Recession Is Already Here for Many Small Businesses

By Lisa Beilfuss

Jeffrey Bastoky and Ann Bastoky of Best Friends Butler Service, a pooper-scooper service in Coral Springs, Fla. / Photograph by Erika Larsen

Jeffrey Bastoky and Ann Bastoky of Best Friends Butler Service, a pooper-scooper service in Coral Springs, Fla. / Photograph by Erika LarsenWhen central bankers and economists gather in Jackson Hole, Wyo., this coming week to debate the trajectories of inflation and monetary policy, there will be hopeful talk of peak prices and renewed discussion of softish landings.

They will be missing the point.

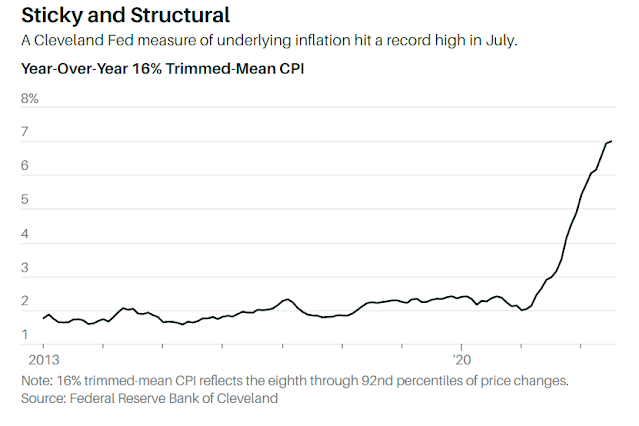

For small businesses and households across America, recession isn’t an abstract concept or technical definition.

It is a reality that many say they have felt since the start of this year, as rapidly rising prices ate into consumers’ budgets, hit firms’ profit margins, and pushed the cost of credit higher.

Recently, the pain has lessened.

A slowdown in major inflation gauges alongside an indication of robust hiring have investors betting anew on a “Goldilocks economy” that gently falls back into balance and allows for the Federal Reserve to stop tightening sooner than previously expected.

The improvement over the past month in economic conditions for some consumers and businesses is a welcome development, and it is driving this summer of market rallies.

But it is a reprieve owing to lower gasoline prices, where the decline is mostly the result of government intervention.

The economy for many consumers and small-business owners is still hurtling toward recession—one that is probably coming sooner and harder than many investors, policy makers, and politicians want to acknowledge, and one that will be accompanied by still-elevated prices.

“There is a perception that the economy has stabilized, but this is not a straight line down.

It is not unusual to have temporary pickups in a slowdown,” says Nancy Lazar, chief global economist at Piper Sandler.

“There’s a view that as long as it’s not like 2008, it’s not a big deal, but this recession will be worse than people are thinking, and I worry it will be more prolonged.”

In Albuquerque, N.M., Matthew Gabel’s business had a brutal first half of the year.

Conditions at Serafian’s Oriental Rugs got progressively worse by the month and then fell off a cliff in June, and Gabel prepared for the recession he felt unfolding by cutting advertising and holding off on filling an open position.

Then the price of gas fell after topping $5 a gallon, and business simultaneously improved.

Gabel says that while his customers generally have considerable disposable income, rising prices—of gas in particular—still hit sentiment and affect spending.

“Nobody needs what I sell.

It’s a luxury item.

We very quickly feel the pinch when we go into recession,” says Gabel.

For now, he is enjoying a bump he attributes to the fall in gas prices.

But he says this year’s slowdown has felt more real than others through the years, and he isn’t betting he is out of the woods.

That’s for good reason.

Some analysts say that while a mild fall in demand has weighed on energy prices, the drop in gas prices is largely due to the government’s release of strategic petroleum reserves.

The Biden administration in the spring announced it would release a record one million barrels a day of oil for six months from the SPR, and then late last month the government said it would sell an additional 20 million barrels of oil.

Prices of oil have fallen 35% from a March high of about $124 a barrel.

The increase in supply because of emergency reserve draws isn’t exactly a good or sustainable reason for lower gas prices, says Lyn Alden, founder of Lyn Alden Investment Strategy.

The war in Ukraine is ongoing, and domestic supply is constrained.

Moreover, the SPR impact may wind up working in reverse.

Oil reserves have dropped to the lowest level since the mid-1980s, and sales are supposed to continue until October, just before midterm elections.

Alden says that when the government stops selling reserves, the impact on prices will become neutral.

The risk, she says, is that when the SPR is eventually refilled, the purchases will be at higher prices than when the sales occurred—meaning the downward pressure on prices that is boosting economic activity and pushing headline inflation lower flips to an upward force.

Ann Bastoky spends $90 a week on gas to power the Best Friends Butler Service truck. / Photograph by Erika Larsen

Ann Bastoky spends $90 a week on gas to power the Best Friends Butler Service truck. / Photograph by Erika LarsenAt the same time, some analysts say President Joe Biden’s tax and spending bill could worsen inflation.

