.

China, meanwhile, faces a long, hard road back to normalcy.

The recovery will come eventually, but a little caution on the part of metals investors now might prevent some heartburn down the line.

0 comments:

Publicar un comentario