Consider that Ford Motor (ticker: F) and General Motors (GM) recently raised the prices of some electric-vehicle models by roughly the amount of the tax credit included in the legislation.

For many small businesses and consumers, the recent pullback in the price of gas isn’t enough.

Ann Bastoky of Coral Gables, Fla., owner of Best Friend Butler Services, has lost a number of customers recently.

Demand, though, isn’t the real problem.

Gas costs her $90 a week—down from about $130 earlier this summer but still double what it used to cost—as the prices of everything else continue to climb.

Trash bags rise about a dollar every six months, trash-hauling fees are up, and Bastoky says that her liability-insurance premium increased significantly over the past year.

She is giving her employees, one full time and the other part time, gas stipends and recently added a small gas fee to customers’ invoices.

For Bastoky, the debate over whether inflation has peaked seems irrelevant because prices at these levels are so painful.

Like many small-business owners, Bastoky is hesitant to fully pass on higher prices to her customers at a time when people are experiencing inflation in virtually every aspect of their lives.

“Most of it I’ve chomped on and am making less money,” Bastoky says.

Her husband, Jeffrey, says the family is meanwhile cutting back on its own spending, canceling travel, eating out less, and thinking twice before making discretionary purchases.

Facing rising condo fees and more-expensive grocery bills, Ann and Jeffrey’s daughter, Elana, has started coming over for dinner three or more times a week to save money.

While higher prices have meant some families and businesses are spending less on nonessentials, they also are artificially supporting some growth data.

Consider Home Depot ’s (HD) recent earnings report, which showed a 3% sequential fall in customer transactions offset a rise in the average receipt.

That is as business improved for Walmart (WMT) in July, as higher-income consumers are trading down and shopping there, notes Peter Boockvar, chief investment officer at Bleakley Financial Group.

Google mobility data show that visits to places like restaurants and shopping centers are still down 5% since the pandemic’s start, as visits to typically free sites, including beaches and parks, are up 47%.

All of that makes it reasonable to question the widely held assumption that consumer and business balance sheets are healthy enough to let the U.S. economy avert a recession or experience only a mild one.

Behind that premise is the pile of cash that consumers accumulated since the start of the pandemic, a result of fiscal transfers, debt forbearance, and more time at home.

But that cushion has dwindled to about $1 trillion, says Ed Yardeni, president of Yardeni Research.

A recent report from economists at Goldman Sachs says the growth boost from excess savings is “probably mostly behind us,” noting that data from big banks suggests that lower-income households with higher propensities to spend are running out of savings.

Consumer credit growth, meanwhile, is accelerating.

Oxford Economics says revolving credit—which includes credit cards—rose 14% in June from a year earlier, the fastest pace since 1996, and suggests that households are borrowing more to finance spending.

Economists there say there is room for more borrowing—Fed data show outstanding credit-card debt was 21% of available credit at the end of the second quarter, versus a long-term average of 25%—but there are signs of trouble.

Delinquencies are still low, but the New York Fed says delinquencies that are newly 30 days or more past due in the second quarter rose 0.5% for credit cards, auto loans, and other debts, while the rate for home-equity lines of credit increased 0.7%.

Nick Reece, strategist at Merk Investments, says new delinquencies are a leading indicator of a turn in the credit cycle.

Tamara Gruschke, owner of Olive Drab Farms, has seen reduced credit-line offers from lenders. / Photograph by Zack WittmanAt the same time, some small-business owners are having a harder time getting credit.

Tamara Gruschke, owner of Olive Drab Farm outside Tampa, Fla., raises goats and makes soaps, lotions, and scrubs.

Orders have recently improved, she says, but not by enough.

Because sales have been so disappointing this year and input costs so high, she doesn’t have the money to buy the raw materials she needs for the fourth quarter, when she makes the bulk of her revenue.

She has turned to lenders including PayPal Holdings (PYPL), Stripe, and Shopify (SHOP), but they’re offering her loans of only about $2,000 to $4,000.

“I thought I would get $15,000 to $20,000,” she says.

“I guess people are scared,” referring to lenders pulling back credit.

Lazar of Piper Sandler says banks will continue to tighten credit, and delinquencies will rise as the job market weakens.

Strength there is another factor behind fading recession expectations, but she says many economists and investors are misreading the data and overestimating the true state of the U.S. job market.

Lazar says the latest nonfarm payrolls figure, which showed employers added over half a million jobs in July, the best since February, is an outlier.

She points to the other half of the monthly jobs report, the household survey, which shows that the U.S. economy has lost 141,000 full-time jobs since June as the number of multiple jobholders has risen by 263,000.

The household survey leads the establishment survey into recession, Lazar says, noting the rise in initial claims for unemployment insurance from a March bottom has been “way faster than their ascents before prior recessions.”

Outplacement firm Challenger, Gray & Christmas reported a 36% rise in layoffs during July versus a year earlier and noted that firings haven’t been limited to the tech sector, where tightening monetary policy and stock market declines have hurt most.

Becauce of a drop in sales, Gruschke doesn’t have the money she needs for the materials she uses to make soaps, lotions, and scrubs. / Photograph by Zack Wittman

Becauce of a drop in sales, Gruschke doesn’t have the money she needs for the materials she uses to make soaps, lotions, and scrubs. / Photograph by Zack WittmanEven so, the labor market is widely considered healthy—and even too healthy, in that demand for workers continues to outpace supply, pushing wages higher.

But the supply problem is deep and long term, forcing a question over what “healthy” means and helping to explain why inflation has become entrenched.

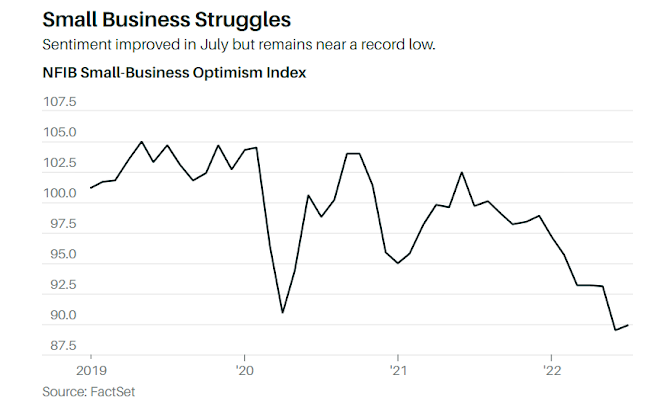

Consider the Cleveland Fed’s spin on the July consumer price index.

Instead of backing out food and energy, the bank tries to capture underlying—or sticky—inflation by dropping extreme increases and decreases.

For July, both the Cleveland Fed’s median and trimmed-mean CPI hit new year-over-year highs, with the former up 6.3% and the latter up 7% from a year earlier.

Inflation won’t fall easily and substantially as rents, heavy inflation-gauge components and driven by home prices that are still rising by double digits, remain high and the labor shortage underpins overall service prices.

Vincent Deluard, director of global macro at StoneX Financial, estimates that the U.S. labor market has durably lost about 12% of its workforce due to early retirements, Covid-related conditions, and the gig economy—leaving the remaining 88% to do more to achieve the same output at a time when demographics are unfavorable.

Recent data on productivity and unit labor costs underline the problem.

The former fell for a second straight quarter and marked a record year-over-year decline.

The productivity boom that economists predicted would help offset inflation isn’t materializing, and unit labor costs, which help drive overall inflation, surged 10%.

They are also a leading indicator of corporate profits and suggest a downturn, says John Silvia, founder of Dynamic Economic Strategy.

The labor shortage, meanwhile, is leading to a potential misconception around Fed policy.

The soft-landing narrative is built in part on the Fed’s argument that it can bring down inflation through job vacancies alone, given the high number of jobs that remain unfilled.

That is unreasonably optimistic, says Alex Domash, economist and research fellow at Harvard University.

“It signals that Fed officials still have not fully internalized the magnitude of the inflation problem,” he says, adding that the unemployment rate needs to rise to at least 5% to bring inflation back down to the Fed’s target.

The central bank has forecast a rise in the jobless rate to just 4.1% from a current 3.5%.

One simple way to read an economy that is softer than it looks is to expect easier Fed policy.

Recent minutes from the central bank’s July meeting gave some investors reason to double down on that bet.

“Many participants remarked that, in view of the constantly changing nature of the economic environment and the existence of long and variable lags in monetary policy’s effect on the economy, there was…a risk that the committee could tighten the stance of policy by more than necessary to restore price stability,” the minutes said.

But with inflation where it is, the situation is more complicated and overshooting is better than the alternative, says Lazar.

Tightening too much may also be an ironic result of markets calling the bluff of a Fed that doesn’t actually want to tighten much more.

The very financial conditions the Fed is trying to constrict are easing as stocks rise, and even meme-stock mania—this time led by a surge in shares of Bed Bath & Beyond (BBBY)—has restarted.

It is possible that the Fed flinches too early.

But the holes in the conventional assumptions underlying no- or mild-recession expectations are reasons to expect a deeper downturn that doesn’t at once support a softer Fed.

The question around the path of gas prices after SPR drawdowns end makes the current upturn in economic activity, and downturn in headline inflation, seem tenuous and probably temporary alongside the unpopular realities of sticky inflation and structural labor problems.

That doesn’t mean there won’t be bounces in the economy, and markets, along the way.

But the bigger picture remains a dark one for households and businesses, regardless of what policy makers and politicians say.

0 comments:

Publicar un comentario